The use of injections in treatments is widespread, but their use can become a burden to patients and severely impact their quality of life. Biograil is working on an innovative delivery mechanism for biological drugs that could offer a valuable alternative to injections. In this interview, Karsten Lindhart, the company’s CEO and founder, reveals how Biograil’s extensive experience, strategic partnerships and innovative approach will help them deliver and scale a market-ready product that will transform drug delivery and improve the lives of patients worldwide.

CEO and Founder, Biograil

Karsten Lindhardt is the CEO and founder of Biograil, a biotech startup developing groundbreaking drug delivery technology for the effective oral delivery of biological drugs. With over 20 years of experience in the pharmaceutical industry, Karsten has played key roles in multiple biotech companies such as Egalet, where he was Chief Scientific Officer and part of the team that took the company public on NASDAQ. He led the development of Arymo ER, the world’s first injection-molded oral product to receive FDA approval. After securing seed funding from a strong syndicate of investors, Karsten spun off Biograil from Egalet. He has held leadership roles at Ferring, Novo Nordisk, Curalogic, and Prosidion.

The last time you spoke to us, it was 2019 and Biograil was just closing its Seed round, how has the company evolved since then?

A lot of things have happened. We’ve grown quite a bit. In 2019, we were 5, now we are about 20 people. We got a lot of experts on board to support the ongoing technology maturation and development process. We also have quality assurance and regulatory experts and people with manufacturing scale-up experience.

We moved to our own facility. Back then we had an office at the Contract Research Organization (CRO) that made our prototyping. We’re now doing our own prototyping. We have our own injection molding machine and manufacturing equipment. We’re still working with external partners as well, but a lot of the final preparations and the fine tuning we can now do ourselves internally.

On the business side, we signed an agreement with [US pharmaceutical giant] Eli Lilly and we have a good collaboration with them. They’re very supportive both on the technological front and of the team we have put together. There are no sensitive IP issues between us because there is a clear differentiation: the technology is ours and the active substances belong to Lilly. I think that has allowed us to build a very solid partnership and they have been one of the main reasons we’ve been able to grow the way we have.

What about BIONDD?

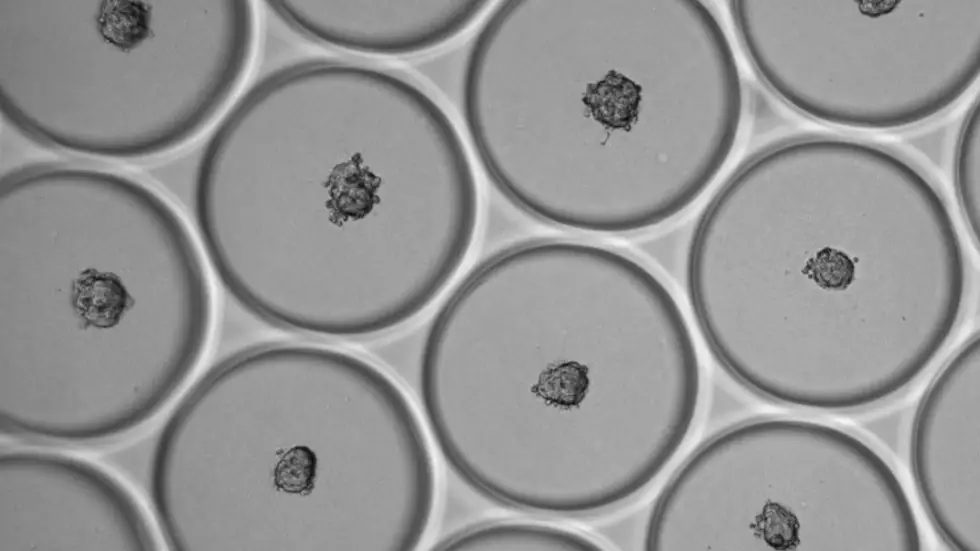

BIONDD is the device side of the combination product that we are developing. It’s the patented mechanism that we add to a standard size capsule that can deliver different compounds directly into the gastrointestinal wall to be effectively distributed in the human body. It does this by attaching to the gastrointestinal wall using a very small spike that then detaches once the active therapeutics have been delivered.

