Quantum offers a revolutionary new way of computing: It provides the most significant change to computers since the invention of the transistor and is poised to impact nearly every sector, from scientific discovery to healthcare, to banking. In this article, Pepijn Rot from Verve Ventures lays out how we think about investments in quantum in the age of AI.

Investment Associate, Verve Ventures

Pepijn has a background in applied physics and graduated from the world-renowned quantum research institute QuTech, where he worked on the experimental implementation of a novel qubit type combining superconducting and spin qubits. For his second degree in management of technology, he wrote a Master’s thesis on the competitive and collaborative strategy in the quantum industry. Before joining Verve Ventures in 2024, he was a partnership manager at the quantum computing startup QuantWare, which is making superconducting processors.

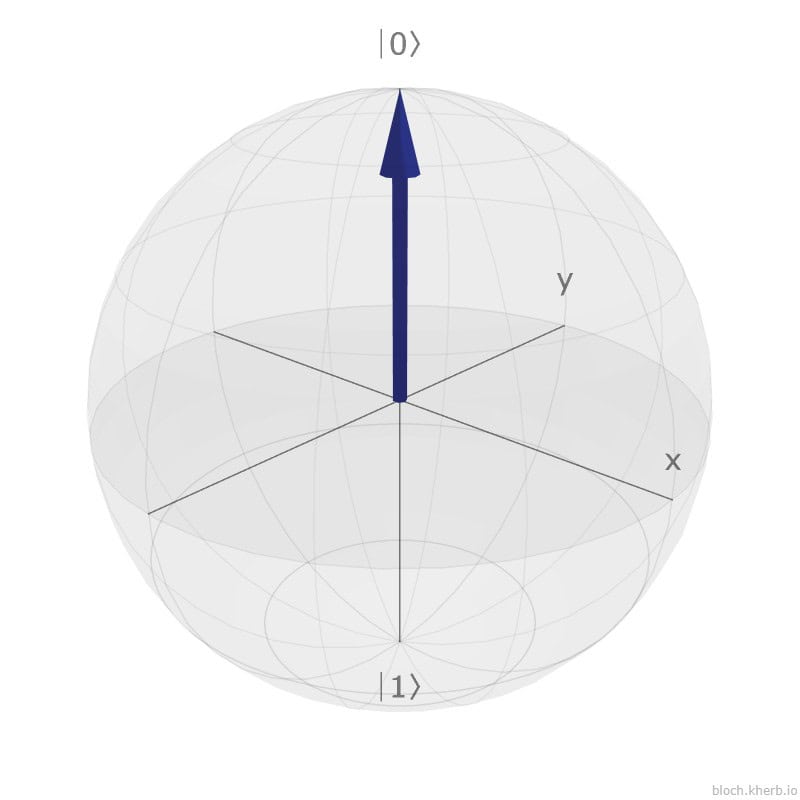

Rather than a two-state system of zero and one, the basic element of computation of a quantum computer, the qubit, can take any value on a sphere around 0 and 1 (see below). This means that every qubit can store and process more information than a standard bit, leading to an exponential speedup in solving specific problems.

Image credit: https://bloch.kherb.io/

This radically new way of computing requires a complete shift in thinking about algorithms, but it will ultimately open up paths that are impossible with conventional computers. Much like with early applications of the classical computer at its inception, it is likely that we haven’t discovered the most valuable applications for quantum computing yet. Nonetheless, the early pioneers of computers, such as IBM, Intel, and Microsoft, still became some of the world’s largest companies.

However, quantum computing is fighting competition from breakthroughs in machine learning and AI: Beachhead applications for quantum are primarily in the same space as AI and are at risk of being cannibalized. Nonetheless, we can identify a few applications where quantum is complementary to AI:

- Quantum computing excels in simulating complex systems governed by many-body quantum effects, a challenge first highlighted by the American physicist Feynman in 1981. This capability could revolutionize industries by unlocking breakthroughs in areas like energy storage, drug development, solar technology, and superconductivity. With rapid advancements, tangible progress in these fields might be closer than we think. AI will especially fail in cases where high explainability and accuracy are required, and data availability is low.

