Digital health is a topic that is gathering traction, both in the world of startups and listed equities. But what do companies in this field do? And what problems do they struggle with? This interview with two experts shows how technology changes the health sector.

Lead Portfolio Manager, BB Adamant Digital Health

Stefan Blum co-manages a fund that invests in publicly listed equity and focuses on digital health, the BB Adamant Digital Health Fund. Stefan joined Bellevue Asset, one of Europe’s largest health investors with CHF 10.6 billion assets under management as a Portfolio Manager in 2008.

Principal, Verve Ventures

Michael Lütolf joined Verve Ventures in 2015 and is an investment manager focused on the German market. He has a Master in Biomedical Engineering from ETH Zurich. Michael led Verve Ventures’ due diligence in startups such as Scipio Bioscience, Neo Medical, Sympatient and OncoDNA.

Stefan, you manage an equity fund that invests in publicly listed digital health companies. What is the rationale behind this investment strategy?

Stefan: Healthcare costs are rising globally, and many new therapies are incredibly expensive. Digitalization can help counteract the cost explosion by making the healthcare system more efficient and by improving treatment quality. Compared to other sectors, healthcare is markedly behind in digitalization and firms that change this will be the winners of tomorrow. Increasingly, investors are convinced of this trend as well. The fund has attracted more than CHF 350 million francs since its launch in 2018. The topic is easier to explain than others because people know from experience how antiquated healthcare still is, they see doctors taking notes on paper and have to store their own radiographs somewhere at home. The new generation of investors also has a pronounced appetite for technology-related innovative firms, they don’t just want to invest in big pharma and be done with it.

Michael, is digital health a topic for venture capitalists as well?

It is a vast field with plenty of startup activity, yes. From a venture perspective two types of startups are interesting: One part of the startups concentrates on helping pharma firms to make sense of the vast amounts of data they’re creating and speeding up clinical trials, for example the Swiss startup InterAx Biotech that combines biological models with informatics, commonly referred to as Systems Biology. The other part of startups focuses on the patient, such as Aktiia that has developed a wearable blood pressure monitor. The interest for this topic is high because other sectors have shown what technology is capable of. But it is also a quite complex field for startups to navigate. They need not only to have their technology in mind but also solve the riddle of who is going to pay for it. Disease prevention, for example, is a very interesting and relevant topic. Startups, however, struggle to secure support from health insurance companies. Startups looking for financing also have to be able to find multidisciplinary venture capitalists, because often the classical life science VCs don’t understand the technology, and the classical technology VC doesn’t understand the dynamics of the healthcare sector.

Stefan: In healthcare, you need solutions that bring advantages to all the stakeholders involved. First, the patient has to have a clinically proven benefit, otherwise, you won’t even pass the regulator. Then, as you mentioned, you have to convince the payer, the insurance, but also the users, in many cases the doctors. If they don’t love your product, you’re out. Last but not least the hospital needs to have a quantifiable benefit. Now, all these hurdles might seem very dissuasive, but we love them, exactly because they are solid barriers to entry. Remember what happened to Fitbit? The day that Apple launched the Apple Watch, Fitbit was dead. In the medical space, something like this can’t happen because everybody has to go through the same regulatory process.

Michael: Indeed, we would never invest in a startup that is not offering a clear benefit to all key stakeholders: payors, providers and patients.

What is the definition of a digital health company?

Stefan: The short answer would be everything that is labeled healthcare technology according to the global industry classification standard. We have a slightly larger universum, we include healthcare equipment and services firms that have a digital strategy driving shareholder value as well as suppliers of digital components that have at least 20% of sales in healthcare. The company Materialise is an example for such a supplier, their medical division 3D prints custom implants. What we don’t count in our investment universe are firms like Apple or Google that might be quite active in digital health but where this has no major influence on their share price. We end up with around 250 firms out of which we pick around 40.

Your fund is mainly invested in the US. Why?

Stefan: Because we see many digital health IPOs in the US, which is also a result of US VCs pouring a lot of money in the sector. The US offers an advantage in terms of commercialization for these firms, it is a single market with 330 million people. And in Europe, I don’t see many IPOs.

Michael: It is true that there haven’t been many success stories in Europe yet. The fragmented market in Europe makes growth more challenging, that is true. But we do have a regulatory and legal framework that is supportive. Germany just introduced a law that facilitates and promotes digital health.

Let’s talk about technology in healthcare. Has AI made any significant progress in this field?

Stefan: Software is a great tool to support physicians, for example to help prepare the decision of pathologists. But software will never be responsible for a diagnosis. Humans are allowed to make errors, but software isn’t. That’s why a doctor will always have the final say.

