Industry veteran Erik van den Berg joined Verve Ventures’ portfolio company Memo Therapeutics right after it raised CHF 25 million in late 2023. The company is now at a very exciting stage in its development, as he explains in our interview.

CEO, Memo Therapeutics AG

Erik van den Berg joined Memo Therapeutics AG in December 2023. Previously, he led AM-Pharma as CEO for 12 years and remains on its board. He has over 25 years of industry experience and a proven track record in leading and growing companies. During his career, Erik has completed over 20 transactions and partnerships and raised USD 500m in equity and debt financings for biotechnology companies from seed through IPO. He holds a master’s degree in chemistry from the University of Utrecht and an MBA from Manchester Business School.

Memo Therapeutics AG (Memo) was founded in 2012 with technology that originated at the Swiss Federal Institute of Technology in Zurich (ETH). Memo is focused on developing best-in-class therapeutic antibodies targeting new cancer and viral disease targets which have previously been overlooked, to achieve better outcomes for patients.

Memo’s lead development program, AntiBKV, is a best and first-in-class monoclonal antibody (mAb) targeting BK viremia caused by the BK virus, which is a potential $1bn market. BK virus can become reactivated in immunosuppressed kidney transplant patients leading to severe complications. 20% of kidney transplant patients develop BK viremia which can lead to BK virus-associated nephropathy. This in turn can lead to increased kidney rejection and reduced patient survival. AntiBKV is likely to be the first and only BKV disease-modifying therapy for kidney transplant patients and is designed for long-term impact for patients due to its ability to combat viral resistance. Phase 2 proof of concept results are expected in early 2025.

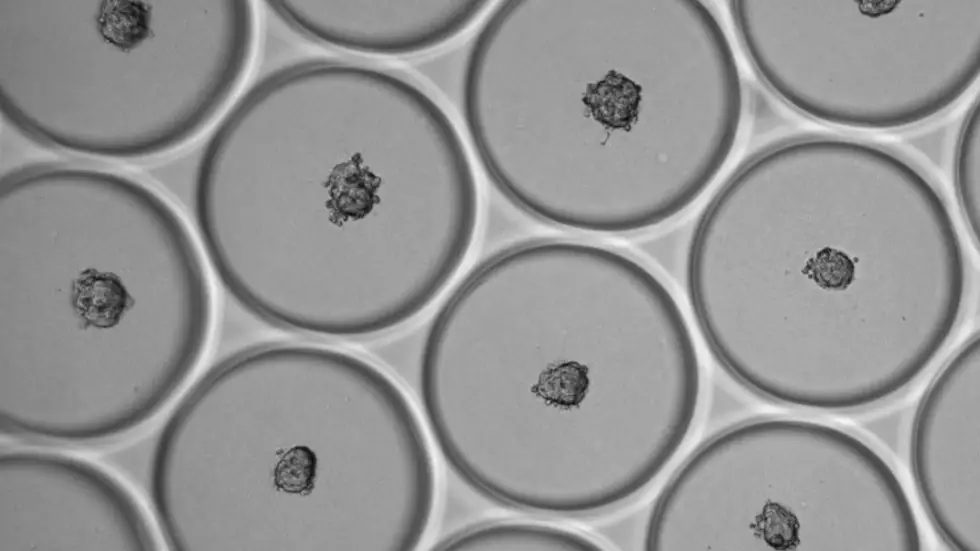

At the heart of Memo is DROPZYLLA®, a powerful and highly sensitive new human antibody copying technology which is faster than current technologies. The Company has developed a patented process which enables antibody identification, isolation, and replication from a blood or tumor sample from an individual donor and expression of these antibodies by B cells (a type of white blood cells). It essentially is a monoclonal antibody ‘copying engine’.

The core of this technology is a microfluidic machine that can process single B cells (the cells that produce the antibodies in our body) at a rate of 400 cells per second in small nano droplets.

With these nano-droplets, Memo produces a copy from each B cell’s antibody in a more robust cell. The Company’s droplet sorter then allows rapid identification of the antibodies that are binding to, for example, a virus or a cancer cell.

Verve Ventures first invested in Memo in 2018 (Series A) and has invested in every financing round since then (both with the Verve Venture Fund I and its private investor network). In November 2023, the Company raised a USD 25m Series C financing round led by Pureos Bioventures.

You are a biotech veteran and have led and grown several companies. Is there a common denominator in the roles you held in the past?

I am intrigued by new science and technology and bringing promising new options to market for the benefit of patients. Biotech is a wonderfully complex industry. It is very international and heavily regulated. But most importantly, it packs in a lot of innovation power and excitement in terms of what is possible thanks to incredible science. My role as a CEO is to build a high-performing team and help it succeed by shaping actionable development plans. Timelines are important, and so are the decisions about what risks we’re capable and willing to take as an organization.