- Very recently, SAP CEO Christian Klein also elucidated SAP’s optimism about the proliferation of quantum computing in supply chain management, where quantum computers can be used to calculate scenarios in complex, many-actor supply chains more efficiently. They foresee a commercial quantum advantage only 3-4 years away.

- Currently, the bottleneck of AI is computing power. The growth of AI models puts a considerable strain on computational capacity. As a result, the future of computing topic is hot. Besides incremental innovations in computing space (marginally improving computational efficiency, capacity, etc.), we’re also seeing renewed interest in the basic elements of computers. Contenders here are, for example, RISC-V (a computational architecture), photonic (or optical) computing, neuromorphic computing (a computing approach inspired by the human brain) and quantum in increasing order of radicality. Although early stage, some studies have highlighted the gains quantum computing could bring to the field of machine learning.

Notably, although many large firms, potential end-users for quantum tech, currently focus very explicitly on AI, all of them still have quantum teams. This means there is still interest; they are just awaiting hardware readiness.

Why do we believe in outsize returns in quantum?

The market has yet to mature, much like in the early days of semiconductors. Early investors got the biggest piece of the pie in terms of returns. Early investments in successful quantum companies will likely yield substantial returns.

When we accept this premise, an important question remains: What is the timeline? Will the industry be substantial in 10 years? Due to the applications mentioned above and continued rapid progress on hardware platforms, we believe there will be initial commercial applications around the turn of the decade. This makes quantum computing a proper venture case, with high risks and potential ultra-high rewards.

After a consolidation period, an oligopolistic outcome is likely: High capital expenditure and development costs ensure that the winning architecture can build a significant and sustained competitive advantage. Combined with a vast potential impact, it means that dominant companies in the winning value chain are in for massive growth and will be able to go public or be acquired at significant valuations. The oligopolistic field that remains will likely consist of computing incumbents like IBM and Google, but also startups that are only founded today or tomorrow.

The quantum computing battlefield: Need for specs

Current quantum computers simply do not have the size or performance to fulfill quantum’s value promise. The fundamental element of quantum computation, the qubit, still needs to become more reliable and plentiful to allow the proliferation of quantum algorithms over their classical counterparts.

Therefore, the hardware competition is driven by a need for a large number of reliable qubits, boiling down to the various specifications that characterize their performance and scalability. In general, the fragile qubits get disturbed by their environment, leading to calculation errors. However, the qubit count is not the only thing that matters. So do operating speed and error rates, platform-specific parameters such as control methodologies, manufacturability, uniformity, operating conditions, and more factors that are crucial to capture the state of the technology. These are the key performance indicators (KPIs) by which companies are judged for the foreseeable future.

Companies’ ability to improve these KPIs depends on many underlying factors. First and foremost, the qubit platform of choice dictates the bottlenecks and challenges that must be overcome to reach good numbers on all these KPIs. Although the topic is too broad to provide exhaustive coverage for each platform, some general remarks can be made.

For superconducting qubits, the challenges generally include fabrication uniformity, line scaling, minimizing crosstalk and qubit surface area.

For spin qubits, it’s about scaling qubit numbers while maintaining performance, automating procedures for tuning the qubits and circumventing interfering impurities in the substrate.

Scaling atom-based quantum computers faces key challenges in precise atom trapping, maintaining error-free control, achieving fast and parallel gate operations, and implementing scalable error correction.

For photonic quantum computers, it’s about generating high-quality indistinguishable photons, minimizing loss in optical components, developing scalable entanglement schemes, and integrating reliable sources, circuits, and detectors into compact architectures.

Ultimately, the exact challenges for a new platform need to be analyzed case-by-case.

Analysing quantum computing investments

Many of the quantum startups are founded after researchers at a university find a novel way of resolving one or a few platform-specific bottlenecks. Therefore, tech due diligence and team track record are vital in assessing potential: “Are these people truly pioneers in the field?”.