We are currently working on the confirmed prototype. In the earlier design, we worked with a metal spike to make the attachment. It positioned well into the tissue and we had a high success rate. However, when we moved away from 3D printers and the limitations of 3D printers in relation to more mature manufacturing setups like injection molding, while still successful, the spike stayed in the tissue for too long and we had to find a solution to get it out again.

Around this time, we had a discussion with Lilly about the vision for the technology on a longer time scale and we agreed to, instead of continuing to work on the metal spikes and the detachment side of the existing model, move into making a polymer spike right away.

How does the use of polymer spikes differ from metal ones?

Detachment for one is no longer an issue. Polymers simply dissolve in the tissue. However, working with polymers comes with other challenges. Tissue is pretty tough to get into so if the material is not strong enough, it can bend instead of inserting. You need a larger polymer spike to achieve the physical strength needed to make the insertion. But that fitted our goal quite well, because at the same time we also wanted a higher dose per device, and we were now able to put that higher dose into the new spike because of the larger size. So, in some ways, we could solve two issues with one change. We are now working on reaching a confirmed prototype and we’ve made great progress. We have reached a high insertion rate for the polymer spikes, but we are still improving on the force and sharpness of the spike. We are very confident we will get there by the end of 2024.

In terms of the substances that you are putting in the device, are they already tried and tested substances or are they new substances that are currently being developed?

It’s mainly well-known substances. We have our partnership with Lilly and they have different compounds in their portfolio. There may be compounds that are more exploratory, but then they have control of that. We also have our own separate portfolio where we use compounds that are of interest to us, but they are well-known substances that already have a robust market within subcutaneous IV. We basically just want to change the way that substance is being delivered. We do not do pharmaceutical development ourselves, but if some partner had a new chemical entity that they would like to deliver using our device, we could go into a partnership with them and deliver that product for them.

Which areas is Biograil targeting with its technology?

We are looking at two main areas. The first is injectables in big populations for indications such as diabetes or rheumatoid arthritis, where you have a huge number of patients using biologics that need to be injected. It’s an area where it would be interesting to have an oral alternative. It would not wipe out the injections in the market, but it would become an alternative and some would prefer taking capsules to injections. The second area is small indications where treatment requires a frequent number of injections which limits patient freedom and negatively affects their quality of life. Having an oral alternative would make life so much easier for these patients.

We are also looking at different areas where our technology could be applied, such as vaccines and gene therapy. Just think about the pandemic, if we could have all just taken a capsule instead of being injected, that would have been so much easier and saved a lot of money.

Invest in Startups

As one of Europe’s most active venture capital investors, we grant qualified private investors access to top-tier European startups. With investments starting at EUR/CHF 10’000, you can build your own tailored portfolio over time and diversify across stages and sectors.

Biograil has some pretty tough competition from robopills such as the Ranipill backed by Google Ventures and AstraZeneca and the Soma Pill funded by Novo Nordisk and developed by MIT researchers. How does Biograil stand out among them?

I could speak about this for hours, but I will try to make it short. Rani has been around for a long time and they are a pioneer in this area, but they have been struggling with miniaturizing their technology. They’re working with a very large triple zero size [2.61 cm in length, 0.99 in diameter] capsule and manufacturing is going to be a challenge for them. If you’re looking at the broader markets, for a lot of patients, triple zero is simply a size they will not accept. I think Rani has made a strategic mistake by going out and defending the size, saying it’s perfectly fine for it to be that big. To me, that shows they are probably struggling with miniaturization. They are also 130 people and burning a lot of cash. They also don’t really have substantial partnerships to support and balance the risk, so they need to go out and find risk willing investors.

