INVESTING IN SAAS STARTUPS: WHY AND HOW

This page provides a framework for evaluating SaaS companies and helps you understand this business model.

Watch this in-depth webinar to understand how to evaluate Software-as-a-Service start-ups and start investing right away.

What you need to know about Software-as-a-Service startups:

WHAT IS A SOFTWARE-AS-A-SERVICE (SAAS) STARTUP?

Software-as-a-Service it’s a bit of a weird term, as it is a mixture between a product description (software) and a business model (service).

As fast internet connections have become ubiquitous, the software has changed from being packaged in a box and installed physically in an office to being hosted in the cloud and made available over the internet via a web browser, now called software-as-a-service (SaaS).

This means that for the first time, the internet allows young companies to start without having to invest in large distribution networks (word of mouth and online advertising are cheap) and without having to spend money on a large sales department or physical product distribution.

At Verve Ventures we invest in many digital startups with a SaaS business model, such as Beekeeper, Cognism, 3YOURMIND, uepaa, and more. Have a look at our digital portfolio.

WHY DO SAAS STARTUPS NEED VC FUNDING?

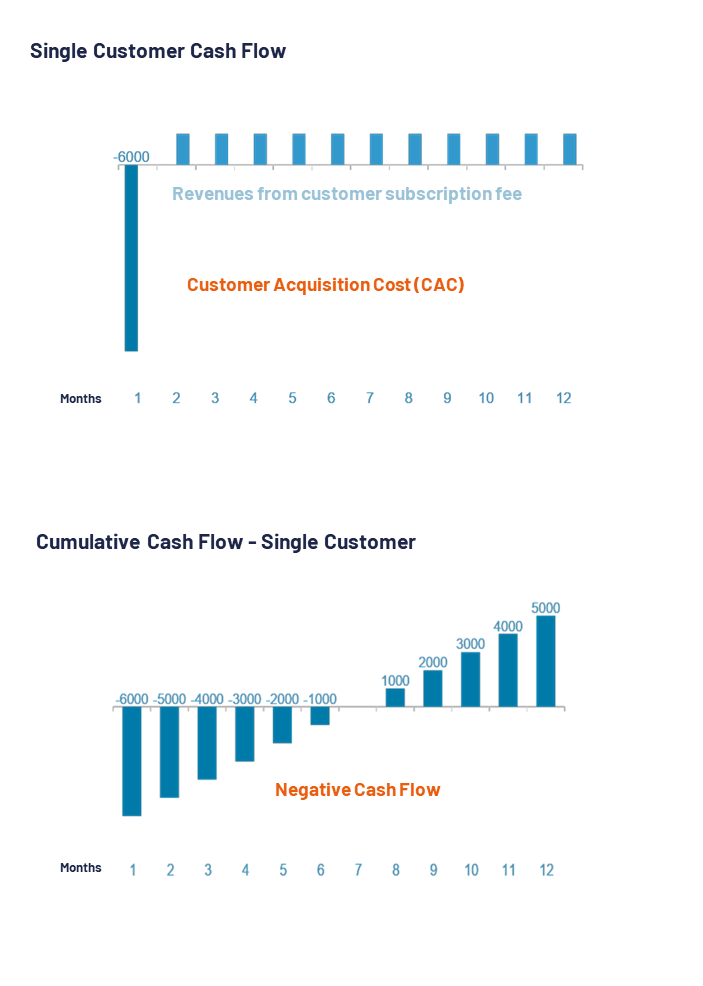

With a plethora of SaaS solutions already out there, startups need to be noticed to attract new clients. This means they have to spend money on marketing and sales. The startup incurs the cost associated with these functions before the customer starts paying a subscription fee. And if the startup seeks to sell to businesses, the sales cycles can belong. From a cash flow perspective, this is equal to negative cash flow for every single customer, which turns positive only after a certain amount of time.

Now, since these companies usually want to grow aggressively and increase their market share rapidly, they spend a lot of money in order to gain new customers. This, in turn, means that the temporary cash-flow hole they dig will be bigger the faster they want to grow.

Venture capital firms step into pre-finance this funding gap and they do so in view of the hockey stick-like growth in revenues that is expected to manifest later. This explains why SaaS startups and venture capital are a very good match.

