The launch of the first European thematic equity fund dedicated to new space companies is a testimony to the growing investor appetite for this topic. Verve Ventures has nurtured one, Astrocast, since 2017. In this interview, fund manager Rolando Grandi explains what characterizes the new space industry, why it is growing fast, and what its prospects are.

Fund Manager, LFDE

Rolando has a decade of experience in financial markets. He is responsible for International & Thematic Fund strategies at LFDE and with his team, manages the newly launched Echiquier Space fund. The fund’s portfolio is composed of around thirty stocks with a market capitalization of more than EUR 1 billion. Echiquier Space covers a key strategic long-term theme that reaches across sectors; it can invest without sector or geographic restrictions in broad swathes of the global economy that have unprecedented potential. In 2021, Rolando received the Refinitiv Lipper award for the best 3 and 5 years performance for one of his funds. LFDE (La Financière de l’Echiquier) is a Paris-based asset manager with more than EUR 14 billion AuM.

You just launched a new equity fund dedicated to “space 2.0” or “new space” companies. If there is a new space economy, there must have been an old one, too. What were the old space companies like?

The first space flights took off 60 years ago, and the old space economy was characterized by several defining features. First, the money that has flown into space 1.0 came from governments, from military budgets. Second, the companies that were active in the space race were large defense companies. They were selling their products and services based on a predefined formula of cost plus a fixed percentage of margins on top. The result of this formula was that these companies had no incentive whatsoever to innovate in order to reduce prices since this would have reduced their margins in absolute terms. The third aspect was that they didn’t care about the environmental impact of their business which has left tons of space debris around the Earth.

Who are the new space companies?