Michael: With RetinAI, we’ve financed a startup that helps ophthalmologists, but doesn’t replace them. The same is true of OncoDNA which uses advanced software to extract meaningful information about therapeutic alternatives out of the incredibly large amounts of data in healthcare. We’ve come to the point where specialist doctors can’t keep up with the amount of information that is published in their field.

What other kind of technological change do you observe in the health sector?

Stefan: Current solutions can be improved, as is the case for heart pumps that now get equipped with sensors and connected with the cloud that enables it to be monitored remotely. But even more interesting is when technology can change processes and leverage great efficiencies, which is true for telemedicine, for example. Until recently, healthcare meant fixing symptoms aka things that were broken, and no or few contacts before and after the treatment. But most of the important diseases are chronic, and they need continuous management. Telemedicine will allow continuous and much more long-term interaction between patients and hospitals. The US is moving towards value-based healthcare, which means that hospitals are responsible for the patient outcome, so they have an innate interest to stay in contact with patients and assure that everything goes fine. Teladoc, for example, is a US-based provider of telemedicine. For the insured, it is a channel that is always open, and many cases can be solved without patients having to go to a hospital, which reduces costs for the insurer. And they also treat mental health problems, basically “the helping hand 2.0”.

Michael: Mental health is an interesting field, but you need a solid base of trials that show that a digital therapy is equivalent or better than medication or a conventional therapy, otherwise no physician will prescribe it or insurer reimburse it. But I think that digital therapies such as the German startup Sympatient offers are very valid, since there hasn’t been any innovation in the field of psychopharmacology over the last 20 years And the prevalence of psychological disorders is, unfortunately, on the rise.

Stefan: But isn’t the exit route very complicated for this kind of startups? For digital health companies in the medtech space you need large amounts of capital to set-up distribution and in the end you only have a few potential buyers.

Michael: Digital health companies do have more potential exit routes than classical medtechs. However, this attracts less capital to the medtech field and this is also apparent in the valuation of these companies. Because they are not that high, you can have smaller exits that are still very attractive for the investors.

Invest in Startups

As one of Europe’s most active venture capital investors, we grant qualified private investors access to top-tier European startups. With investments starting at EUR/CHF 10’000, you can build your own tailored portfolio over time and diversify across stages and sectors.

The Swiss health insurer Sanitas has just recently announced to work together with the startup Ava and make it possible to insure your wish to have children.

Stefan: Children and companion animals are excellent business, demand curve is not price sensitive at all when it comes to those two categories.

Michael: Did you know that a startup that does telemedicine for pets was able to raise more than 10 million dollars by tier one VCs in Europe?

Stefan: That makes total sense, you not even have to care about data security and privacy rules, I would have invested as a business angel too. (Laughs).

Can digital health help prevent illness?

Michael: There is so much potential for savings in the healthcare system by preventing chronic diseases. We are, for example, closely monitoring the pre-diabetes and obesity space, where solutions are urgently needed if we don’t want healthcare costs to rise further. Health insurers are aware of that and have their prevention budgets that many startups try to tap. But if startups monetize their product via the patient I don’t count them among digital health startups, that’s a consumer technology product for me. There are many interesting startups that use technology and large databases that enable early diagnostics of diseases, Pathoquest from Paris is an example.

Stefan: Guardant Health is also a good example, they have developed a blood test that might replace tissue biopsies, and allows to find the right drug for a patient and could even identify cancer earlier. Thrive is another company that tries to detect cancer earlier with a universal blood test. This company is still private though it will go public soon. But in order to decrease the costs a high specificity is needed. Otherwise the costs of would increase even more because more patients without diseases, i.e. “false positives” are funneled through the system.

What about the valuation of listed digital health companies?

Stefan: If you compare the valuations of our specialized fund with our broader medtech & services fund, the difference becomes apparent. The medtech fund has a valuation of 4.3 times sales on average, with a yearly sales growth of 9%. Our digital health fund has a sales multiple of 7.1x, but growth of 25% per year. Compared to Tech valuations it compares very well. One of the companies recently said they don’t want any health care analysts to pick up company coverage, because their tech analysts give them higher valuations.

