How hard has COVID-19 hit our startups? With over 80 investments across different sectors and countries, our portfolio might give an indication of the impact on the European tech landscape as a whole. While some companies are hit hard, there are also very positive stories to be told. One thing has been made painfully clear: If you invest in startups, you should diversify.

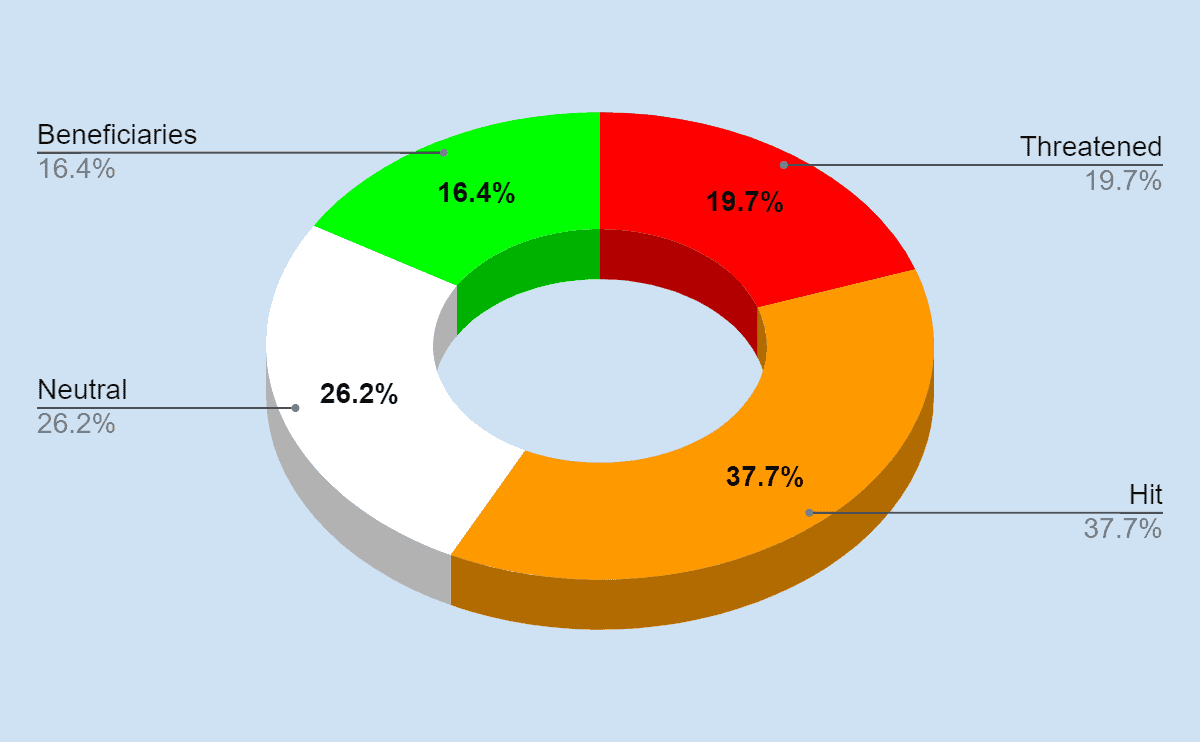

As soon as the threat of COVID-19 began to manifest in Europe, we reached out to our portfolio startups to assess the impact. Based on these talks, we grouped our portfolio into four categories: Threatened, Hit, Neutral, and Beneficiaries. It is important to mention that these 4 labels are at best a snapshot of the situation in mid-April, as the startups react fast to the challenges and often see both positive and negative developments at the same time.

More important than just gathering data points is the immediate support we can offer our portfolio firms during these difficult times. Our portfolio success team was very quick to organize webinars around pressing issues such as labor law and also offered hands-on support with client introduction and hiring. For more details on how we are supporting our startups, read this.

Threatened: COVID-19 poses a vital threat to these startups

For 20% of our portfolio companies, the coronavirus crisis is indeed a crisis. This category includes startups in industries that are severely affected such as leisure, hospitality, and tourism, for example. They have seen their revenues fall rapidly and they have responded with drastic cost-cutting. Not knowing how long it will take until their markets recover is especially difficult for companies that don’t have ample liquidity, while companies that just recently raised funds are more confident that they can weather the crisis and survive a prolonged dry spell.

Some of these companies are not affected by COVID-19 per se. What puts them in a difficult position is low liquidity combined with a capital intensive business that makes it difficult to cut costs significantly. Their main concern is fundraising in an environment where risk capital is scarce. Companies with high cash burn rates are always at the mercy of financing conditions, not just due to the corona crisis.

Hit: Everything is much slower now

This is the largest category with 4 in 10 startups and for diverse reasons. These are fundamentally solid businesses. But for now, they feel the general slowdown of economic activity. It’s difficult if not impossible to meet prospective clients. Trade fairs and in-person meetings are all canceled, critical acquisition channels for many startups selling physical products or working with enterprise clients.

Most of these companies are also busy reducing their costs, adjusting their sales projections, and extending their cash runways, even if they have sufficient cash reserves.

