Grégoire Ribordy is a pioneer among entrepreneurs in the quantum industry, his startup ID Quantique just turned 20. In this interview, he talks about the quantum internet, the difficulty of balancing near-term and long-term goals, and the startup Miraex.

Co-founder and CEO, ID Quantique

After completing his Ph.D. in Physics at the University of Geneva, Grégoire co-founded ID Quantique in 2001 together with Prof. Nicolas Gisin and Prof. Hugo Zbinden. The company provides quantum-safe cryptography, optical instrumentation, and random number generator hardware. Elections in the canton of Geneva are protected by ID Quantique’s technology since 2007, a world premiere. The company employs around 100 people in Geneva, South Korea, and the US. It has raised USD 65 million from South Korea Telecom in 2018. Grégoire received several international awards and holds patents in the area of quantum cryptography and quantum information technology. Since 2020, he is also an independent board member of startup Miraex.

You are a pioneer in quantum cryptography. Where does your interest in this field come from?

I’m a physicist by training and studied at EPFL. At the University of Geneva, I was only the second Ph.D. that wrote a thesis about this topic, it was very early days, and we were, together with British Telecom in the UK, the first group to work on practical applications of quantum cryptography, which just had been demonstrated to work. We received keen interest from potential clients and also investors, which gave us the confidence to found ID Quantique.

Did you have a predisposition for entrepreneurship?

Not necessarily, but I did have an interest for industry, having worked in Japan for some time for Nikon. I’d add that the great education we receive in Switzerland also fostered my ambition to create value and jobs.

“We couldn’t pursue our grand vision from the start but rather had to focus on a simple product that could be sold quickly.”

ID Quantique turned 20 in October 2021. What did the company do in its early days?

The challenge with quantum cryptography is that it is very multidisciplinary and needs experts in the field of computer science, quantum technology and cryptography. We couldn’t pursue our grand vision from the start but rather had to focus on a simple product that could be sold quickly. The time was after the internet bubble burst, after 9/11, and there were no venture capitalists in Switzerland to speak of, so we bootstrapped the company. We started by building a quantum sensor, which is able to detect single photons. A single particle of light is a very weak signal, so detecting it is difficult. We solved this problem, sold the sensor to universities, and reinvested the proceeds in R&D for the next step.

Which was?

Because computers are deterministic, they cannot generate truly random numbers. We have developed products that are based on the insight that quantum physics is the only way to build true random number generators. We were lucky with the timing, as there were plenty of online casinos with a need to demonstrate to the regulators that they based their games on a random process. Again, we were able to reinvest the money from these products into developing our quantum technology for informational security.

Before we dive deeper into this topic, let me ask a question about this step-by-step approach, which sounds very logical with hindsight. Was that roadmap that clear to you in the early days?

We didn’t have much choice, as we didn’t have the money to pursue our grand vision from the start. The two professors who are co-founders showed a lot of common sense by saying: “Let’s start to sell something early and we’ll get there”. Today, with more money being around and heightened interest from investors in the quantum industry, it might be different. Interestingly, we had a US competitor that raised venture capital and was quite aggressive in its approach to intellectual property. But we’re still around, and they’re not, because they had no revenues, which lead to a difficult time convincing investors after the financial crisis.

How has the quantum industry changed in the past two decades since ID Quantique is active?

It’s incredible how it has evolved. I’d say the real acceleration for us started in 2015/16. Google as the first large company started its own quantum computing group. National security advisors realized that they need to upgrade their quantum safety efforts. And the National Institute of Standards and Technology started a project of quantum-safe cryptography. For us, this meant that we didn’t have to explain the threat that quantum computing poses anymore, we could just focus on our offering.

Could you summarize the benefits and threats of quantum computing for a layperson?

It is a disruptive new type of computing, not just faster but exponentially faster and able to solve problems that today are unsolvable because they take too much time. We are talking about a specific family of problems here, not general use, so you won’t have a quantum laptop at home soon. They will rather be mainframe computers connected to the cloud that people can access to solve specific problems. The first applications will be researching new materials and molecules for drug discovery, applied chemistry problems that today are solved on a trial-and-error basis.

And the threat?