Michael: In the startup world, the valuation of medtech companies is often flat for a long time until they hit an inflection point such as the regulatory approval of a device. The valuation of tech startups grows faster and earlier. In my experience, digital health startups are more comparable to tech startups from a valuation point of view.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

01.07.2020

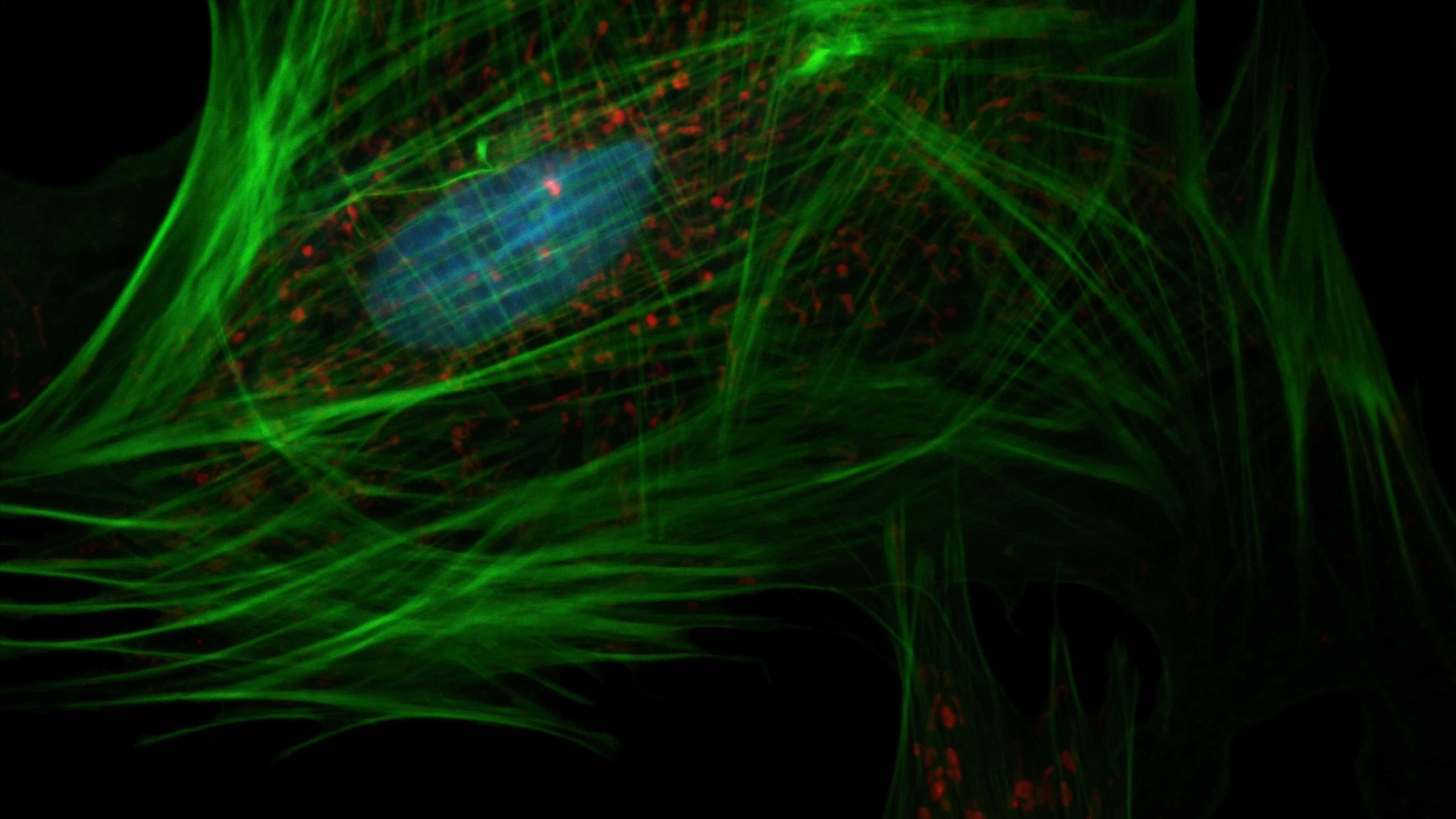

Teaching biology to the machine in order to learn from it

How can computers understand what is going on in cells and diagnose diseases? In this interview, Prof. Manfred Claassen explains how our understanding of biology is advancing thanks to technological progress. A key element is the application of machine learning to the wealth of data created by single-cell analysis technologies. The startup Scailyte is pioneering this approach with the goal of developing early diagnostics for complex diseases.

03.02.2020

A world premiere in digital health

On the 29th of January 2020, the biggest German health insurance announced the launch of a novel anxiety therapy: Invirto. This premiere is a major milestone for the digital therapeutics startup Sympatient which is developing Invirto. Sympatient’s co-founder and managing director Christian Angern explains how this all came about.

10.04.2019

“Learn systems biology”

What impact do computers have on drug development? We asked Maria Waldhoer, Chief Scientific Officer of InterAx, a biotech company pioneering computational pharmacology.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.