Music was the first medium to be dramatically disrupted by digitization and the internet. An industry that relied on selling physical albums people wanted to own turned into an industry where nobody buys records anymore but can listen to everything, paying for access instead of possession. But there are still possibilities to invest as the transformation continues.

Introduction

The music industry went through several transformative steps. Mainly driven by technology, the transformation took several decades. Additionally, the actors that changed the industry often previously played no role in the industry. They were either new players – like Spotify and Deezer – that offered a totally new service or established players in other industries that leveraged their existing position to diversify into a new segment – such as Apple or Google. At the same time, some of the oldest and most successful players in the industry were often the slowest to adapt and became victims of change.

The four transformative phases of the past

According to Ulrich Dolata of the Institute of Social Science of the University of Stuttgart, there are four main phases in the transformation of the industry, which are the following:

1. Digitization of the audio medium (1983-1999)

With the arrival of the CD, global sales of audio media tripled. Indeed, in addition to being more practical, companies could exploit their entire back catalogue as music fans wanted to get not only new albums, but also albums which they already owned on other formats. However, CDs were merely a profitable and physical replacement to the vinyl record.

The real issue with CDs was that they had no physical copyright protection. Nothing was easier than saving your songs on your computer or even burn new copies to share them. Soon enough, advances in data compression software brought along the MP3 format, which, together with the internet, opened the next chapter of the music industry’s transformation.

2. Boom of free music file-sharing (1999-2003)

The advent of a format that was easy to copy and share, together with the internet, contributed to the rise of free music file-sharing, notably with the rise of Napster. For the first time, music was easily accessible to everyone online, without need to go to the music store to buy your favourite album. This led to a loss of control for the music industry and had a strong negative impact on its revenues and profitability.

3. Order on the internet: the commercialization of downloads (2003-2013)

For years, the industry tried to get a grip on non-commercial exchanges on the web, taking all the legal actions they could against file-sharing networks, without much effect. But then came a new light on the horizon: the sale and distribution of downloads. Apple opened its iTunes Store in 2003 in the US, with an offer combining hardware and content which was extremely well received by consumers. Music companies were steadily losing control over their content and had no choice but to accept this new chapter. In the end, digital simply replaced physical alternatives. Although music companies had lost sway over the distribution chains, they remained essential actors as content producers and holders of rights. Nevertheless, this new source of revenue could not catch up the sharp drop in CD sales and the global revenue of music companies dropped from $23.4 billion to $14.4 billion between 2001 and 2013. YouTube, a new video streaming service that lets user play music and video online free of charge, did not help either.

4. Don’t pay for music, pay for access to music: commercial streaming services (since 2013)

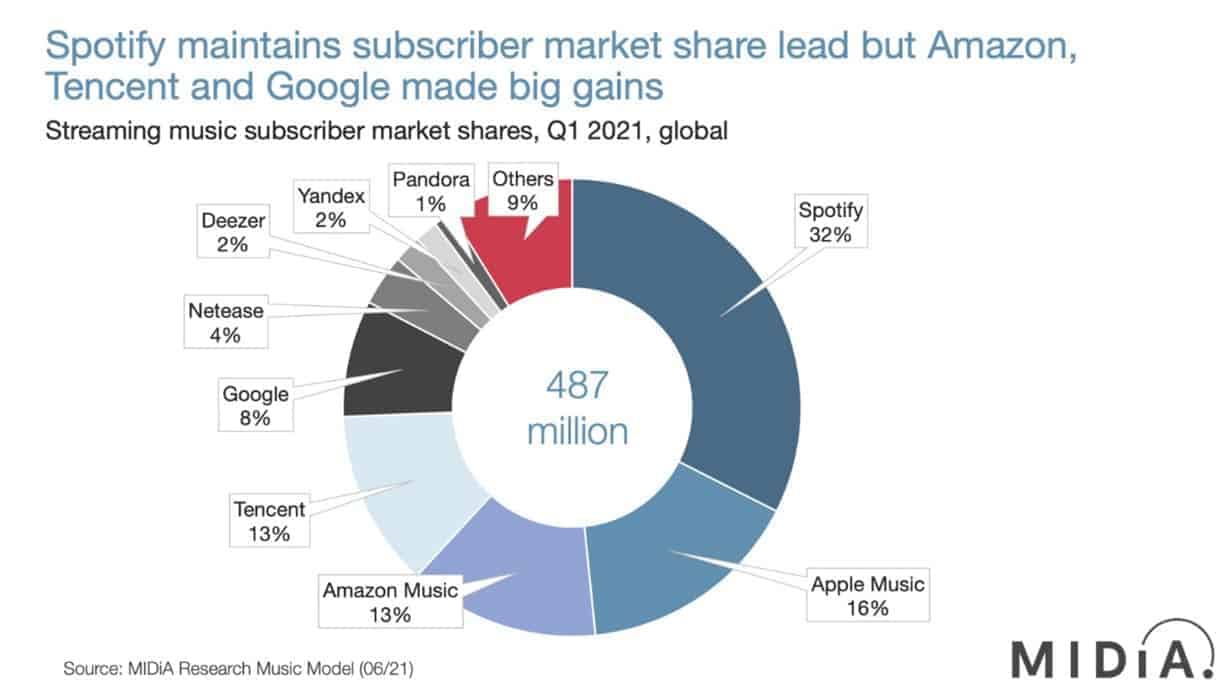

Things looked grim for music companies, but prospect of overcoming this crisis arrived when commercial music streaming made its way to the market. For the first time in the recorded music industry – jukeboxes aside –, we went from purchasing music to a paying access to music. Two technologies made the switch possible. First, the internet with high data transfer rates and transmission speed. Second, a growing storage capacity such as Amazon Web Services and Google Cloud, making it possible to dematerialize digital files even more by having them stored outside the device playing them. In 2020, streaming revenues reached $13.4 billion worldwide, accounting for over 62% of total global recorded music revenue. As of Q1, 2021, Spotify dominates the industry with about a third of the total music streaming market share, followed by Apple Music (16%) and Amazon Music (13%).