On top of this, public funding drives the current quantum industry directly or indirectly. Consequently, those companies that are best at attracting capital will be able to innovate faster and embed their technology into the emerging ecosystem. With high switching costs for clients and end-users due to the non-standardization of interfaces, early winners can build a competitive moat. Among the skills needed for attracting capital are having an extensive and high-quality professional network, a deep understanding of industry drivers, and experience in grant or tender application writing.

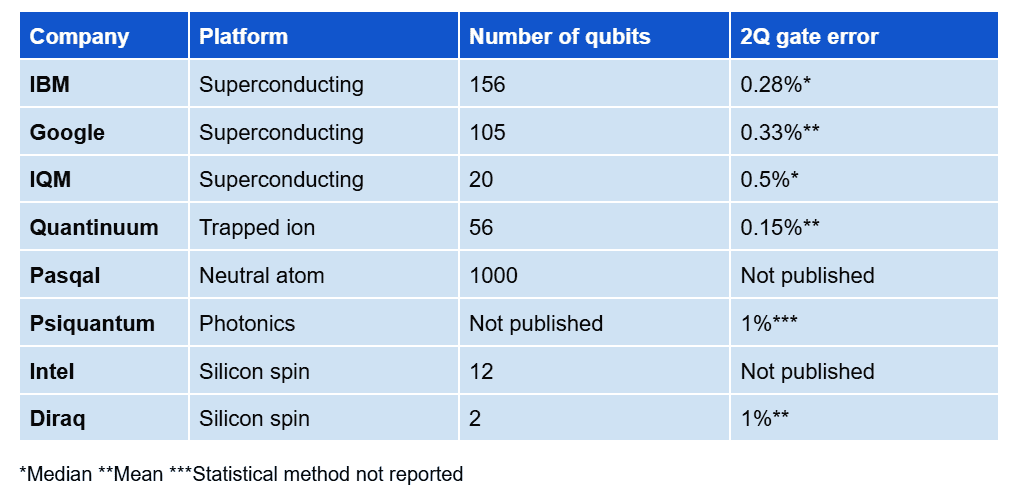

The leaders in qubit technologies

The table below shows the performance metrics published by the world’s leading quantum computing companies. As qubit number and error rates between qubits are key metrics, we collect these to illustrate the state of these technologies. Note that this does not provide the complete picture: other parameters, such as gate speed, connectivity between qubits, uniformity of qubit performance, scalability potential, and many more, also play key roles in the tech’s potential.

Invest in Startups

As one of Europe’s most active venture capital investors, we grant qualified private investors access to top-tier European startups. With investments starting at EUR/CHF 10’000, you can build your own tailored portfolio over time and diversify across stages and sectors.

One of the most challenging aspects of quantum computing hardware is producing a large amount of good qubits rather than having a cherry-picked, small-scale sample. It is, therefore, generally more impressive to have a large amount of ‘okay’ qubits (with little variance), than a few great ones. Thus, the combined metric of large qubit numbers with low average gate errors is a reasonable estimation of frontrunners. In this regard, IBM, Google and Quantinuum lead the race.

The US has been exceptionally good at fostering the innovation required for computers to be built and expanded. Historically, the US is well-positioned for the quantum revolution, and several very early quantum companies have been founded in the US: Rigetti, IonQ, and Psiquantum.

However, Europe has been very early in funding tech through national and international schemes such as the Quantum Flagship program and national programs such as Quantum Delta NL or the National Quantum Computing Centre in the UK. On top of this, Europe has played a leading role in academic research into quantum tech. The considerable talent scarcity may give the EU an early edge.

An outstanding question is the access to growth capital for quantum companies in Europe. We have seen several investments in series B+ quantum companies from both European and global funds, but it is no secret that raising growth capital in Europe is hard. Nonetheless, several funds are interested in investing in the EU quantum growth market, and we believe great quantum companies will be able to attract capital. It helps that Europe has investment funds specifically investing in quantum technologies, such as Quantonation, QAI Ventures, and QDNL Participations.

Verve’s current quantum portfolio

Our current quantum portfolio comprises six companies spread across various quantum hardware platforms and value chain positions.

Our portfolio has so far included two qubit technologies. Orca Computing works on photonic quantum computing, and C12 creates qubits using carbon nanotubes.