Quantum computers will be able to perform integer factorization, which means decomposing large numbers into a product of smaller integers. Many cryptographic systems provide protection based on the fact that finding prime numbers as factors of a large number is unsolvable in a meaningful time frame today. But quantum computers will eventually render this encryption method obsolete. Even if we’re not there yet, it already poses a problem today, namely for data that has a longer lifetime. If you trust data to be stored safely encrypted for the next ten years, you are wrong.

Let’s come back to quantum computing later. First, let’s talk about the startup Miraex. Why did you join its board of directors?

I met the co-founder Clément Javerzac because he invited me to give a presentation during a conference, and he asked me for some advice. I told him that having an independent board member has proved to be of significant value for ID Quantique. And then he asked if I wanted to join Miraex’s board. I agreed because Miraex has a similar strategy of providing short-term applications with significant potential and the long-term vision to build interconnections between quantum computers, a topic which is also relevant for us at ID Quantique. I felt that I could contribute to this dual strategy. People might dismiss it as a distraction but in the field of quantum, it brings a lot of maturity and reliability to the technology if you can first test it in a classical application. For startups without an infinite amount of money, it is a clever approach.

“You need to make your story clear enough so that clients, partners, and investors can understand it.”

What is the main challenge of this dual strategy that targets both the short and long term? The allocation of resources between the two goals?

Finding the right balance between different projects is a challenge for every company, this strategy just adds another dimension to it. I’d say the difficulty lies in telling a coherent story, especially when you’re developing complex technology people cannot personally relate to. You need to make your story clear enough so that clients, partners, and investors can understand it. I can bring this external view to the board, take nothing for granted and ask dumb questions. I know where the challenges are in this nascent industry. Finding people with a business and quantum background, for example, is still quite difficult.