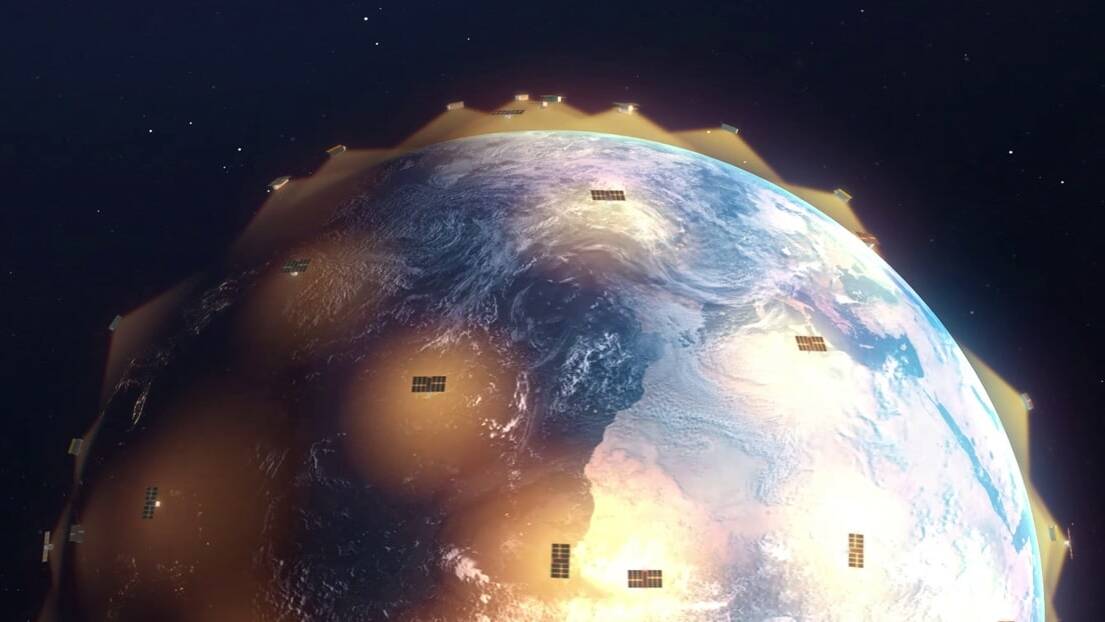

For the past decade or so we have observed the emergence of new space companies that are built on a completely different paradigm. They have been financed by private investors, not governments, and are led by ambitious founders. They were able to innovate because a confluence of technologies like robotics, 3D printing, digital twins and cloud computing allowed them to build new things from the ground up. Elon Musk’s company SpaceX and its reusable launch vehicle have brought disruption to the sector by making space launch a lot cheaper, and prices continue to decline at a rate of about 10% per year. In a way, it is about democratizing space. Jeff Bezos talks about building the infrastructure that allows every company to build space applications. There is a great number of new space companies like Blue Origin, Rocket Lab, Astrocast, Planet, or Spire. And there is a move towards using cleaner fuels to power rockets. Ideally, they would run on hydrogen and liquid oxygen, which would leave only water as a residual.

You mentioned a few names, but how large is the investable universe of space companies really?

You might think that we’re talking about a small niche here, but it is already a USD 400 billion market with about 170 listed companies and countless private companies, some of which will become public eventually. For our fund, we excluded all the military companies, which still leaves us with about 120 to choose from. Not all of them are pure plays, of course, but space is an ecosystem that is linked to many sectors. Take for example Autodesk, the design software used to manufacture new spacecraft. We have taken a holistic approach to look at the space industry.

“With companies such as Astrocast or Rocket Lab, you get 100% exposure to space.”

What is the cutoff point where you say, ok now this company is still close enough to the space industry to qualify?

With companies such as Astrocast or Rocket Lab, you get 100% exposure to space. With others, where a smaller part of their business is related to space, we ask us where their growth comes from. Take 3D systems as an example. Today, space might represent only 10% of their business. But their management has stated that the most impressive future growth for their company will come from healthcare and space. When we launched our AI fund in 2018, there were about 80 companies in our investment universe. Today there are over 300, and it is growing by about 10 per quarter. With more choice comes the possibility to be more strict.

You’ve mentioned our portfolio company Astrocast, an IoT satellite company that just went public. The stock is not in your fund, why not?

We are tracking more than 100 private companies and every time I travel, I make sure to visit a few of them as well. We want to better understand them because, at some point, they might go public. Now I met with Astrocast’s management in the past, and I like what they do, there is a lot of potential for IoT applications. But with a large equity fund, we need to consider the size of the company too, and in this case, it was still a bit too small for us. We might miss on some of the upside potential of the stock if we only invest later, but as a fund manager, you have to strictly adhere to your own investment rules, which in our case say, we only invest in companies that have a market capitalization of more than EUR 1 billion.

Palantir is a software company that builds an enterprise data platform for handling complex data. How is their business related to space?

Palantir has recently partnered with satellite imaging companies to put in place a framework for the sharing and leveraging of data of other providers in an organized way. It allows to better track moving objects both in space and on earth. By putting small antennas embedded in chips on different objects, you can track them around the globe, understand what is happening to them, and decide what to do. We’re still away from a complete Internet of Things, but if you put together worldwide connectivity with artificial intelligence that is able to track, unlike humans, thousands of objects simultaneously, IoT will become an incredibly broad ecosystem and one of the most important applications of space technology.

“IoT will become an incredibly broad ecosystem and one of the most important applications of space technology.”

Some people are worried when they hear that everything, even machines, will be connected in the future. Why do we even need IoT?

I wonder why so few things are connected! I learned about a fantastic job the other day from a German robot manufacturer. They employed a few people that possess a very specific skill: they could tell from listening to the sound of a robot’s actuators if they would need to be repaired soon. These people would fly around the world and stand in production facilities and listen to robots. That was crazy! Today, this is no longer necessary, as connected sensors can prevent breakdowns and allow factory owners to plan the downtime necessary for repairs with much more precision. We have very low energy sensors today that allow controlling the optimal temperature of a room or the filling level of a water tank remotely. The Internet of Things was mainly a buzzword 5 years back, but many of the enabling technologies weren’t ready yet. Eventually, IoT will enable new kinds of services, improve productivity, and unlock use cases we can’t even imagine right now. It shows huge potential.

