In this interview, Paolo Buzzi recounts the story of how Swissquote went from a startup in a paint warehouse to a public firm and market leader. As a CTO, he shares insight about remote work, growth and expansion and why he joined the board of the fintech startup Netguardians.

Co-founder and CTO, Swissquote Bank

Paolo Buzzi is co-founder and CTO of Swissquote Bank, an online trading platform quoted on the Swiss Stock Exchange (Ticker: SQN). Swissquote has close to 800 employees and a market capitalization in excess of CHF 1.1 billion. Paolo is also a board member of the award-winning Swiss software company Netguardians that provides AI-powered fraud detection software for global banks. He studied Engineering (Microtechnology) at EPFL.

What was the idea behind Swissquote when you founded the company with Marc Bürki?

When we started our first company named Marvel Communications in an old paint warehouse in Gland, our goal was to provide stock price information to banks. Over time, however, our business model became difficult because we became competitors to our partners such as Telekurs, Six and Reuters. With the advent of the internet around 1996, the idea of Swissquote was born: We wanted to challenge the traditional banks by democratizing stock trading and empowering investors to act on their own. Initially, we just wanted to build a website that generates traffic and sell advertising on it (laughs). We started in 1996 by displaying 250 Swiss stocks on our new website Swissquote.ch, and then in 1998, we worked together with a small private bank based in Zurich. They were the only ones that wanted to work with us. We had the status of an introducing broker while the stocks were held by the bank. When we wanted to move fast and add US stocks and other things to our platform, our partner couldn’t follow that pace, which is why we decided to apply for a banking license ourselves. In order to do so, Swissquote became a public company in 2000 and raised CHF 70 million in the process. We got the bank license in 2001. I always say that I’m an engineer that became a banker by accident.

Over three decades, you built a successful business or, as people would call it today, a fintech unicorn. Is there still fun at work after such a long time?

I still enjoy work even if things have changed a lot. In the early days, we did all-nighters to get developments done, we worked without pause. Now, with 780 employees, the rhythm is different but we’re still always at the forefront of innovation. We were the first bank in Europe to offer cryptocurrency trading, for example. Up until today I still share the same office space with Marc, we’re accomplices in this.

What was the hardest time you ever had?

I’d say the years 2001 and 2002, after the tech bubble burst, were the hardest for us. We had to terminate about 40% of our workforce, the regulator was asking questions if we were still solid enough to continue working as a bank, and our stock price, which went up a bit after the IPO price of CHF 250 came down as far as CHF 11 at one time. It was like a descent into the abyss. But we fought on and recovered and became profitable later. A startup’s path to success is rarely a trajectory that goes only up.

A startup’s path to success is rarely a trajectory that goes only up.

You mentioned continuous innovation as something that keeps you going. Swissquote was indeed a pioneer on many occasions, for example when you launched an iPhone app in 2008 as the first Swiss bank. You even introduced a VR trading app 3 years ago. I assume this pioneering spirit is possible because over a third of your employees are engineers?

We are a tech company with a banking license, indeed. We have more than 300 engineers and pride ourselves to do things differently. Our offices in Gland are in the middle of nowhere, we interact with our customers only digitally. But innovation isn’t an end in itself, it needs to correspond to a customer need. For people who are fed up with their private banker, for example, we launched the first robo-advisor called e-Private Banking 10 years ago.

With so many engineers, hiring must be a top priority for you as CTO.

It is, because Switzerland does produce very skilled and passionate engineers, but simply not enough of them. This is why we have sizable teams in Ukraine and Portugal as well. The primary reason is not the lower salaries, it is the availability of talent.

Many of our portfolio companies practice nearshoring as well. What tips can you share regarding the choice of the countries that you made?

With the size of our projects it is not necessary to go as far as India where there are thousands of engineers available, so we opted for countries that are nearer. Ukraine qualifies as a good place because education is excellent, and the engineers have formidable skills. Romania would have been interesting as well, but at that time many companies rushed there which led to a shortage of highly skilled people. As for Portugal, it is impressive how polyglot the people are. We looked at Spain but found the English skills lacking. Overall, leading remote teams takes a lot of time and energy, especially because the level of independence in working isn’t the same as here in Switzerland. If you practice agile software development, this means that you need to spell out tasks in much detail.

Let’s come back to the topic of your business model, which is online trading. How can you grow the company going forward?

We are the market leader in Switzerland and will defend this position while pushing our international business. We bought Internaxx Bank in Luxemburg last year which gives us access to the EU markets. We already have offices in London, Malta, Singapore, Hong Kong and Dubai. Instead of applying for a banking license in each and every country, which is an onerous process, we provide our platform as a white-label solution to foreign banks as a means of expansion.

Who is the typical Swissquote customer?

Agewise, we have a Gaussian distribution with a peak at about 40 years and a second one at above 60. An average account is CHF 70’000 but that number hides the variety which goes from students with CHF 1000 to family offices with millions.

Do you trade yourself?

