Removing humans from dangerous industrial jobs by using drones for inspections saves plant owners a lot of money. In this interview, Flyability co-founder Patrick Thévoz talks about the potential of the market and how to unlock it.

Co-founder and CEO, Flyability

Patrick Thévoz founded Flyability together with Adrien Briod in 2014. Flyability is a Swiss company based in Lausanne, building safe drones for operating indoors, in complex and confined spaces. It has received numerous prizes, including the USD 1m UAE Drones for Good award. With over 100 employees and 1500 drones in the field, Flyability targets revenues of USD 20m in 2022. The company has raised USD 27m so far.

You co-founded Flyability in 2014. What were you doing before that?

I was an engineer at the EPFL, where I was studying robotics with Adrien Briod, my co-founder. He went on to do a PhD in robotics and I went on to do strategic consulting, advising companies on product launches and conquering new markets.

What lead you to drones?

We were studying robotics at the time of Fukushima and the Haiti earthquake – moments when we hoped to see mobile robots’ potential to gather data and help people in those very difficult environments. That was Adrien’s PhD thesis: robotics for complex environments. It was very much nature-inspired, looking at how robots could replicate insects’ flight dynamics. Our first prototypes of an indoor, collision-tolerant, flying robot were produced at the EPFL in 2013.

What makes Swiss drone companies credible?

Switzerland is home to a very important “drone valley”, as some people call it, and many successful drone companies. There are various reasons for this. The technical universities – the EPFL in Lausanne and the ETH in Zürich – have very good robotics labs. There is good know-how in mechanics and electronics in Switzerland due to country’s industrial fabric. And there have been early success stories, such as senseFly and Pix4D, which did an exit a few years ago and inspired many entrepreneurs. Together, we form a close-knit community and there is a sort of emulation. It makes total sense to be doing drones in Switzerland.

What problem did you set out to solve?

Our mission is to remove humans from dangerous industrial jobs. This is a major problem in industry, where many areas require scaffolding or rope access, and people climb up chimneys and crawl into pipes to get the data needed to maintain those assets. Entering a confined space is one of the most dangerous occupational hazards. It also involves expensive access methods – scaffolding can cost hundreds of thousands of dollars – and leads to downtime. You need to take the plant of offline, which costs huge sums of money. If you can reduce this time by using a faster tool – such as a drone, which can get to any part of the plant in five minutes – you are saving the end customer tens, if not hundreds, of thousands of dollars.

Who are your customers?

We currently have over 800 customers around the world, in different segments. Firstly, inspection companies that provide services to many different customers and industries; the likes of Bureau Veritas, DEKRA or SGS. Secondly, there are end users or asset operators – the people who run the plant. For us, the largest industries are chemicals, oil and gas, power generation, cement, utilities and mining. In all of them, we have landmark customers: for example, Dow and BASF in chemicals, and BHP and Rio Tinto in mining. We are present at around 75% of US-based nuclear power plants. We work with most of the large electric companies– Exelon, Duke Energy and TVA – and, in Europe, with Enel and EDF.

How are your drones designed to operate in challenging environments?

Navigating indoors is a very difficult challenge for drones. Flight reliability is a challenge due to obstacles, complex environments and collisions. One of our drone’s major features is its collision tolerance. It is protected by a carbon-fiber cage, which provides the first level of protection. The second level is based on algorithms and sensors, which enable the drone to understand its trajectory and location. Our drones are able to operate in very dark, dusty, complex and GPS-deprived environment.

Flyability makes inspections safer and faster, but also cheaper. What are the associated savings?

The savings can range from millions to tens of thousands of dollars, depending on the industry, the use case and the field reality. In the nuclear industry, customers have reported savings of over half a million dollars with a single flight – because they could carry out the inspection inside the reactor building without having to turn down the power plant’s output. In many other areas – such as power generation, chemicals and maritime – our customers record savings in the hundreds of thousands of dollars. Sometimes you save up to a week in downtime simply by carrying out the inspection more rapidly, without scaffolding or rope access. Building scaffolding is expensive, too. Finally, there are safety-related costs: by using our drones, you can remove the safety measures and protocols required when sending in humans.

What role does data play in your product?

Data is at the heart of what we deliver. The drone itself is only part of our solution; it is the data-acquisition vector. Live output from the drone to its operator allows him or her to understand where it is and spot defects. After the drone’s mission, all the data is organized and used to identify defects. It is then exported to an inspection report built by our software or to the software our customers use to manage their data.