What are other space-related innovations that show a lot of promise?

Satellite communications are ready for an upgrade as well. The German company Mynaric is developing laser-based communication networks, which are a major improvement over radio communication. They are faster, more reliable and don’t need to be translated from analog to digital. Space X recently announced that Starlinks low Earth orbit satellites will use laser communications. They might develop their own method, but it certainly validated Mynaric’s approach. Communication is important not just to connect satellite constellations, but also, eventually, data centers in space.

Data centers in space?

Amazon and Microsoft both have space divisions. At present, satellites send data down to a ground station, and then the data gets relayed to a data center for processing. This is a costly, slow, and error-prone way of handling data. So yes, there is going to be a growing need for data centers in space that will handle all the data faster and more efficiently. One of the big drivers will be on-orbit manufacturing and research.

Why would someone want to manufacture things in space?

Because on Earth, you can control almost everything during the manufacturing process, temperature, pressure, and humidity, for example, but you cannot escape gravity. There is a case to be made for very high-value high-precision machinery to be manufactured in space, and the second important aspect is research. The space on the International Space Station is very limited. Recently, Blue Origin launched a flight that took a lot of research equipment into space for a few minutes, for experiments to be done during that time. We’ve only started to explore the opportunities that space offers to build and grow things. A grapevine that was recently grown in space and afterward brought back to Earth has been shown to grow faster and be healthier than its Earth-born cousins.

What about space mining as an industry?

This might still sound like science fiction, but only if you think that the premise that going to space is extremely costly won’t change. But as I mentioned, space flights get cheaper every year, and therefore, the attractivity of mining rare strategic resources in space increases. And a second premise might change too, namely, the one of bringing stuff back to earth. If we’re going to build a lunar base, we can mine the moon for ice to be turned into fuel. There is no need to bring this back to Earth. But of course, this scenario is still far away in the future, maybe a decade or so.

You said before that space 2.0 is already a large market, with USD 400 billion annual sales. How fast will it grow?

Bank of America Merrill Lynch has put out an estimate that it will grow to USD 2.7 trillion by 2045. The companies in our fund’s portfolio grow between 20 and 30% per year, on average, some a bit less, some a lot more. I’ve elaborated on the reasons why the old space industry was stagnant, and why the new space industry is much more dynamic. If we look into the future, we have reasons to believe why this impressive growth rate might even increase because there will be new applications, new countries joining, especially with Asia lagging still a bit behind, and new drivers for growth. When I watch the takeoff of a Space X rocket, I am always amazed at how it continues to accelerate, and I see this as a fitting symbol for the whole industry.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

26.07.2021

How Astrocast connects things in the middle of nowhere

Startup Astrocast plans to launch 100 shoebox-sized satellites to bring connectivity to every place on earth. To finance this ambitious project, the company aims for a listing on the Euronext stock exchange. But why do even the remotest places on earth need connectivity?

02.03.2021

An introduction to quantum sensors and the investment opportunities

in this space

Quantum computing and its supremacy over the classical computer capture the imagination of people all over the world. Less known, but no less fascinating is the practical application of quantum phenomena to build sensors that can measure what is otherwise impossible. Scanning a single cell, looking around a corner, hearing a mouse eat in a grain silo, all of this becomes possible thanks to quantum sensors.

11.11.2019

The Race for a Place in Space

Is there a place in space for Swiss startups? Yes, says José Achache, former director of Earth Observation at the European Space Agency (ESA). José wants Switzerland to be seen as a space nation. In this interview, he explains how. He works closely with Nanja Strecker, who runs the ESA Business Incubation Center in Switzerland. We asked her about the benefits of the incubator for startups.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.