Absolutely, I read a lot of articles about different companies in the newspapers and enjoy that the stock market allows me to feel the pulse of companies. I’d say I do about a trade per week on average.

What was your worst investment decision?

I tend to remember the good ones more clearly. (Laughs). I had a bad experience with investing in gold because of very volatile price movements, and concerning stocks, I’d say that a big source of frustration can be if you sell a well-performing stock too early.

Besides your day job as CTO of Swissquote, you’re also an investor and board member of the banking software startup Netguardians, which uses AI to prevent fraudulent transactions. How did this come about?

I have to say that I’m very selective about taking on such roles and do so only rarely. But when I met the founders Joël Winteregg and Raffael Maio, I was very interested because I see the need from a banking side. The technology of deep learning is right in my alley. From the beginning, the founders struck me as being very professional and enthusiastic and as a complementary duo, and this reminded me of our beginnings as well.

As a bank, you simply cannot be asleep at the wheel.

When you say you understand the need for such a solution from the bank’s perspective, how relevant is the topic of fraud prevention really?

The big trend is digitalization, and Covid-19 really accelerated that trend. Transactions are moving online, and it is clear that this attracts people with bad intentions. These people are sophisticated and creative and move very quickly to new methods. This means that is a real need to detect fraudulent transactions and protect your customers. As a bank, you simply cannot be asleep at the wheel. And it’s not just external threats, errors that happen internally can be prevented as well. For example, when someone enters a transaction and erroneously adds too many zeros, a “fat finger” mistake as we call it, it is a huge nuisance to get money back once it has left the bank. At best, it takes time and effort. Such headaches can be prevented and this gives us peace of mind. There are different ways to go about these problems. I remember when we started we employed two people that just checked every single transaction. Netguardians software is not just about the automation of controls, its quality also lies also in a low rate of false positives.

How do you help the founders as a board member?

For a startup, growth is essential, but growth isn’t easy. When you scale your organization, there are different levels of structure, when you pass from 2 people to 10 and then to 50 and beyond. We have experienced this ourselves, and I also have the experience of an IPO. The other aspect is advice from a client perspective, I can help to shape the product to assure that it corresponds to actual client needs. But I also learn from them, it is fascinating to be up to date about the different types of banking fraud that exist and are regularly tried out.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

08.07.2020

Investment Activities H1/2020

We're happy to share a few highlights from our investment team from the first half of 2020.

07.07.2020

“I’m bullish about the Swiss startup ecosystem”

Lucian Wagner has two decades of experience as a startup investor. Together with Jacqueline Ruedin Rüsch, he runs Privilège Ventures, a seed and early-stage venture capital firm active in Switzerland and Europe. In this interview, they share the story of how they came to invest in startups and what fascinates them about the Swiss startup ecosystem.

16.01.2020

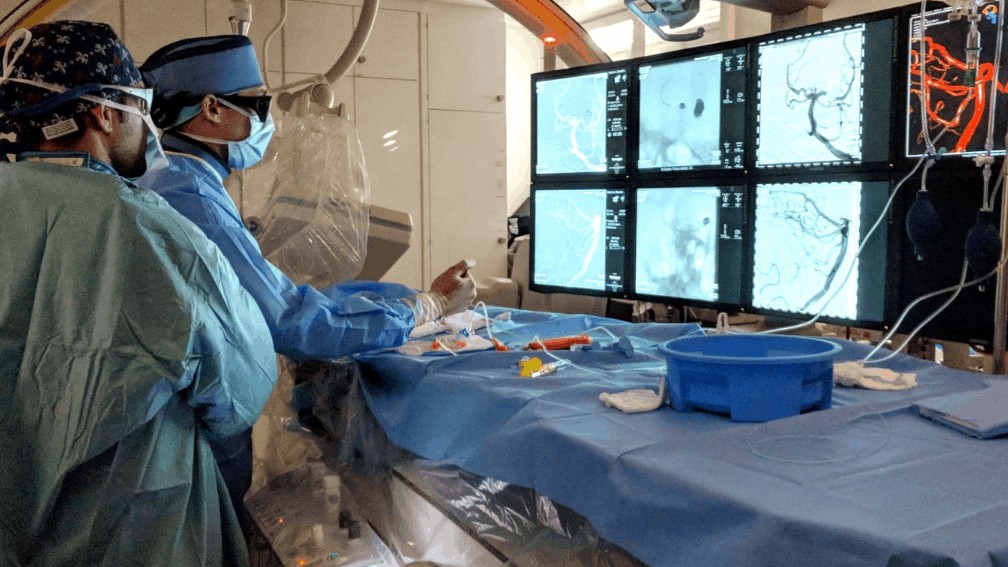

“I’m a brain plumber”

Stroke is a serious medical condition that affects the brain of 15 million people each year. Since the 1990s, continuous technological improvement enables more lives to be saved year after year. Interventional neuroradiologists can perform operations in a minimally invasive way, guided by modern imaging technology. In this interview, endovascular neurosurgeon Pascal Mosimann explains how.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.