Finnish entrepreneur Kustaa Valtonen invested in the first batch of Startup Sauna companies more than a decade ago. Now, he plans to build the world’s longest railway tunnel together with the Mighty Eagle. Europe could be the global startup powerhouse if there were more cross-border collaboration and if politicians got their act together, he says in this interview.

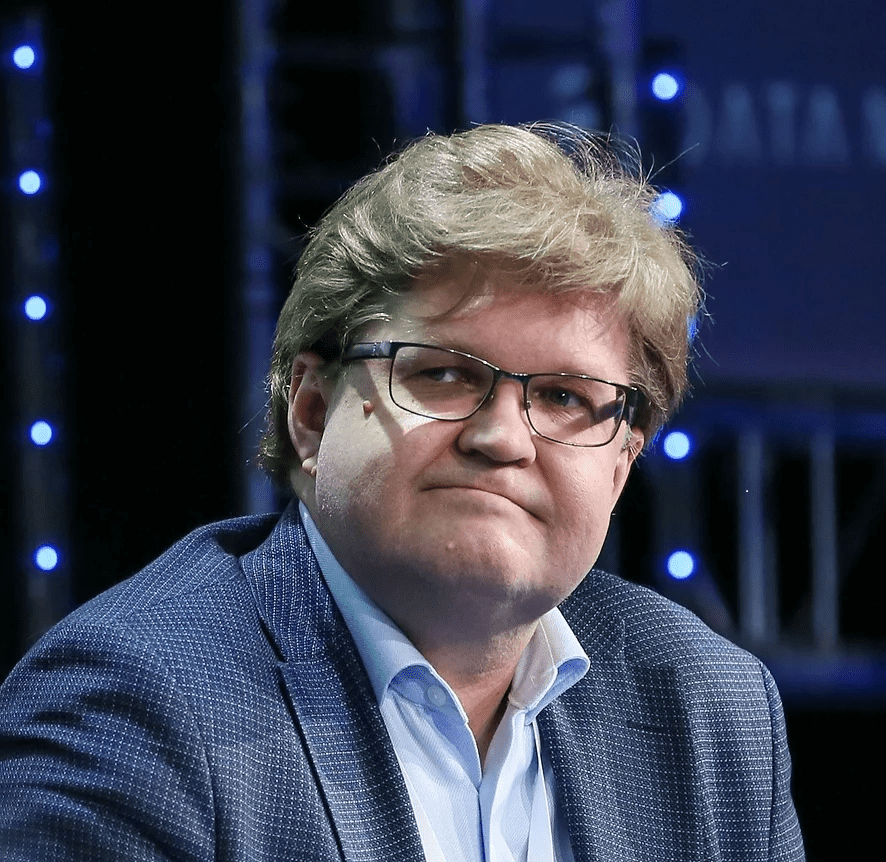

Angel Investor and Entrepreneur

Kustaa Valtonen is a Founding Partner of Finest Bay Area Development, a company that aims to build the world’s largest undersea railway tunnel between Helsinki and Tallinn. He has been an active business angel for over a decade after more than 10 years of experience working for Hewlett Packard and Microsoft. Kustaa is a Civil Engineer decree in Industrial Engineering and Management from LUT University (Finland).

When did you start investing in startups?

In 2009 I made my first investment in the company Audiodraft, a web-based platform that lets companies create and manage their audio brand. I liked the founders, 4 engineering students from Aalto university, and their business idea. It was one of the first companies to come out of the Startup Sauna.

Startup Sauna?

My friend Peter Versterbacka gave a lecture to the students of Aalto University back in 2007 that was titled “It’s ok to be an entrepreneur”. When he asked the room full of 600 students who wants to start their own company, only 3 hands went up. At that time, everyone wanted to work for big companies like Nokia, Kone or IBM after their studies. Peter thought this was a disaster because most meaningful innovation happens in small companies. And so he set out to change that. In 2008 he started Slush, which has become the biggest startup conference in the world, taking place in Helsinki in November. He was also part of a group initiating the Startup Sauna, a student-run organization at the university of Aalto that helps entrepreneurs grow their businesses and brings them together with businesspeople. This is how I met the first startup I invested in.