Watch this webinar on Investing in SaaS hosted by the Head of Private Investor at Verve Ventures David Sidler.

WHY DO STARTUP INVESTORS LIKE SAAS?

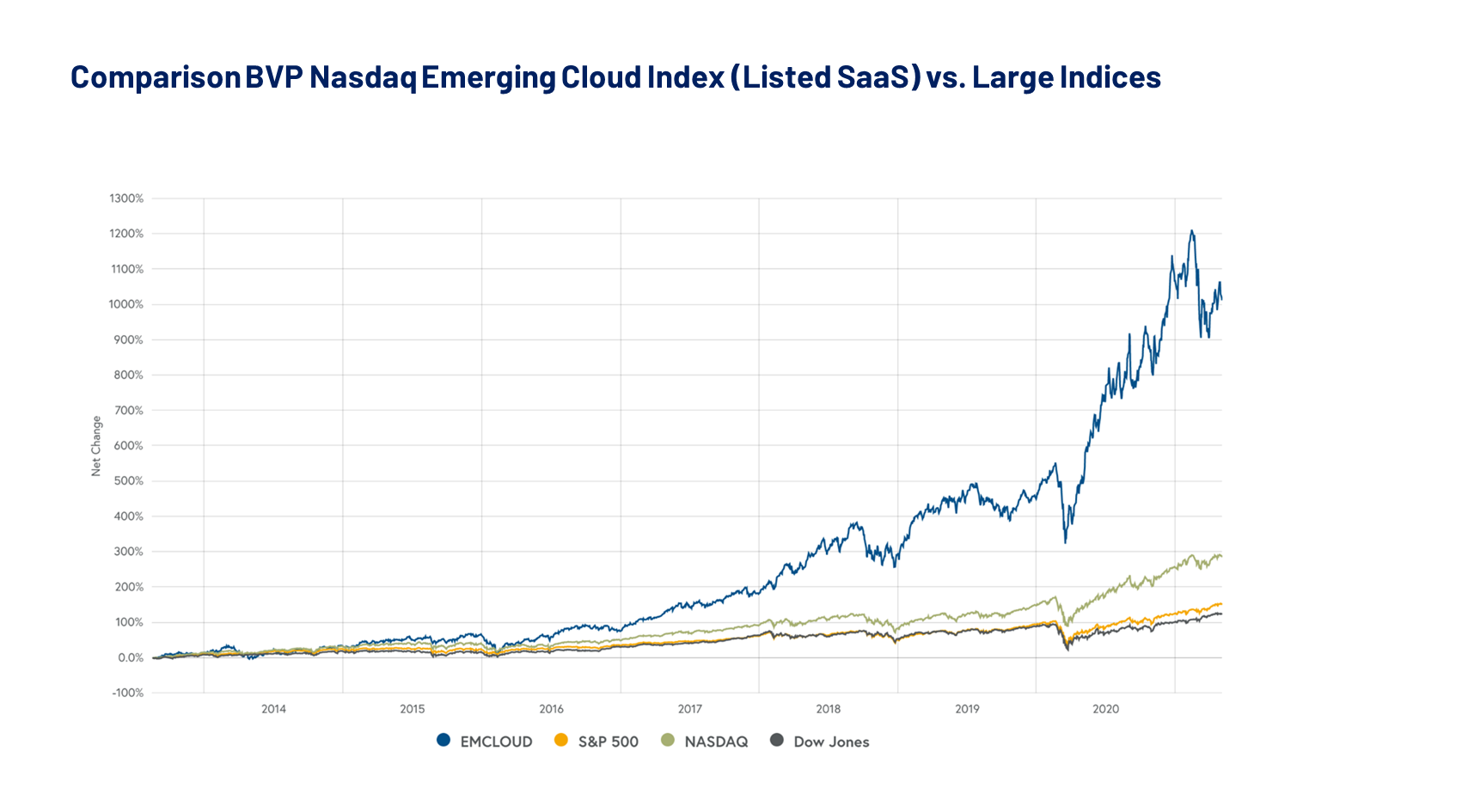

This graph shows the development of the Nasdaq Emerging Cloud Index which includes many international SaaS companies such as Slack or Zoom. It shows that with an average growth of 35% per year this index was clearly outperforming traditional indices such as the Dow Jones or S&P.