This is a very different leadership role than that of, say, an established and profitable pharma company.

What I like most about small biotech companies is the fast pace. Ideas can be readily actioned and implemented. Guiding a large organization takes a lot of patience to establish changes. In a small company, every individual matters. If someone is absent, you feel it.

Invest in Startups

As one of Europe’s most active venture capital investors, we grant qualified private investors access to top-tier European startups. With investments starting at EUR/CHF 10’000, you can build your own tailored portfolio over time and diversify across stages and sectors.

Someone with your background can choose where to work next. What made you decide to join Memo Therapeutics?

You need to have a risk appetite in life. The investors in Memo are taking a risk as well but see potential in the technology invented by Christoph Esslinger and the team. The power of Memo’s antibody discovery platform is unparalleled. It allows the identification of countless potent antibodies. Our immune system has developed very powerful and targeted defenses against viruses and cancer over millions of years. Our platform Dropzylla allows us to find the most potent of them, potentially helping patients with many different diseases to help fight viruses and keep cancer suppressed. Our most advanced project is an therapeutic monoclonal antibody against the BK virus. It is a virus most adults have, but it only becomes a problem when a patient receives a kidney transplant, and their immune system is suppressed. This can result in the loss of the transplanted kidney. The market potential of a drug against BKV is large, as 20% of the estimated 100,000 kidney transplants every year experience BKV. Our lead program, AntiBKV, responds to a clear unmet medical need, as there is no treatment available right now. The clinical Phase 2 trials with patients are currently underway, with data expected in H1 2025. This means that Memo is in a very exciting phase of its development right now.

Could you explain why the data from the sample of patients that are now treated in this clinical study is so important for Memo Therapeutics?

Clinical data is a key value inflection point in the life of a biotech company. We have proven in preclinical models that our AntiBKV antibody works exceptionally well. But humans are complex biological systems, they all respond differently, so the clinical trials establish how well our antibodies really work. As clinical trials progress, our AntiBKV program becomes significantly derisked. The Phase 3 trial is just confirming the findings from the Phase 2 trial with more patients. Therefore, the data from the Phase 2 trial allows us to have detailed discussions with pharma companies that are interested in taking such a program into their development pipeline. As an alternative, we could further develop and ultimately commercialize the program ourselves because the remaining risk has become quite small.

That would take a long time and you would need to raise substantial funds to do so, and build up a commercial operation from scratch.

This is why partnerships are so interesting to pharma companies that can leverage their existing operation to the fullest. But the biotech field is maturing. We have seen examples in the US and Europe where biotech companies have been funded through commercialization. Of course, the shareholders will have an important say in how the value of our lead program, the other programs we’re working on, and the technology platform can be maximized. My job is to create optionality, and this is what I intend to do.

Speaking of options: Memo is not a company that depends on a single asset but a platform. And this platform is valuable in its own right, as it can come up with numerous new assets over time.

Yes. This is why we’re keen to talk to pharmaceutical researchers about interesting collaborations. While the value of our platform will be demonstrated through our lead AntiBKV program, it can also be attractive for partnering as well as stand-alone product development, based on our ongoing discovery programs.

You mentioned that you have already brought a startup from inception to IPO in the US where, at least up until 2021, early-stage biotechs were able to raise funds by going public. How is the situation in Europe?

The US is definitely still the place to be for biotech listings and is unmatched in the depth and breadth of its public market. However, the situation in Europe is improving. There are increasingly larger biotech funds than there used to be, hence, also more later-stage biotechs being financed. But there is always the need for more money at every stage of company development, and European public markets would benefit from more specialized biotech investors. In Switzerland, it seems to be quite established for private individuals to invest in private biotech companies. And the more success stories people miss out on, the more inclined they will be to invest in the future.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

09.02.2024

“Diagnostic methods in eye care have undergone a revolution”

Professor Francine Behar-Cohen is a key opinion leader in the field of eye care. In this interview, she talks about how startup EarlySight’s medical device that can spot eye diseases much earlier than conventional methods will enable novel treatments.

06.11.2023

“My goal is to take biology to the next level”

In this interview, Orakl Oncology CEO Dr Fanny Jaulin tells how her techbio startup is spearheading a revolution that will bring data science to biology for more precise effective cancer treatments.

11.09.2023

“The support from the nuclear medicine community has been phenomenal”

The gold standard of PET tracers in blood flow research for nearly 30 years has been 15O-water. However, it has yet to make it into hospitals on a large scale. MedTrace is aiming to commercialize the use of 15O-water for easy widespread adoption. COO Rune Wiik Kristensen tells us how.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.