Lukas Weber

You studied computer science. Why did you choose this career path?

I looked at 3 studies more closely, medicine, architecture and computer science. Medicine would take too long until I can really work, I thought, and architecture seemed only fun if you’re in the top league, otherwise you’d be damned to build boring terraced houses. Computer science, on the other hand, seemed to me like a creative discipline that allowed an entry into many different industries. I also like engineering and project work and seeing the results of what I’m doing.

But you’re a Co-CEO, not a coder.

Unfortunately I don’t write code anymore, that’s true, and I would maybe one day get back to it, if I have time. But I’m very happy that in the context of Verve Ventures, I can give guidance on the development of our platform but otherwise know that things are in the capable hands of Cristian Cirstea, our Head of Software Engineering, who does a tremendous job. I think it’s a plus if a CEO understands the technical language and can selectively give input.

How complicated is it to have two CEOs in a small firm like Verve Ventures?

It’s not complicated because Steffen and I are complementary but are on the same line when it comes to decision processes. I appreciate not being alone at the top but having a sparring partner. It’s also a blessing to be able to put some of the load a CEO has to bear on two pairs of shoulders.

How would you describe a typical employee of Verve Ventures?

I’d say they have a rare combination of being very smart and very ambitious but also quite modest at the same time. They take ownership of their work, are able to develop ideas on a conceptual and strategic level, but also don’t shy away from actually executing the work. We don’t hire manager types.

Who should not apply to work for Verve Ventures?

People who are always very adept at explaining why they couldn’t do a specific task and don’t get stuff done.

Let’s turn to Verve Ventures as a company. What is its mission?

At its core is the observation that small companies can create immense value, and because startups are at the forefront of technological developments, have an outsized impact on the world. I’d say if you really want to change how things are done, you need to join a startup or go into politics, and politics is definitely not for me. Now, what we enable on a more practical level with Verve Ventures is that we support ambitious people that are working on solving hard problems, and that we allow other people to join and support this journey. Verve Ventures is the infrastructure that allows financing innovation.

What does that infrastructure actually do?

We’ve built a powerful machine that sources, assesses and structures startup investments and presents them to investors when they’re “investment-ready”, so they can invest with a simple click. Our investors see only the ready result, they don’t need to suffer the sometimes painful negotiation of the minutiae of the terms and conditions with a startup and 2 other venture capital funds, they don’t need to experience deals not happening for months because some VCs drop out and others come in, they don’t need to haggle with entrepreneurs who have an excessive valuation of their startup in mind. We’ve perfected the art of making startup investing as painless as possible over more than 100 single investments and we’ve come a long way from a pure brokerage platform to full-blown life cycle management of the investments with ongoing management of the holdings and accelerating the success of the startups with a dedicated internal team.

What role does technology play in all of this?

Without the sophisticated system we’ve built over the years, we wouldn’t be able to handle thousands of individual investment transactions and we also wouldn’t be able to manage the reporting and management of all the individual portfolios our investors have built. Technology is one of our key elements for creating highly efficient processes in managing deal flow, deal execution and portfolio management.

So it’s more about automation than artificial intelligence?

The venture capital industry is characterized by many different manual processes, and that’s not a big issue if you have a fund that only does an investment every now and then. But we believe the venture firm of tomorrow needs to be more agile than that. For us it is paramount to support as many of these processes with IT as possible, as we’re approaching 100 transactions per year, which are partly new investments and also follow-on rounds of portfolio firms. Our goal is to clearly outpace our competition by the number of transactions we can handle. We want to be in all the good deals – no matter how many of them there are.

Who is Verve Ventures’ competition?

If you look at the deal sourcing side, other venture capital funds are our competitors. And they are our partners and co-investors – that’s how the industry works: you compete to get into the most sought after deals. On the investor side, there are fundamentally two ways to invest in venture: via a fund or into individual deals. If you want to invest via a fund, then your access to invest into the leading funds will mainly depend on the check size you can write. Minimum investments usually start at CHF 250’000 but CHF 1m is not unusual. If you want to invest deal by deal, but without the hassle of doing all the work yourself, Verve Ventures is the best way to do so. Having an investment team of 15 Investment managers and analysts sourcing and negotiating deals on your behalf without you having to do any upfront commitments or pay any membership fees or retainers is simply a strong value proposition.

Who are the investors that are in Verve Ventures’ community?

I’d say no matter if they’re old or new money, their heart beats for entrepreneurship. They want to make money by investing but they also want to empower a new generation of entrepreneurs to build successful companies. For them money is a tool and not a purpose in itself. We also have lots of C-level executives and board members of bigger companies that want to open their network and share their professional experience, and that want to follow very closely how technology develops. As you get older, you need to put in more effort to stay innovative – this goes for people as well as for companies. And an entrepreneur will always think about both their personal development as that of their companies. Finally, there are more and more family offices that want to broaden their skills in private markets and find a way to access startups that balances the share of mind and share of wallet.

What does Verve Ventures offer to these kinds of sophisticated investors?

As startup financing becomes more and more competitive, you need to show entrepreneurs how you can be relevant to them apart from just writing a check. We’ve built up our reputation and our value proposition of a very large international investor network over time, and this is how we can offer access to very competitive rounds. But a big part of our work happens after the investment. You need to actively manage your holdings, get information from the startups, distill the information and act upon it, if needed. Most of it happens in the background, but Verve Ventures puts in a lot of effort and resources to help its startups to be successful, and these are efforts that benefit all of our investors. At the same time, with every new investor signing up, our international network gets more potent. It’s a network effect for startups and investors alike.