This looks nice. But how can you capture the value of a SaaS startup even before it is publicly listed – and become an early investor in such success stories? Learn more about startup investment here, and start investing in the best SaaS startups with Verve Ventures.

Investors like SaaS companies because their subscription fees, which recur every month or year, make the revenues predictable. Well-run SaaS companies are also inherently scalable, as the cost of serving each customer goes down as SaaS companies grow. They offer juicy margins (with gross margins in the region of 80%-90%) and impressive growth.

Another prominent feature of SaaS companies is that their business model has torn down the barriers to entry into the software market. Distribution, for example, requires only a web browser to access and use the application.

The deep-tech VC of choice for entrepreneurial investors

Since 2010, we have invested in 180 European deep tech companies based on topical experience. With a highly skilled team of investment professionals, we back outstanding entrepreneurs driving growth in key industries. Verve is the pioneer of deep tech in Europe.

THE KEY PERFORMANCE INDICATOR OF A SAAS COMPANY

The most important metrics to gauge the sustainability of SaaS companies revolve around the questions of how hard it is to gain new customers, and how much these customers will be worth. These metrics are but one element when looking at a startup, and investment decisions should be based on a complete picture that also includes the team and its strengths, market size, traction and milestones achieved, the competitive landscape etc.

ARR (annual recurring revenue)

This is a central measure of how much recurring revenue can be expected per year.If billing happens monthly, ARR=12 X MRR(monthly recurring revenue). As a company adds new clients and sells additional services to existing clients, ithas an immediate impact on the ARR. If a SaaS startup makes subscription revenues of1k in January and 10k in February, the ARR is120k (12x10k).

Customer Acquisition Cost (CAC)