Orca Computing is closing the gap to datacenter adoption with a photonic accelerator product, which can already be implemented today. Moreover, photonic qubits have seen massive growth, with Psiquantum’s recent contracts to Australian and US governments totaling over 1.4B USD.

C12 is tackling qubits’ scalability problem. Material impurities and manufacturing imperfections hinder scalable systems, particularly in superconducting and spin qubits. Using carbon nanotubes allows C12 to create qubits free of imperfections, leading to better performance. Though it’s early for this technology, the C12 team has demonstrated impressive business-building capabilities, raising over EUR 25M and opening a world-class lab in the heart of Paris.

Other value chain position companies include Kiutra, Kipu and Miraex: these companies enable or enhance qubit technologies but do not develop them themselves. Kiutra provides part of the infrastructure needed to create spin and superconducting qubits: the fridge to cool the samples to temperatures required for operation. Kipu Quantum is working on maximising the use of current amounts and quality of qubits for algorithms, to provide beachhead applications for quantum computing. Lastly, Miraex is creating an interconnect to link multiple quantum processors.

Lastly, we have Qnami, a quantum sensing company. It harnesses the quantum properties of defects in diamonds to make incredibly sensitive magnetic sensors. This has applications in materials science and semiconductor processing, where defect detection is crucial for process optimization.

On exits

The quantum game is a long one. Tech exits might be possible, but only a few select cases will exist. These will likely be vertical or horizontal expansions of current quantum companies (such as Pasqal with the acquisition of Qu&Co), or purchases by classical computing companies wanting to enter the quantum space (such as Formfactor’s acquisition of HPD). As the quantum industry and the companies therein grow, we expect more significant acquisitions of this sort. Platform switching will also likely occur more, such as Intel’s decision to venture into spin qubits after their program on superconducting qubits, or Google’s recent investment in QuEra.

For vertically integrated quantum companies, IPOs are a potential exit route. We have seen a handful in the first wave of quantum computing (Rigetti, IonQ, D-Wave: all at valuations above a billion dollars), and expect to see more in a second wave. This second wave will come once we reach the first commercial applications or fault-tolerance at scale, whichever happens first.

Market sentiment is essential for exits. If people are optimistic about quantum’s development, we expect investments and exits to be more sizable. We believe that quantum will reach its next wave before the turn of this decade. As a result, investing now in companies that will be well-positioned in 5 years, with high capital efficiency to get there, is a good strategy.

An active approach is key

Our stance regarding qubit platforms is the following: We want to invest in great companies in the qubit verticals that we treat as equal from a technology potential perspective. There are five leading qubit platforms: Superconducting, spin, trapped ions, neutral atoms and photonics. All could have a place in future quantum computers. They might coexist, or they might outcompete each other.

However, not all verticals are equal in terms of development. Superconducting qubits are the most mature of the platforms; a large field of incumbent full-stack providers already exists. Therefore, bets on new full-stack players within these verticals do not make sense. The same goes for photonic and trapped ion qubits containing many full-stack hardware providers. Nonetheless, specialized players within these verticals may make good investments, provided they solve at least a single significant bottleneck. These companies need to innovate the business model, which might allow them to have significant revenues before the quantum end-user market becomes substantial.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

06.09.2023

“We’re developing the computers of tomorrow”

Quantum computing is a key technology of the future, says Pierre Desjardins of C12 in this interview. In order not to fall behind in this technological race, European investors need to be more courageous.

02.03.2021

An introduction to quantum sensors and the investment opportunities

in this space

Quantum computing and its supremacy over the classical computer capture the imagination of people all over the world. Less known, but no less fascinating is the practical application of quantum phenomena to build sensors that can measure what is otherwise impossible. Scanning a single cell, looking around a corner, hearing a mouse eat in a grain silo, all of this becomes possible thanks to quantum sensors.

01.07.2019

“We need to explain what quantum technology is about”

Quantonation is the first venture capital fund dedicated to investment in quantum technology. Founder Christophe Jurczak explains when the different quantum technologies will be ready and why he invested in the Swiss startup Qnami.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.