The number of family offices, which safeguard wealth over generations, is on the rise, but young people today have a different relationship with money than their parents. In this interview, Carl Wieandt talks about the role of the family office and why they are keen to invest in startups.

Carl Wieandt is CEO of a single-family office based in Zurich. His professional career includes stations at investment banks Goldman Sachs and Lazard as well as the consulting firm McKinsey.

Family offices can consist of a single person acting as a secretary for a busy entrepreneur or a whole office floor of specialists for financial and legal matters that cater to dozens of family members scattered around the globe – or something in between. No matter what their size is, their common goal is to handle the investments of very wealthy families in an independent way. If they offer their services to several (unrelated) families, they’re called multi-family offices (MFO). Joining an MFO as a client usually necessitates upwards of 20 to 50 million Francs. In the case of a single-family office (SFO), it works exclusively for a group of individuals from one family. Cost considerations raise the threshold of wealth for a SFO to several hundred million Francs. Unlike pension funds, family offices aren’t restricted by law in their way of investing. And since they command substantial fortunes, and are managed by very experienced financial professionals, they have access to virtually every investment product. This is why family offices are generally considered to be among the most sophisticated and demanding types of investors in the financial markets.

Every family office must answer the question of what kind of knowledge they want to have inhouse, and what expertise they are happy to buy externally. What is your opinion on this?

The “make or buy decision” depends on the mission that principals want their SFO to have and the size of the fortune. Many services can be bought externally. Generally, strategic topics lend themselves less to outsourcing than operational topics. Sourcing services externally requires careful definition of demands, selection of partners and monitoring. The minimum inhouse competencies for an SFO are strategy, selection and control. Firstly, the SFO has to be able to help the family formulate an overriding wealth strategy and to break that down into actionable parcels. Secondly, an SFO has to be able to run systematic selection processes and thereby support decision making by providing alternatives. Thirdly, control competencies are a key inhouse competence. This competence not only applies to backward-looking performance reviews but also to scenario planning as to how the fortune will develop and what to do in certain market environments.

You talked about the strategic asset allocation as the fundamental decision. How much of laying this groundwork is driven by the owners of the wealth, or how deeply are they involved in this work?

It’s important to understand that strategic asset allocation isn’t a very granular plan, but rather a general guideline. In our case, the idea that informs this guideline is to protect and perpetuate capital for the coming generations. Principals need to decide how much return the capital should aim to generate, how much of it will be used every year for consumption and what risks they are willing to take. The family office can inform what the possibilities in the markets are. As to the question of how active owners are otherwise, there is a broad range. I know an old-school entrepreneur who calls the family office as soon as he has finished reading the newspapers in the morning and instructs them which stock to buy or sell. Most SFO owners are much less involved and concentrate on strategy setting and decisions. Our work is to translate big goals into several concrete programs and actions. More often than not, this takes time. If for example, you believe the hypothesis that diversification across vintage years makes sense in private market investments, well, then it takes years to build up a target allocation.

Why do owners of wealth even bother to build their own organizations? They could just go across the street to one of the big wealth managers of which there is ample choice here in Zurich.

The main reason is the desire for performance, independence and direct control. But you can’t generalize and say that a single-family office, a multi-family office, or an asset manager is the best solution. These are different options that should be explored. And they’re also not mutually exclusive. Even if you own a family office you can give mandates to different wealth managers. Conflict of interest in wealth managers can sometimes be detrimental to the client’s wealth. If for example, the wealth manager promises its own shareholders the goal of achieving 1% of fees on assets under management, this can create a sales-oriented dynamic inside the wealth manager which might lead to products and solutions being “pushed” and to be riskier than they otherwise should be in the interest of clients.

But having more than one client also gives you the possibility to learn from different situations and gain experience that ultimately benefits all clients, which is not possible in the case of a single-family office.

The rising number of family offices increased the number of like-minded partners and thus our network for the exchange of experience. Similar backgrounds and missions increase trustworthiness among family offices. This is helped by the fact that SFOs do not compete. SFOs often invest together, sometimes knowingly in jointly established purpose-structures (Club Deals) or sometimes just in parallel. I think there is much more room for cooperation among family offices. Just imagine the buying power, say already 10 family offices would have if they joined forces to buy certain services or to even get cost-efficient exposure to certain risk factors.

Let’s talk about venture capital as an asset class. The startup ecosystem in Europe would flourish if more institutional investors such as family offices would consider VC investments, which would benefit innovation and create jobs. What is your position?

For us, venture capital is a small part of the asset allocation. But still, we’re interested. The question is how to go about VC investing it in a programmatic way. We’ve done direct investments, but they are a lot of work, and you need to ask yourself if the share of wallet of such investments merits the share of attention required. We’ve also invested in VC funds, but they really are a blind pool of capital. A VC fund is close to the maximal form of delegation. The only thing you get to decide is how much you invest. We see Verve Ventures as a good mixture between these poles. It lets us be selective, which means that we can scan the deal flow for startups that correspond to our thematic focus areas. But even outside of them, it is interesting just to stay abreast of what is happening. It allows you to come to conclusions by analogy that are even relevant for listed equities as well. The pre-selection of startups and the standardized documents reduce the effort needed a lot. What Verve Ventures does, and what they charge for, is basically lowering the cost of information, broadly defined. And I see why many people want to invest directly in startups. Within collective investments often the individual company and story including its human aspects disappear. I joined one of Verve Ventures’ investor calls recently and I think they are a great opportunity for entrepreneurs to get exposure to a wider audience and engage in a dialogue.