Invest in Startups

As one of Europe’s most active venture capital investors, we grant qualified private investors access to top-tier European startups. With investments starting at EUR/CHF 10’000, you can build your own tailored portfolio over time and diversify across stages and sectors.

What sets you apart from your competitors?

We are the pioneers in the world of indoor inspection; we basically invented this market and are the market leaders. Our biggest competitors are traditional access methods; scaffolding, rope access and sending people into confined spaces. Our other competitors fit into three categories: firstly, big, well-established drone companies that focus on the outdoor market. So far, there has been no move to enter the indoor market. If there were to be one, it would probably go through an acquisition. Secondly, there are vertically-focused inspection solutions, many of them in mining. Finally, there have been a few companies recently inspired by our products, leveraging Flyability’s success, but they obviously have some catching up to do in terms of reliability and market coverage. Building UAVs with the high reliability and consistency required by the industry is a very large barrier to entry. Flyability benefits from the experience of designing, manufacturing, shipping and supporting a fleet of over 1’500 drones as the market leader.

More than 25M USD have been spent in research, development and industrialization of our products over the past 7 years, with a world leading team of scientists and engineers; and 47 patents filed grant a strong protection against possible new entrants

Another very important barrier to entry is the global network of partners that the company has built, providing support, training logistics, and marketing efforts. In a market such as robotics, a very limited number of competent partners exist, and those are mostly locked-in with Flyability.

How do you sell your products?

We sell through a mix of direct and indirect. Around 23% of our sales are direct, to our key accounts with which we are building fleets of drones. For example, we just signed a $1 million contract with a leading industrial company. The rest of our sales are done through a network of around 60 resellers around the globe, managed from our three offices, in Lausanne, Denver and Singapore.

Flyability has seen strong growth in recent years. How many employees do you have now?

We currently have 102 employees. Almost 50% of them are in R&D; half of them in hardware and the other half in software.

How many customers do you have, and what is your target revenue?

We currently have around 800 customers and roughly 1500 drones in the field. Our target is CHF 20 million in revenues this year.

What is the potential for scalability?

The target market is huge. We estimate that, with the current use case, product line and go-to market, the target market is about USD 4 billion at full capacity. We are part of a huge inspection market worth over USD 200 billion, which is growing rapidly this decade, driven by digital solutions.

Are you operating in a capital-intensive industry? How much money have you raised already, and how much more will you need to raise in the future?

We have a very high growth margin. We are not as capital intensive as some hardware industries operating under a tight margin. Pioneering a market is an expensive endeavor: you have to do a lot of the customer education and marketing. This is scaling very fast though, with rising awareness and with the network effect of our first product. We have raised around CHF 27 million to date. We will raise another financing round, which is expected to be our last, as it brings us to profitability and to an exit window of 3-5 years.

Is it difficult to find investors interested in this topic?

You need to target the right investors. A growing number of investors are focusing on this trend of Industry 4.0 and the digitization of industry. We are having a lot of success speaking to people who understand this business, which is very different from B2C SaaS companies, which is what many VCs had been focusing on. There is a lot of enthusiasm about this big opportunity.

Flyability is among the first companies in the Sparks IPO Academy, a new segment on the Swiss stock exchange. Is an IPO your preferred exit route?

We strongly believe in the relevance of an IPO track, in parallel to strategic acquisition. We need to get our revenue to CHF 50-100 million to be very successful on the stock market. In parallel, we are looking into the right partners for further acceleration, in terms of strategic acquirers. So we are really looking at both sides. The Sparks IPO Academy is a relevant source of information as we prepare the company for this journey.

What are your priorities for Flyability for the year ahead?

Our priorities are our new product launch, commercial scale-up and the fundraising discussed above. We are preparing to launch a new product this year – a very big step towards a more automated, end-to-end solution that adapts to our different verticals. Our commercial objective is to continue scaling up, converting our most important customers into fleet owners, each with several dozen drones.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

01.12.2021

“Astrocast will become the market leader in satellite IoT”

The internet of things is finally taking off, thanks to satellite communication, explains Astrocast’s CFO Kjell Karlsen in this interview. In early 2022, the company will start delivering the communication modules that connect to its satellites.