Some of these companies were planning financing rounds in the second half of the year. In anticipation of this, they were busy working towards their revenue goals, trying to win new clients, and finish projects. The slowdown thwarted these ambitions, and without rapid growth, large growth financing rounds are difficult to put together. As a result, these companies have postponed their financing rounds and are opting for smaller bridge rounds with existing investors instead. 2020 may well become the year of bridge rounds.

Neutral: If you have nothing to sell yet, you keep calm and carry on

26% of our portfolio startups are not affected commercially by the current situation. These are hardware, medtech or biotech startups in an early phase that are still working on their product. They have raised funds recently and, with a full bank account, need not worry about the next few months where they planned to be focused on internal development anyway.

Not having sales yet, and not feeling the harsh wind of the economic downturn doesn’t mean that there aren’t any problems, however. Clinical trials might be on pause and with many research institutions and universities closed, working in the lab might not be feasible at the moment. These companies focus on other things instead, tasks that can still be done from their (home) offices and own labs, such as software development and documentation, applying for grants, or working on chip design.

Beneficiaries: Offering a solution for dealing with the crisis

For 16% of our startups, this is the time to shine. These are companies that offer pertinent solutions to the current situation, either in the biotech industry or with digital tools.

These companies are witnessing an unprecedented interest in what they do, be it from the media, investors, or from clients. We’ve seen usage numbers of digital platforms explode. Thanks to high demand and shortened sales cycles, their already impressive growth has been supercharged. We’ve heard that business deals that would take months to close in a normal environment are now done in a matter of days. Apparently even large corporations are very quick to make decisions if they are confronted with unprecedented problems. The crisis cuts through the inertia.

Take the necessity of switching a large company to home office from one day to the next, for example. This has been a boon for Beekeeper’s mobile employee communication tool. Updating employees with the latest information has also become a very urgent need for the health sector, from which Beekeeper has seen rising demand, as the company’s CEO Cristian Grossmann explained in our interview.

People have become reluctant to go shopping during the crisis or weren’t able to because of shutdowns. This has led to a rapid rise in e-commerce volumes. It has also increased the load on customer service at a time when many call centers had to shut down. GUURU’s AI-based chat software was perfectly positioned to help retailers and e-commerce sites cope with this demand. Its chat volume rose 84% in March, according to CEO Tonio Meier.

In a time when face-to-face meetings are impossible and trade fairs canceled, Cognism’s digital prospecting solution helps salespersons identify the most interesting sales leads.

As most companies were forced to hold their general assembly digitally, Sherpany, which specializes exactly in this, was perfectly positioned to profit from this digitalization rush.

Ueepa’s proximity technology can be used for contact tracing, and it has already been implemented in an app by Red Cross Austria.

Last but not least, companies can show an almost miraculous reversal of fortunes. COVID-19 stopped the sports world. For the court booking platform GotCourts, this was a disaster, as revenues quickly ground to a halt. They were a clear case of a startup being hit heavily. But now, as tennis clubs in Switzerland prepare to reopen in May, they need to ensure traceability. GotCourts digital reservation system makes this possible and will probably be mandatory for all players. Read the full story of ups and downs GotCourt went through here.

While these digital solutions are helpful to combat the effect that COVID-19 has on society, we’re also very proud to have invested in biotech firms that combat the cause itself.

The crisis has highlighted the urgent need to find a better and faster way to identify vaccines, a topic that pharma firms have been neglecting for economic reasons. Our portfolio company Memo Therapeutics has developed a platform technology that allows it to capture genetic information of millions of immune cells from COVID-19 survivors and based on this, identify the rare antibodies that are most effective against the virus. CEO Karsten Fischer is confident that he can present results in the coming months.

Our portfolio company PathoQuest applies next-generation sequencing (NGS) technology to microbiology testing. It is now rolling out its clinical diagnostic tool in hospitals, which detects COVID-19 among hundreds of other viruses and bacteria in blood samples. PathoQuest aims to raise USD 15 million this summer, as Mergermarket has reported. The fact that this company, like the other examples before, has received a lot of attention recently because of what they do, should provide a strong tailwind in fundraising.

Are these numbers good or bad?

In the recently published European Startup report an exercise similar to ours was done, albeit at a much larger scale. The definition of the two categories in the middle differs, but we would argue that the picture is not fundamentally different. For us, the lesson learned from the crisis reinforces our view that it makes sense to build a well-diversified portfolio. And with a deal-flow that spans software, hardware, and Life Sciences startups from all over Europe, Verve Ventures enables private investors to do exactly that.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

11.03.2021

We’re now called Verve Ventures

Europe’s leading digital startup investment platform formerly known as investiere is called Verve Ventures. Verve Ventures has become one of the most active venture capital firms in Europe.

22.07.2020

Supercharging our startups

It has been more than half a year since we established our Portfolio Success Team to help our portfolio companies. We are happy to share a review of what has happened so far, what were some key results and what is coming next for the second half of 2020.

01.04.2020

How we are supporting our startups

Established at the end of 2019, the portfolio success team is playing a pivotal role in supporting our startups in these trying times. Here’s how.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.