Investing in startups can be a way of fostering the exchange of ideas between generations, and I know several families that invest through Verve Ventures based on discussions between parents and their adult children. Talking of the next generation, how easy is it for family offices to bridge the generational gap? And does it even exist?

Yes. The objective function of investing of NextGens is more complex. The next generation looks beyond mere risk-return optimization. It has a very pronounced view on societal and environmental problems both positively (do) and negatively (don’t). Also, they show a keen interest in philanthropy because they are very well aware of their privilege. And they are committed to using that privilege to change things actively. Other than that, they’re more digital, more international, and more informal. Many financial service providers are struggling a lot with this. Which twenty-something feels at ease in the meeting rooms at Bahnhofstrasse that often have the flair of an interrogation room? Just showing them some numbers on an account statement once in a while won’t do. Sharpe ratios and other financial numbers might be essential tools for us professionals, but they’re not enough for NextGen. Where is the wealth manager that digitally offers a “walk” of the companies invested in? What’s the story behind the portfolio? Answers to questions like this is what wealth managers and SFOs alike will increasingly have to provide. We need to bring wealth to life – while producing a good performance.

How can the next generation be prepared for wealth?

Wealth transfer isn’t a single event, it is a long preparation process. A harmonious wealth transfer is a measure of success for the current generation, the next generation, and the family office alike. Our mission is to facilitate the perpetuation of wealth over generation. As to the question of how to prepare the transition, the best thing is to get the next generation involved on an individually suitable level well before they need to make decisions. A staggered approach that increases their involvement and teaches them how to make decisions “by doing” in a safe environment over several years makes sense.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

01.03.2021

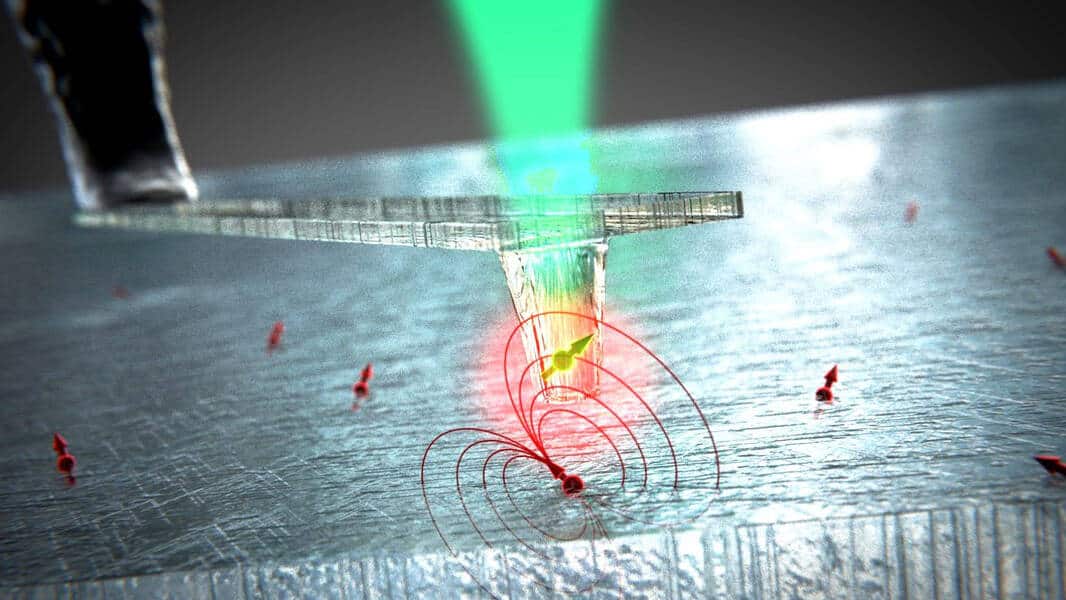

“We need to build a functioning quantum ecosystem”

Since we participated in Qnami’s Seed round in 2019, the company found its product-market fit and has achieved sales above CHF 1 million. Co-founder Mathieu Munsch sees a lot more applications for quantum sensing but also warns that investments are needed to bolster the nascent quantum industry.

11.01.2021

Building a diversified startup portfolio: why and how

Venture capital is a risky asset class because unlike in other asset classes, the major part of the expected returns come from a handful of investments. But there is a way to mitigate this hit-or-miss problem: Instead of trying to foresee the future and bet big on winners, investors should build a broad portfolio of investments.

25.05.2020

“Invest in high-risk assets, but do so in a conservative way.”

From tech analyst to successful entrepreneur, from business angel to partner at a venture capital fund: David Sikorsky has a wealth of experience he shares in this interview. And since he has been investing in both Switzerland and Israel for a long time now, he offers an insightful explanation why the startup cultures in these countries are quite different.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.