In this interview Covagen’s co-founder, Dragan Grabulovski talks about the challenges of biotech companies and how to lay the foundation for a successful exit. He also explains why 2022 will be an interesting year for the antibody-discovery startup Memo Therapeutics AG.

Grabulovski Consulting Services

Dragan Grabulovski was a co-founder and CSO of Covagen, a biotech company bought by J&J in 2014. Since 2015, he advises venture capital and biotech companies, and coaches startups. Dragan is serial biotech entrepreneur and as such founding chairman of Araris Biotech, and board member of several startups. He is a strategic advisor of Verve Venture’s portfolio company Memo Therapeutics AG. Dragan has a Ph.D. in Pharmaceutical Sciences from ETH Zurich.

In 2007, you co-founded the biotech company Covagen, which was sold 7 years later to J&J in what the press called the biggest biotech acquisition in 2014. Another 7 years have passed since then. With hindsight, what is the biggest learning from that time?

Every startup experiences difficult and joyful times. For example, fundraising is always a challenge, especially if you see your cash reserves dwindling. Potential collaborations with industry partners can fall apart for reasons you have no control over. But there are also good times when you achieve milestones or reach a scientific breakthrough. For me, the most important thing is to celebrate even small wins together with your team. This shows your appreciation of the efforts everyone is making and welds the team together, which is important for the difficult times that will eventually come again.

“Celebrate even small wins together with your team.”

How did you prepare for the trade sale to J&J?

Selling a biotech company isn’t done overnight. It is the result of constant exchange with several players in the field over years. Biotech companies must do business development from day one on, and give larger companies constant updates about its work and results. With Covagen, we raised over USD 60 million, 45 million of which in late 2013, early 2014. This means that we weren’t planning on a sale in 2014, we raised the funds to bring our next-generation protein drugs into clinical phase I and II. Early 2014 we just submitted our first Clinical Trial Application. When a biotech company receives the green light from regulatory authorities, which means that the drugs are good enough to be tested in humans, this is a major achievement and a strong signal. As it happened, one company was triggered by that signal to have a closer look and visited us and expressed its interest to acquire Covagen. This triggered the interest of other companies as well. In the final sales process, we had 6 interested parties, which was a comfortable situation that allowed us to follow a strictly timed sales process.

Around a year after the sale, you left J&J. What kept you busy since then?

In essence, I started my own consulting business and became a startup coach at ETH and Innosuisse. Most recently, I became a Venture Partner at Pureos Bioventures. I guess as a one-man-show consultant I can’t compete with larger consultancy companies, however, I have real experience in growing a biotech company from 2 persons to its exit, including negotiating partnerships with pharma companies like Roche and Mitsubishi Tanabe. So in my role as a an advisor, I’ve worked with venture capital firms on due diligences and have been busy advising dozens of startups in Switzerland. I feel that the real value for young entrepreneurs is that I can bring my own experience to discussions with startups, and even though I might not always have an answer to all questions I usually have at least an idea of the process of how to tackle the next steps and challenges biotech companies have.

What are the main questions that you hear all the time?

Many of the university spin-offs have developed powerful platform technologies that could be used to address countless problems. Their main challenge is to decide which indications to work on first. For this, they need to take into account what problems a potential buyer wants to solve down the road, which goes back to the question in which indication the platform can provide the most value for the patients.

How has the biotech scene evolved in the past 2 decades?

The startup ecosystem has evolved a lot. There are more Ph.D. students that want to become entrepreneurs and those that do have more knowledge in business matters, thanks to the many initiatives out there. I see a growing number of interesting projects coming out of universities. And it has become easier to raise seed funds, as investor appetite has grown too. However, there is also a risk that there might be more projects that get financed that do not have a good chance of success.

What would you look for to assess the risk of success or failure?

