Single-cell technologies are a powerful new approach used in life sciences but they are not widely known. They determine the characteristics of individual cells and cell types in a biological sample. The field is developing at an incredibly fast pace, promises to have a high impact on healthcare, and offers highly attractive investment opportunities. This article summarizes the current state of the field and gives examples of our investments in the single-cell ecosystem.

1. Background: DNA Sequencing

Our body is made out of different tissues which in turn are made out of cells. All cells in our body share the same genes, also called “genotype”. However, only a subset of these genes is being used (or “expressed”) at a given time in a specific cell type. For example, although having the same genes, a muscle cell uses a different set of genes than a nerve cell, which is the fundamental reason why they are different. This means that the summary of all active genes defines the characteristics and functionality of a specific cell type.

The order of the nucleotides, the building blocks of DNA, can be obtained by a process called DNA sequencing. In its principle, the entire DNA is made of four different bases, namely adenine (A), cytosine (C), guanine (G), and thymine (T) whereas the exact sequence of these 4 bases determines the ‘code of life’. Since the introduction of DNA sequencing in 1977, scientists had limited tools and could only determine short and specific DNA sequences of cells of interest, and the generation of medicinal products was rather based on other biological observations than the DNA sequence.

With the introduction of high-throughput sequencing in the mid-2000’s – or more widely known as next-generation sequencing (“NGS”) – which also became rapidly more affordable for translational and basic research, the world became equipped with a tool that accelerated R&D in various fields such as medicine, biotechnology, and virology. With NGS, it also became practicable to sequence whole genomes of organisms. The fundamental advantage that clinical applications experienced was that the DNA of healthy cells could be compared with the DNA sequence of diseased cells and thus certain biological conclusions about alterations of the DNA sequence were suddenly widely accessible. With that development, therapies and drugs could be developed that target specific malfunctioning cellular pathways that are caused by mutations.

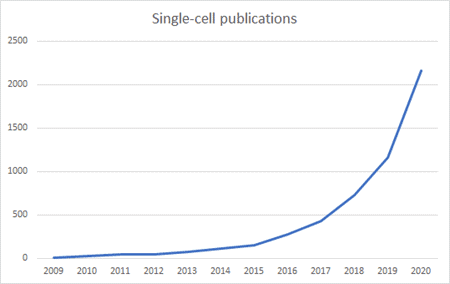

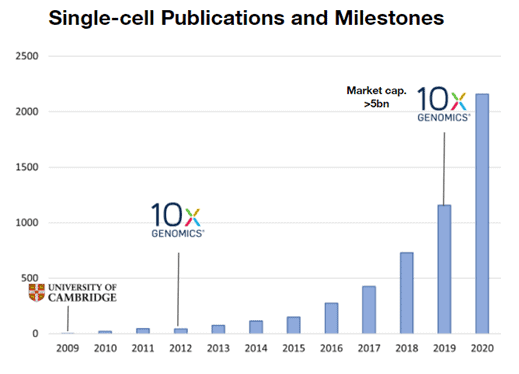

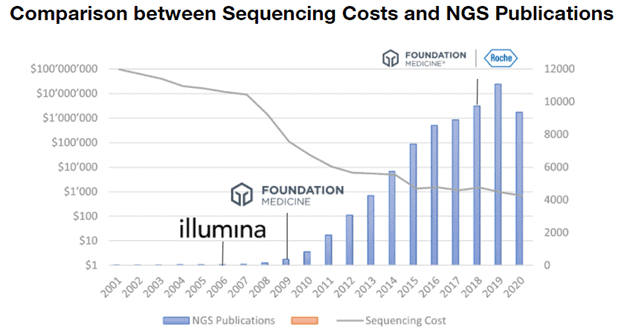

In 2006, Illumina Inc. (Nasdaq: ILMN) launched the first commercial sequencing machines to labs and pharma and thus equipped the field with tools to explore the underlying coding mechanism of living cells and gave birth to uncountable applications in medicine and research. In 2009, the pioneer of clinical DNA analysis, Foundation Medicine, was founded with the goal to develop tests for genomic cancer testing. Their first product launched in 2012 and in 2018 the company was acquired by Roche for 5 billion US Dollars. It is clearly visible from the graph above that the timing for Foundation Medicine was phenomenal taking the number of NGS-related publications as a proxy for the growth of the field – mainly driven by technological advances by companies such as Illumina that resulted in decreasing sequencing costs (log-scale!) outperforming Moore’s law.

2. The advent of single-cell technologies

But innovation didn’t stop there. One of the core issues with ‘conventional’ sequencing methods is that those analyze so-called ‘bulk samples’. In these bulk samples, hundreds of thousands or even millions of cells are sequenced at the same time and thus the signals obtained by the sequencing machines (see above, the sequence of A, C, G, and T) are an average of the DNA sequence of all cells in that sample. For example in cancer, it is known that a small number of cells have pathogenic mutations already very early on in disease formation and with time, evade the human natural defense mechanism. Now if you take such a sample, with a proportion of >99% healthy cells and very few pathogenic cells, and sequence the whole sample, the output will represent the average of all reads and will not show any signal of a cancerous cell as it is lost in the ‘noise’.

This is where single-cell technologies come into play. Single-cell technologies enable the analysis of the smallest functional unit of a tissue, a single cell, and examine differences between individual cells instead of the averaged signal as is the case with bulk samples. Important readouts include mutations specific to a tissue (cancer) or transcriptional profiles (what genes are used at a specific time point). One can imagine this as magnifying one level deeper into biological samples and be able to look at biology with an additional level of accuracy and resolution. In other words, through the advantages that single-cell technologies can bring to science, there is potential to develop true transformational technologies that can eliminate the noise in biological samples and unravel hidden biological mechanisms.