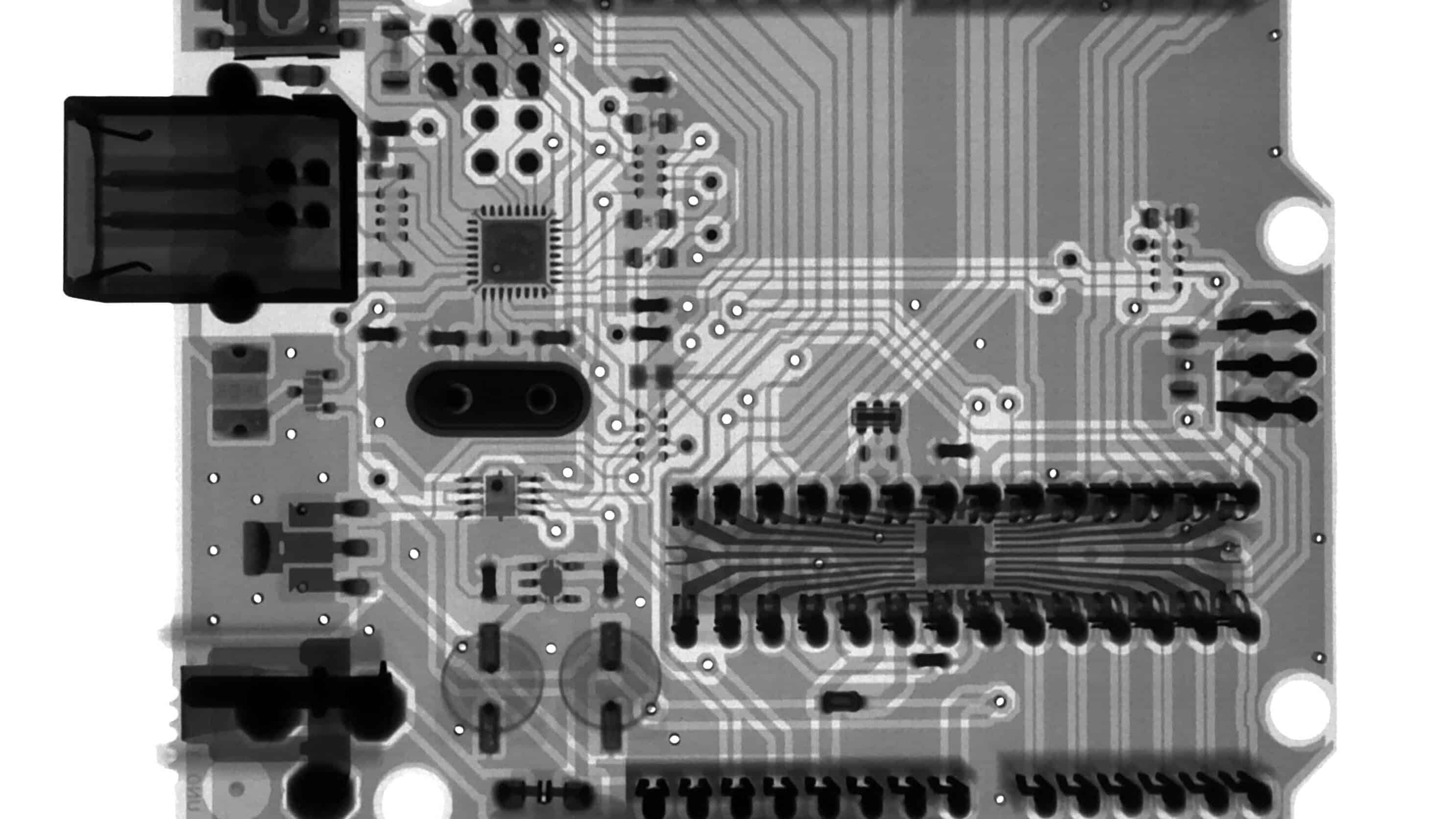

Let’s dive deeper into Miraex’s technology. Their short-term goal is to commercialize quantum sensors to be used in harsh industrial environments. The long-term goal is to develop quantum converters, which are apparently necessary to connect quantum computers. Why this long-term vision?

Some people also call this the quantum internet. If quantum computers are to communicate with each other in the future, they need to do so in a quantum way to retain their full power. If you take a measurement at one quantum computer and send that data to another, you lose some of the power inherent in quantum. To preserve this power and build a network of quantum computers that acts as one large machine, you need to be able to send quantum data.

You said that ID Quantique is also interested in this technological development. Why is that?

Quantum communication based on the exchange of single photons provides an unprecedented level of security. This is based on the fact that if you eavesdrop on the line and measure the photon’s properties, you modify it, which can be detected. We are now at a point where we can make this work up to a distance of about 100 kilometers, and the university labs have extended this to several hundreds of kilometers (for example, the University of Geneva has demonstrated that the limit of quantum communication is about 400 kilometers). In order to have secure and long-distance quantum communication, we need quantum repeaters, and this is very similar to what Miraex is working on.

All this sounds exciting, but also like it won’t happen tomorrow.

As of today, we still don’t know what the “killer applications” of quantum computing and quantum technologies will be. We shouldn’t try to predict them, but instead, be ready to be surprised. We should also acknowledge that there will be ups and downs and that we need the trust of investors to overcome the down periods. If this business was easy, we could just get a bank loan, right?

There are investors that pride themselves on providing patient capital that finances long-term innovation.

Interestingly, with ID Quantique, we never had an investment from Switzerland. South Korea Telecom invested USD 65 million in 2018. They had been working on quantum since 2011, their group was led by a visionary who postulated that they need to master this technology to secure their future. They developed solid technology but found it difficult to generate revenues. That is why they wanted to team up with us. Asia in general has a much more positive outlook on technology. We always had to go where the capital was, even if we would have preferred to raise money in Geneva or Zurich. But at that time, investors didn’t have the stomach for that. This is changing though, Miraex found it easier to raise capital. But there still is a massive lack of growth capital in Europe that hinders the European technology market.

Written by

Investors

Our sophisticated investors include visionary family offices, leading wealth managers, institutions, founders, and senior executives. These individuals and organizations are all committed to shaping the next generation of innovation.

More News

Growth capital for quantum cooling startup kiutra

The financing round is led by the new shareholders TRUMPF Venture and the Swiss deep-tech VC Verve Ventures. Together with the existing investors High-Tech Gründerfonds (HTGF), APEX Ventures and the Initiative for Industrial Innovators, the syndicate is investing a mid-seven-digit amount in the spin-off from the Technical University of Munich.

Qnami (Quantum Sensors): CHF 2.6 Seed round

Qnami has raised CHF 2.6 million from Quantonation, investiere, ZKB Starup Finance and High-Tech Gründerfonds. investiere contributed CHF 1 million to this round.

“We need to explain what quantum technology is about”

Quantonation is the first venture capital fund dedicated to investment in quantum technology. Founder Christophe Jurczak explains when the different quantum technologies will be ready and why he invested in the Swiss startup Qnami.