Our Investment Topics

Resilience inEnergy & Resources

Our future success in fields like computing and pharma relies on a resilient energy infrastructure. We focus on disruptive innovations that leverage collaboration with leading enterprises to scale the next industrial base.

Future ofComputing

Our progress in various fields, from everyday use to pharma and research, is increasingly driven by computing capabilities, driving a huge demand for compute.

Frontiers inHealth & Bio

Advances in healthcare and life sciences are increasingly driven by the convergence of biology, engineering, and data. This convergence is unlocking more precise, efficient, and accessible solutions for patients.

Insights about European deep tech innovation

From Bern to Global Impact: Looking Back at Our Journey with Ikerian

We are thrilled to announce that EssilorLuxottica has acquired our portfolio company Ikerian (operating under the RetinAI brand). This exit marks a major milestone for the Swiss and European deep-tech ecosystem.

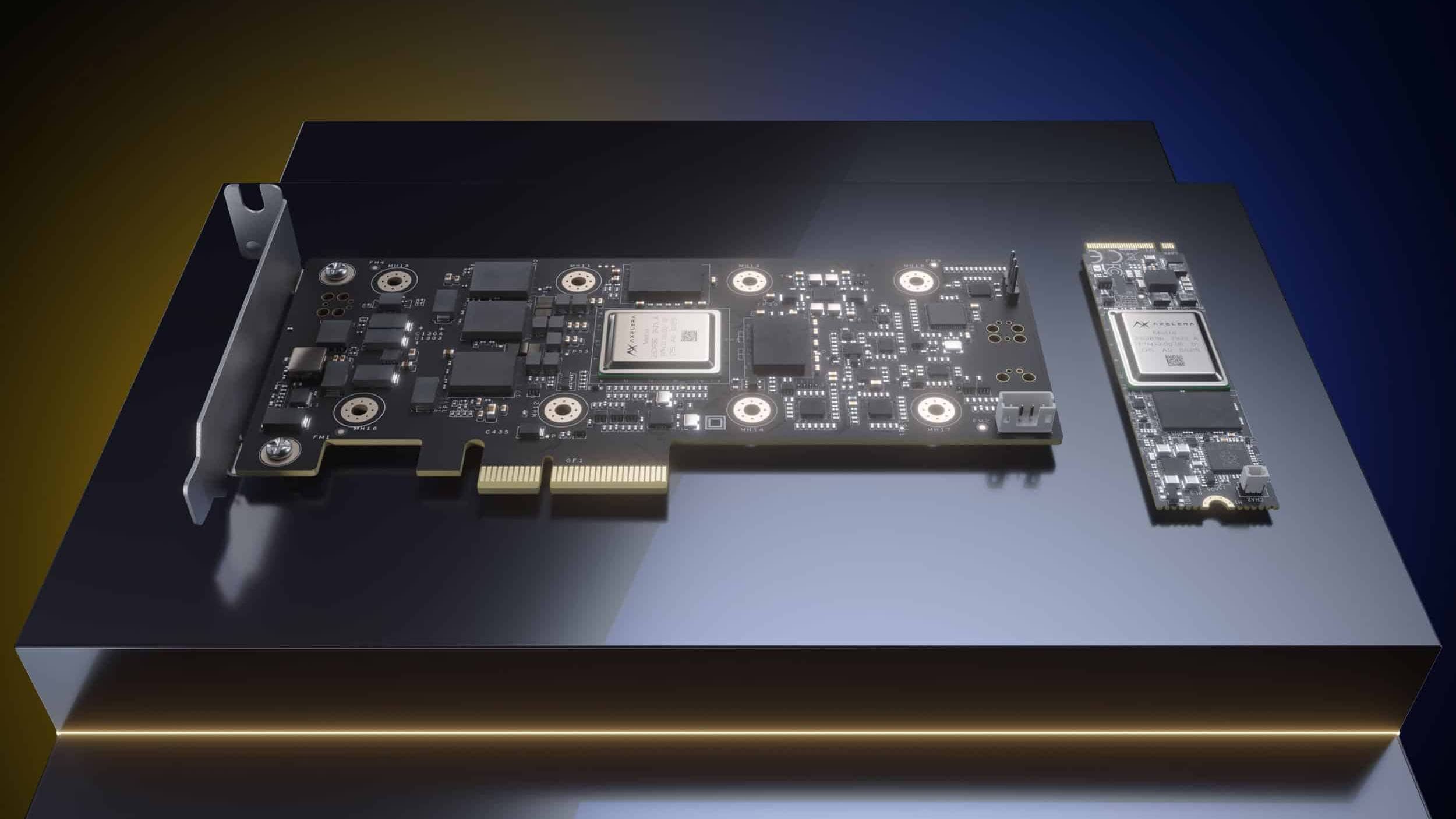

“Axelera will become a cornerstone of European AI sovereignty.”

In four years, Axelera has developed and launched its Metis AI accelerator chip, raised more than 200 million euros, and grown to 200+ people. Axelera’s CEO Fabrizio Del Maffeo thinks big, moves fast, and hires missionaries, not mercenaries, as he says in our interview.

“I believe in equipping the next generation of impact champions.”

As the founder of the Center for Sustainable Finance and Private Wealth (CSP), Falko Paetzold is redefining what it means for wealthy individuals to invest with purpose. In this conversation, he reflects on the personal journey that shaped his mission, the structural barriers that keep banks from embracing impact investments, and how CSP empowers the next generation of wealth holders to turn a burden into a force for good.