I think Biograil has a big advantage in simplicity, in size, in cost and in the partnerships that we are building along the way which help us finance some of our activities. We are only 20 people and we are careful that we do not increase our burn more than the technology can hold from a risk perspective.

What about Soma?

This MIT/Novo Nordisk technology is smart and well thought through, but it’s also quite complex. When you look at the number of parts, we’re down to three-four parts while Soma is still at least 10. That’s part of the reason they have also been struggling with miniaturization. They’re using larger than triple zero capsules. At least, however, they never defended that and always understood they would need to miniaturize it.

There is also the cost of goods to consider. A lot of the price driver of these technologies is the number of pieces you need to put together. The more parts you have, the more complex and uncertain the assembly process becomes. The fewer parts you can bring the device down to, the smaller the variation and the more consistent the device.

How small is Biograil’s device?

We have focused on getting it down to at least double zero [2.33 cm in length, 0.85 cm in diameter], which is much smaller than a triple zero, but we also want to prove that we can go further down to single zero [2.17 cm in length, 0.76 in diameter]. We want to make sure that miniaturization is possible, that our technology and our functionality, our design, would still work in a miniaturized piece. I think that’s going to be key, because miniaturization is not necessarily a simple thing to do. Going into human trials with a size that can be used in the market will show investors and pharmaceutical companies there is a real product opportunity.

I think that’s a much stronger case than pushing your product to clinical trials and getting data from the human trial, but not having the technology to follow through because it’s not good enough for the market. In that case, it’s questionable what you actually gained from it.

You talked about the challenges of scaling robo-pills, how will Biograil handle scaling?

I have enough experience in this field to know saying scaling is not a challenge is something you should never say, because then everybody would know that you either do not have experience or you’re lying [laughs]. So scaling is always a challenge. That being said, we’ve been working with polymers for a long time. We previously made a polymer oral tablet that got approved by the FDA. Of course, Biograil is a different technology with added layers of complexity, but we have a really good understanding of scalability and how to make this work. We have some excellent senior engineers with considerable experience.

We have our partnership with Lilly and the expertise of their highly experienced team across the fields of substances, formulation, stability, technology, manufacturing, commercialization, positioning. Roquette Ventures also joined us as an investor this year and, together with some of our other investors like Evonik Ventures, they bring a lot of experience in the polymer space. It’s great to have support from people who truly know the space and are interested in getting these different types of polymers used in the pharmaceutical and medical industries.

We therefore feel that we are uniquely positioned to succeed, with both the best technology and partners, as well as the best people to run it.

You recently announced a new partnership with CSL Behring Lengnau. What does this collaboration mean for Biograil?

The CSL deal will provide additional funding for our activities, but, more importantly, it confirms the need and relevance of the BIONDD™ technology for patients. We have had our ongoing agreement with Eli Lilly for some time now and getting a new commitment shows that Biograil is on the right path. CSL has a lot of expertise in specialized indication areas very relevant for our technology and we are very pleased about the partnership. We hope our technology can benefit as many patients as possible, to make their treatment less complicated and stigmatizing.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

19.03.2024

“Biotech is a wonderfully complex industry”

Industry veteran Erik van den Berg joined Verve’s portfolio company Memo Therapeutics right after it raised CHF 25 million in late 2023. The Company is now at a very exciting stage in its development, as he explains in our interview.

09.02.2024

“Diagnostic methods in eye care have undergone a revolution”

Professor Francine Behar-Cohen is a key opinion leader in the field of eye care. In this interview, she talks about how startup EarlySight’s medical device that can spot eye diseases much earlier than conventional methods will enable novel treatments.

06.11.2023

“My goal is to take biology to the next level”

In this interview, Orakl Oncology CEO Dr Fanny Jaulin tells how her techbio startup is spearheading a revolution that will bring data science to biology for more precise effective cancer treatments.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.