What has changed in the Finnish startup ecosystem since your first Startup Sauna visit?

Several things. Back in the day, for example, it was a lot of work and quite expensive to structure a financing round. Now, everybody is more educated about the mechanics, there are standard documents like shareholder agreements that people know how to use, and it has become more routine work. Today there is a lot more capital available, as the interest to invest in private companies has increased a lot. The number of early-stage investors has increased, which enables more companies to take off. By now, Finland is number 2 in terms of capital invested in startups per capita, after Estonia. And like in sports, where great athletes inspire the next generation, we have had a lot of success stories that act as inspiration. The Finnish game industry is especially strong, take examples like Rovio which developed Angry Birds, Supercell that became a decacorn [valued at more than EUR 10 billion], Small Giant games, and lots of others. This is quite cool; Financially successful founders usually start investing in the next generation of startups, which gives a huge boost to the ecosystem. Success breeds success.

What have you learned from more than a decade of investing in startups?

I’d like to think that I’ve gotten better at picking good founding teams, but it could also be that founders today know better what they’re doing. From my experience, I can judge better what the right size of a financing round should be. Sometimes it is better to invest less so that they don’t spend too much. Sometimes it is better to invest more because the founders might underestimate their capital needs. When I started, I was very keen on software companies, having worked at HP and Microsoft before. I soon realized that other industries are very interesting as well, so I broadened my scope. Lately, I’ve been looking at health and food startups, for example. There are sectors that I do not understand well, like medtech or biotech, but that wouldn’t stop me from investing in them – I am just much more cautious.

You know a lot of other angel investors. Is there a common denominator between people that invest in startups?

We’re all individuals and the motivation to back the next generation of entrepreneurs varies according to each’s perspective and personality. But a common theme is that these people want to change the world, they want to use their money for a purpose they can identify with.

Who shouldn’t invest in startups?

It’s not for everyone. There is a great likelihood that you will lose all of your money with some investments, you have to be able to stomach that. Still, in the end, hopefully you make more. My first advice is to move slowly and be very careful. My second advice is that it’s better to start today than tomorrow.

What is the relevance of business angel clubs such as FiBAN (the Finnish Business Angel Network) in helping people start investing?

FiBAN has established a very good nationwide structure that helps to educate people. If you come from a traditional field, say you sold your family business and want to make your first steps, its a very good place to start because you get access to an established deal flow and you don’t have to start from scratch. There is also a social aspect to joining a business angel club. I’m not a very active member anymore, because I’ve been doing this for a while now and get a lot of requests on my own, I’ve established a close group of friends that do deals together. I run a portfolio of around 40, 50 startups by now, not just in Finland or in the Nordics, they can be based literally everywhere. What I like about Verve Ventures is that I get a much better visibility about what is happening in Central Europe and the quality of the deal flow.

What are the challenges for Europe as a place to nurture startups?

If I would write a letter to Santa Claus, I’d ask him to nudge the European governments to improve the framework conditions for startups: Less paperwork, more digitalization, intelligent tax treatment. We should also realize that we’re in global competition for talent. Europe, with stable governments and good education, has good cards, but we’re not playing them right. We take in the brightest people from around the world, give them world-class education, and then, instead of encouraging them to stay and start a business, send them back. That doesn’t make any sense. Another challenge is that the startup ecosystems in Europe are dispersed. Europe needs to come together to support more success stories. We need to learn from each other what works and what doesn’t and need a lot more cross-border collaboration and investment. Here again, Verve’s persistent work to make cross-border investments easier and more common is very important, that’s why I’m cheering for you.

Invest in Startups

As one of Europe’s most active venture capital investors, we grant qualified private investors access to top-tier European startups. With investments starting at EUR/CHF 10’000, you can build your own tailored portfolio over time and diversify across stages and sectors.