The quality of the team will always be a success factor. When it comes to technology, it is important to understand how it differentiates itself from what is already available, and not only that, but also, from what will be available in 5 or 10 years. It is not a bad sign if other players are working on a similar topic, this can serve as a validation that the field is interesting. But it pays off to be fast, obviously.

“It is not a bad sign if other players are working on a similar topic, this can serve as a validation that the field is interesting.”

What about the appetite of pharma companies to buy biotech firms? Has it changed?

I’d say the market conditions are excellent, and pharma companies are eager to replenish their pipelines. What is more, in today’s environment, going public is a viable alternative to a trade sale for many biotech companies.

At what stage is an IPO realistic for a biotech company?

In Europe, you ideally should have one or two assets in clinical phase II and some external validation such as a collaboration agreement with a pharma company. Most likely, the investors will be willing to bear the risk and finance the costly phase III studies. Interestingly, in the US there are biotech companies nowadays in the preclinical stage that have already gone public successfully, even if the risk for investors is a lot higher.

Let’s talk about our portfolio company Memo Therapeutics AG. You were a board member of this ETH spin-off that has developed a platform technology and now act as an advisor. What differentiates its technology from others?

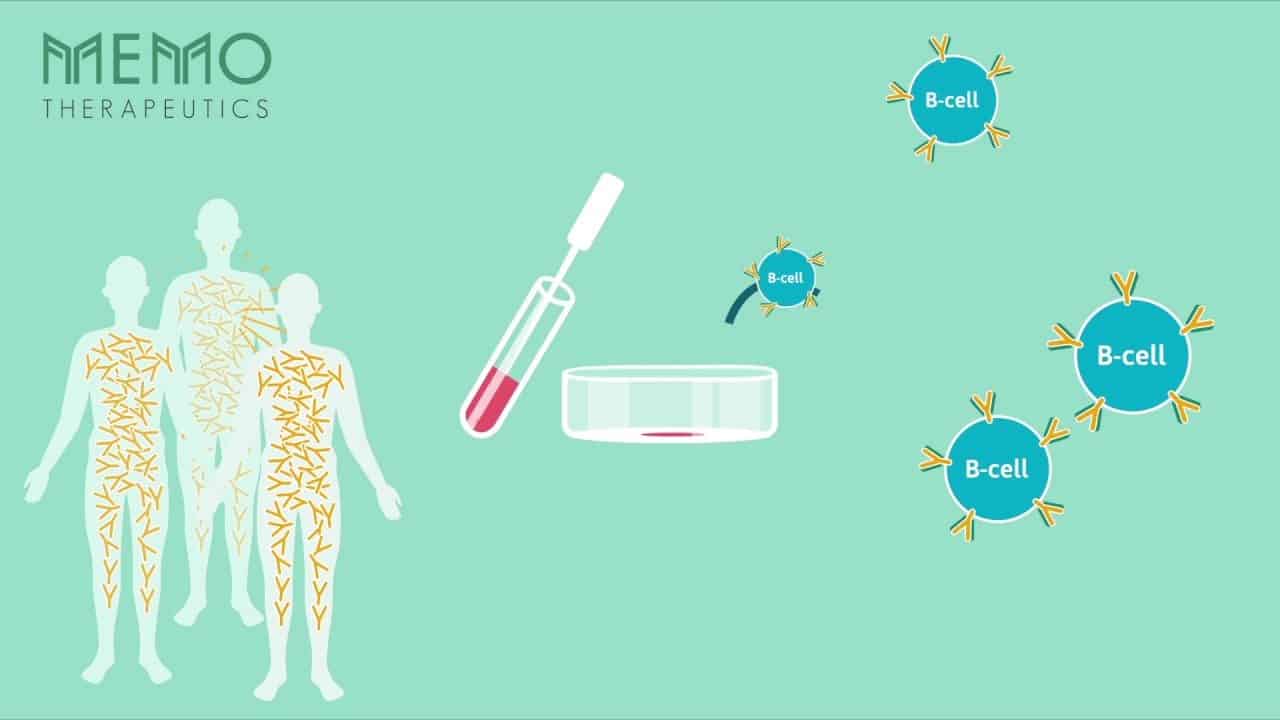

The core of Memo Therapeutics AG’s platform is an antibody discovery engine. Antibody platform technologies have been around for a while, but what sets them apart is that they have reversed the process of selection and cloning where typically more than 99% of specificities are lost. They have a patent protected process by which they get nearly all B cells cloned and thereby can screen the entire antibody repertoire of any given species very fast, and then do the selection process in an unprecedented breadth. This allows them to find very rare antibodies that have very powerful properties, which for example means that Memo Therapeutics can isolate magnitudes more efficient antibodies than other technologies can do.

As you mentioned before, biotech companies developing platform technologies can do many things, and it’s crucial to find the right projects to work on.

Exactly. What Memo Therapeutics AG’ team has done, even before I joined, is talk to a lot of clinicians to find an application with a large unmet medical need. This allowed them to identify the BK virus as a target where their technology can deliver results that are fantastically superior to those of other players in my view. The BK virus is a virus most adults have, but it only becomes a problem when a patient gets a kidney transplant and their immune system is suppressed, resulting potentially in a loss of the transplanted kidney. In this huge over a billion market, Memo Therapeutics AG has identified antibodies that are very efficient in blocking the virus. In 2022, the clinical trials will start, which will be a major milestone for the company.