20.04.2020

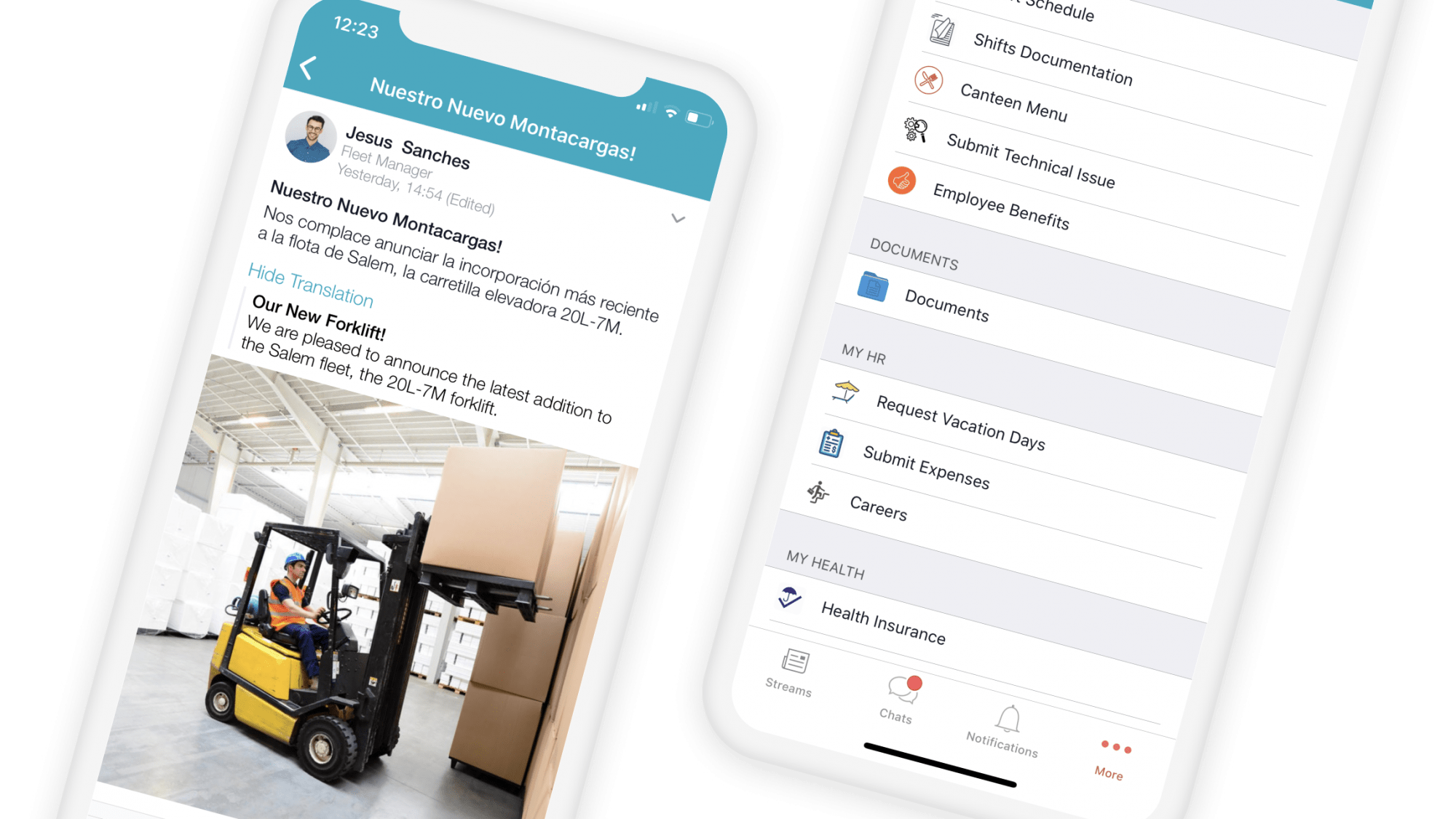

Beekeeper (Mobile Communication): USD 45m Series B

Beekeeper raised USD 45 million from Verve Ventures, Thayer Ventures, Swisscanto Invest, Atomico, Alpana Ventures, Edenred Capital Partners, Fyrfly Venture Partners, and other existing investors. Verve Ventures contributed CHF 3.2 million.

11.06.2019

Wingtra (Drones): CHF 10m Series A

Wingtra has raised CHF 10 million in a Series A financing round from Verve Ventures, Helvetica Capital, ZKB, and private investors.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.