Investment opportunities in the digital music industry

The main beneficiary of digitalization in the past was the consumer, who now has access to an unprecedented choice. In the future, musicians will profit from technologies that help them to distribute, promote and monetize their music. For anyone interested in investing in music, especially in the trend of digitalization, there are several opportunities.

1. Believe (EPA:BLV)

Believe is a French music company that acts both as a record label and a music distribution service. The group’s main mission is to offer technological solutions and marketing strategies to promote content from other independent artists and labels. The group is active in 50 countries with over 850,000 artists served, which can be at any stage of their carrier, from emerging artists to world-famous artists. Through a series of strategic acquisitions, including labels and other music services, Believe quickly became one of the references in music promotion and distribution. The company recently went public in June 2021 on the Euronext stock exchange and now has a market capitalization of 1.56 billion EUR.

2. Groover (non-listed)

Groover is a French start-up that might change the way music is promoted. It is a web platform where artists submit their music to professionals, who can be media, labels and other music professionals which are paid to give them feedback on the content within a week. The main issue for curators is that they get hundreds of – very often untargeted – requests, making talent discovery a real hassle. On the other side, artists send hundreds of emails and receive few answers and quality feedback. Groover makes artiste pay for a promotion and distributes the piece of content to the right curators with the help of an algorithm. Curators are incentivized to participate as they are paid by Groover to listen to the content and provide feedback on it. This way, artists can get played on a radio or discovered, and in the worst-case scenario, they’ll benefit from a professional feedback. Groover is already working with more than 65’000 artists and this number keeps growing. This allows Groover to identify potential future stars before anyone else, based on the data and feedback from curators. This means that Groover has the potential to sign early deals with these artist for premium services and grow together with the top new artist.

3. Spotify (NYSE:SPOT)

Spotify often comes as the first idea when thinking about investing in digital music. Not only does it dominate the market as mentioned previously, but it also keeps growing and expending its offers. They recently made a lot of noise with their exclusive podcasts, and their latest coup includes live audio with the acquisition of Locker Room, a Clubhouse-like start-up focused on sports related content. The company plans to keep growing its profit margins over time, blending subscription fees, ad-supported streams, and premium services for both content creators and consumers. In short, Spotify’s impressive user growth and promising monetization ideas make it a promising investment for the years to come, especially for investors bullish on the streaming industry.

4. Universal Music Group (non-listed)

Universal Music group is the world’s largest record label and music company, with a valuation estimated at around $40 billion. While still in the hands of the Vivendi Group, Universal Group has announced plans to go public in September 2021. It is one of the “Big Three” of music labels, along with Warner Music Group and Sony Music. The company has signed licensing agreements with more than 400 platforms worldwide. In 2019, it was even nominated as the world’s most innovative music company by Fast Company, which stated that “amid the music industry’s digital transformation, Universal is redefining what a modern label should look like.”

5. iMusician (non-listed, Verve Ventures portfolio company)

iMusician makes it easy for everyone to sell, manage, protect, and monetize their music. Artists sell their music online with iMusician and reach hundreds of international shops like iTunes, Deezer, Amazon, Beatport and Spotify. Over 200,000 independent artists and labels trust iMusician to distribute their music.

Conclusion

Over the past decades, the music industry has radically transformed itself. It went from a business model that relies on the acquisition of albums and singles to the purchase of access to music. The music industry experienced a crisis when songs were available to download for free over the internet, but the evolution to streaming has reinvigorated the industry, as it can add even more value through data collecting and dedicated curation for each user. For independent artists, it has never been easier to produce and distribute music, and their number is expected to reach 50 million in a few years.

Written by

Investors

Our sophisticated investors include visionary family offices, leading wealth managers, institutions, founders, and senior executives. These individuals and organizations are all committed to shaping the next generation of innovation.

More News

Trends in the drone industry

Investments in drone startups have gone up considerably in the last few years and reached USD 1.2 billion in 2019. Venture capital firms contributed two thirds of that sum. Why does investiere invest in drone startups and what are current trends? The drone market experts Kay Wackwitz and Hendrik Boedecker exchange ideas with our Investment Manager Romeo Bütler.

“We want to drive digital transformation forward”

In this interview, Tiziano Lenoci explains why insurance company GVB invests in startups and why it became a founding member of Swiss Immo Lab (SIL). He also talks about a new investment SIL recently announced, the construction startup Mobbot.

Building the future of the real estate industry

Proptech is still a relatively new field, but already large enough for specialist funds. In this interview, Nikolas Samios, Managing Partner of PropTech1 Ventures, explains why PropTech appeals to conservative investors, why having less venture capital in Europe that in the US might not be such a bad thing after all, and why the fund invested in the Swiss startup Archilyse.