In 2016, you started the Finest Bay Area Development company together with Peter Vesterbacka. Its goal is to build an undersea tunnel between Helsinki and Tallinn, more than 100 kilometers long. Why on earth do you burden yourselves personally with such a high-stakes long-term project?

Because we can. We’re stubborn Finns, you know. Not many people can make such a thing happen, and Peter and I would feel bad if we didn’t try to do it. Peter was instrumental in Rovio’s success with Angry Birds. His title at that time was “Mighty Eagle”, because he takes things to the next level. [The Mighty Eagle is the most powerful character in the Angry Birds game.] Above all, we have a good business case. Helsinki is the busiest passenger port in the world, it recently overtook Dover. More than 11 million passengers take the ferries between Tallinn and Helsinki every year, and these ferries aren’t exactly environmentally friendly. The tunnel will cut travelling time from 2,5 hours to 20 minutes. Finland is at the far end of Europe, and shares a long border with Russia that no one is eager to cross right now. Connecting via train to Estonia, and via the Rail Baltica project that should be completed by 2028 to Latvia, Lithuania and Poland, makes a lot of sense.

Where does the project stand at the moment?

We’ve signed a memorandum of understanding with infrastructure investor Touchstone Capital for 15 billion Euros. We’ve started the environmental impact assessment in collaboration with the ministry of environment of Finland and are doing detailed planning. On the Estonian side, this takes a bit longer because of a change of government. Once this is done, we’ll continue with the construction permits.

The Gotthard Base Tunnel through the Alps that opened in 2016 was a huge undertaking. It took two decades to build, and it is 57 kilometers long, not 103.

The engineering company we work with, AFRY, participated in the construction of the Gotthard Base tunnel as well. Digging through the Alps, with an uneven moving mass, is much more complicated than building an undersea tunnel on solid bedrock.

What could go wrong?

A project of this magnitude always poses not only engineering problems but also financial and political ones. Just to give you an example: what has already caused a significant delay is that the Finnish and Estonian governments wanted to sign a common letter of intent. In the end, that 8-pages document took 21 months to come up with. At least, there are no political excuses anymore. I can’t tell you a completion date, but it would be nice to finish before the end of this decade. We want to speed up the development of the entrepreneurial ecosystem, the Fin-Est Bay Area takes its name from Finland and Estonia. We want to attract the most brilliant talent to this bay area. When there are a lot of skilled people in one region, and you add a bit of money, a lot of great things will happen.

In August 2022, FiBAN and Verve Ventures concluded a partnership that allows FIBAN members to access the large and varied deal flow that Verve Ventures offers to private investors. In Finland, Verve has already invested in Bob W and plans to make more investments in the coming years. As this interview illustrates, Finnland is highly dynamic environment for startups. Connecting to it will benefit Verve’s portfolio startups and strengthen its pan-European investor network. It is another important milestone for Verve’s mission to encourage cross-border investments and knowledge exchange in Europe’s startup ecosystem. Verve Ventures already has established partnerships with business angel networks in the Czech Republic, in Estonia, in Luxemburg and in Belgium and will announce further partnerships soon.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

12.08.2022

“Europe needs more real business angels”

Verve Ventures recently announced a partnership with DEPO Ventures based in Prague. DEPO’s co-founder Petr Sima explains in this interview why he is excited about the potential of startups in Easter Europe and why Europe needs more cross-border investments in startups.

01.04.2022

“I’m convinced that entrepreneurship is important“

E-commerce pioneer Thomas Gottheil recently sold his startup Frontastic to the unicorn commercetools. Such an exit is a big event for every entrepreneur, a crowning achievement of a career, but not completely life-changing.

17.03.2022

“Women need to be empowered to try startup investing”

As General Counsel, Odile Gastaldo was part of the core team that built up French telecom provider Neuf Cegetel from scratch to one of Europe’s biggest IPOs in 2006. She loves investing in startups and says women can overcome their self-doubt when it comes to investing.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.