The second project Memo Therapeutics AG is working on is a therapy against the coronavirus, again based on human antibodies. Several big industry players are working on this as well. Is it not too late for this?

No, not at all. As we all know, a significant proportion of the adult population does not want to be vaccinated against Sars-CoV-2, others cannot get vaccinated because they are immunosuppressed, and even those who are vaccinated sometimes end up in the hospital, especially the elderly population. All this means that there is a need for therapeutic and prophylactic agents. It is really honorable to see how the whole team worked essentially day and night to contribute in the fight against Covid. Clinical trials are expected to start soon and we have ideas how this antibody – typically antibodies are delivered via injection – can be administered in a different and more convenient form for the patients, in contrast to some of the other players. Hence, there is a lot of potential in this project in my view.

When do you expect pharma companies to get really interested in what Memo Therapeutics AG is developing?

In general, when biotech companies see good data from the clinical phase II – which proves the safety and efficacy – this is an ideal time for an out-licensing deal or a takeover of the company. As several examples, not only just Covagen, have shown in the past, this appetite can manifest itself earlier, too. But a trade sale is just one option. About 80% of biotech companies with a platform technology eventually go public nowadays, which allows them to continue to work on developing their own pipeline. With Elias Papatheodorou and Thomas Taapken, Memo Therapeutics AG has recently appointed two new board members that have practical experience in taking companies public. Whatever option will eventually manifest itself, I think it is fair to say that 2022 will be a very interesting year for Memo Therapeutics AG and I am proud to act as a strategic advisor to this company.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

23.09.2021

“When the stars align, you can’t wait”

In this interview, entrepreneur and investor Gaëtan Marti recounts how difficult it can be to find financing for a startup, how he bootstrapped Atracsys and eventually, despite different plans, sold it to a big MedTech company.

26.08.2021

“Your business plan has to be rock solid”

How do you sell a business and who’s buying? In this interview, M&A advisor and healthcare expert Dierk Beyer from the investment bank Cowen provides insights into the dynamics of the M&A process.

15.03.2020

The “Hack Corona” Initiative

ETH spin-off Memo Therapeutics (MTx) is searching for effective antibodies against the coronavirus. The startup is recruiting patients who have recovered from it. In this interview, CEO Karsten Fischer explains how the “Hack Corona” initiative works.

Startups,Innovation andVenture Capital

Sign up to receive our regular newsletter and learn about investing in technologies that are changing the world.