3. Single-cell technologies becoming “big business”

Similar to the market development of “conventional” DNA sequencing, the first single-cell experiment performed in 2009 was followed a few years later by the introduction of commercial single-cell technologies for the broader market which resulted in a lower price and ultimately in a higher scientific acceptance and output. This can be illustrated by looking at 10x Genomics (Nasdaq: TXG), a pioneer in the manufacturing and commercialization of single-cell technologies. 10x Genomics was founded in 2012, was one of the first companies to commercialize single-cell instruments and has more than tripled its share price since its IPO at the beginning of 2020 and has a market capitalization of roughly 19B USD.

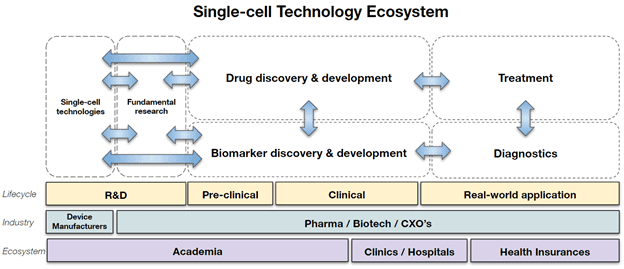

Single-cell technologies have many applications and are already used by a variety of different stakeholders in the pharma and healthcare ecosystem. For instance, single-cell technologies are used not only by academia but also by pharma to gain novel insights into fundamental biological processes which allow to better characterize diseases and develop strategies to cure them. A concrete example where single-cell technologies are applied in Neuroscience. It is known that humans have neural stem cells and that those have the potential to be activated and thus regenerate neurons de novo, which could, in turn, be used as a therapeutic approach for neurodegenerative diseases such as Alzheimer’s Disease. By examining the gene expression of different nerve and stem cells at the level of a single cell, scientists hope to characterize critical interactions between them. A better understanding of neural stem cells and how they interact with their microenvironment will pave the way for methods that repair damage to the central nervous system.

Furthermore, single-cell technologies also enable translational research such as drug and biomarker discovery. Empowered by fundamental research, single-cell technologies enable pharma and biotech companies to discover novel drug targets, screen large drug libraries with an enhanced cellular resolution, or find small biological signals expressed by individual cells that can be indicative of early stages of various pathologies. The products are then translated from the R&D phase into pre-clinical and clinical phases and ultimately promise enhanced therapeutic and diagnostic outcomes for patients in need.

At the end of the value chain are also healthcare insurers that, in the long run, will be able to reimburse more treatments based on efficacy and at earlier stages and thus contribute towards a more cost-effective healthcare system.

4. Opportunities we see

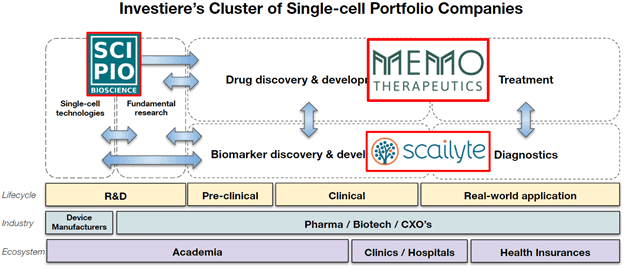

At Verve Ventures, we have been working on this topic for a few years and decided to build an entire cluster of portfolio companies around single-cell technologies. We already identified outstanding investment opportunities for our investors in the single-cell space that cover the entire landscape.

Scipio Bioscience, a start-up from Paris, develops the next generation of single-cell benchtop technology that can be used in a practical way by every researcher around the world to turn “conventional” samples into single-cell samples without the need of expensive 6-digit equipment (for example offered by 10x Genomics). We believe that such technology will further increase the impact that single-cell technologies can have on scientific research and will increase innovation down the translational funnel.

Memo Therapeutics based in Schlieren (Switzerland) uses a sophisticated microfluidics-based platform technology to isolate single B-cells and discover rare neutralizing antibodies. Next to assets in virology, Memo Therapeutics has recently discovered broadly neutralizing COVID-19 antibodies that are entering the clinics in spring 2021 to be used as a treatment for patients affected by the virus.

Lastly, we have backed Scailyte, a Basel-based single-cell data analytics start-up that uses artificial intelligence on the large amounts of gene expression data that single-cell sequencing produces. The goal is to identify the molecular profiles of cell populations that are associated with a certain medical condition or clinical outcome. With this approach, Scailyte discovers unique sets of genes, expressed in a specific cell population and associated with a given disease (so-called biomarker signatures), which are then translated into new, ultra-sensitive clinical applications and diagnostic assays. The company is currently working on several indications with a focus on immunology and oncology and has filed patents for biomarkers in skin T-cell lymphoma and acute respiratory distress syndrome.

We are currently looking to broaden our portfolio across the entire single-cell landscape and have some interesting candidates in the pipeline – stay tuned!

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

05.02.2021

Getting access to the best startup investment opportunities

As the returns of startup investments are predominantly determined by a few rare successes, getting access to the best opportunities is quintessential. This is more difficult than it sounds.

12.08.2020

Scailyte (Single-Cell Technology): CHF 3.7m Pre-Series A

ETH-spinoff Scailyte, which leverages artificial intelligence to help identify diseases earlier, raised a CHF 3.7 million Pre-Series A round led by Swisscom Ventures.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.