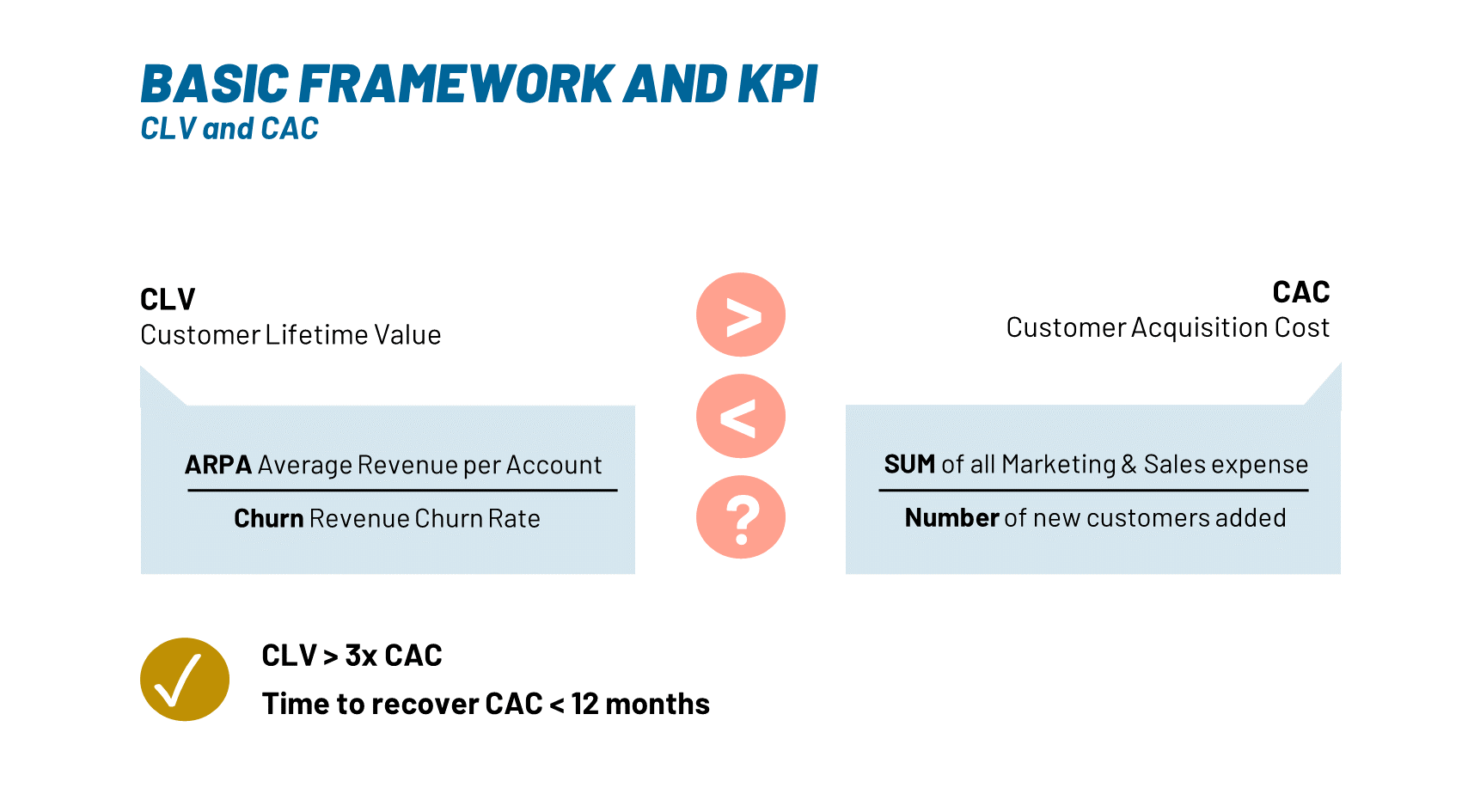

This number tells you how much a companyspends on acquiring customers and is expressed as the cost to gain a single customer. It is calculated as the total of all marketing and sales activities needed to motivate a customer for a purchase, divided by the number of new customers.

Customer Lifetime Value (CLV)

This number indicates the revenues of a single customer during the time they use the product. There are several ways to calculatethe CLV. If, on average, customers will stay loyal to the product for 5 years, and the subscription price is USD 100 per year, the customer lifetime value is USD 500. Theproblem is that maybe that product hasn’t been that long on the market and you need to calculate the average life time of a customer based on other information you have at hand.One information that is available is the number of customers that do not renew their subscription. This is called churn rate. If Customers spend USD 100 on average per year, and 20% of them cancel every year, theCLV is USD 500 on average (100/0.2).

THE RELATIONSHIP BETWEEN CAC AND CLV

CAC and CLV have to show a healthy balance. If it costs more, on average, to attract new customers than what they’re worth (CAC>CLV), the company is in big trouble. CLV needs to be significantly higher than CAC to allow for healthy development. As a rule of thumb, CLV should be at least 3 times higher than CAC. If the ratio is very high, however, say, 10:1, this might indicate that the company is not spending enough to acquire new customers and that it could grow even faster by doing more.

In this free eBook, you will find and in-depth explanation of this crucial relationship.

KEY TAKEAWAY

Here are the main points to remember on how to assess SaaS:

- SaaS startups lend themselves more easily to an analysis based on numbers than others, and they typically are textbook examples of companies with a financing gap that venture capitalists are eager to fill.

- Proof of concept in SaaS is not a working product, but (first) reliable data on CAC and CLV.

- Don’t get lost in the KPI jungle: understand the basic numbers and questions.

In this eBook, you will find a streamlined introduction to the topic, with a focus on the KPIs that have been key in our evaluation of hundreds of SaaS startups we have examined over the years. It is important to reiterate that these metrics are only one important factor in the analysis of a startup and should by no means be the only one.

EXAMPLE OF SAAS COMPANY

Verve Ventures’ mission is to identify the most promising European startups and support their founders on their entrepreneurial journey.

Here are some SaaS startup examples from our portfolio.

Beekeeper is a mobile communication platform for companies thatempowers, informs, and connects their frontline workers. More than700 companies in 150 countries rely on Beekeeper’s productivity toolto connect to more than 600’000 employees.

Chris Grossmann

CEO and co-founder of Beekeeper.

Read the interview with Chris here.

Cognism is the world’s best all-in-one globally compliant prospecting solution. Powered by patented AI technology, it provides organizations with compliant B2B data and a suite of sales acceleration tools to help action it. Cognism enables its worldwide business customers to find and deliver new revenue, faster.

Read our interview with the co-founder and CEO of Cognism, James Isilay.

The deep-tech VC of choice for entrepreneurial investors

Since 2010, we have invested in 180 European deep tech companies based on topical experience. With a highly skilled team of investment professionals, we back outstanding entrepreneurs driving growth in key industries. Verve is the pioneer of deep tech in Europe.