The property management market is hyper-fragmented. In Germany alone, over 20,000 companies manage 12 million residential properties. Most of them are small, old-school pen-and-paper companies. Often, they lack designated successors. Erste Hausverwaltung (EHV) has set its sights on bringing this ailing market into the 21st century. CEO Marcel Tamm tells us the full story.

CEO and Co-Founder, Erste Hausverwaltung

Marcel Tamm is the CEO and the Co-founder of EHV. He previously worked as Senior Associate at global consulting firm McKinsey for over 2.5 years. He has a Master of Science in Financial Economics from Oxford University’s Said Business School.

Founded in 2021, EHV aims to modernize the low-tech property management market, offering an improved experience to both tenants and property owners through digital property management paired with local hands-on expertise. EHV buys small-sized traditional property management companies, then builds them up through digitization and process improvement. This makes customer service more efficient and reduces property management work time by up to 40%.

With three deals under its belt, this young company already manages over 2,500 properties. EHV recently raised a seven-figure Seed round led by UK-based proptech fund Roundhill Ventures which was joined by Constructive Venture Fund, Verve Ventures and Venpace.

First of all, how did you come up with the idea for EHV?

It was thanks to my parents. They bought these two apartments in a new building in Munich. Before that, I had no touch points with real estate. I got involved in the day-to-day administration of the apartments, so I got to know what a property management firm actually does and how frustrating it can be to deal with a bad one. They are hard to reach and often completely unresponsive to emails, calls or even letters. At one point, we decided to look for another property manager. When I asked my colleagues if they could recommend a good property manager, most of them just laughed and told me, if you find one, let me know. And that was the moment I realized it’s a real problem.

This is when I got together with Justus Mentzel, my co-founder, who, at the time, was working at ista, the largest submetering company in Europe whose primary customers are property managers. We sat together on a Sunday in Justus’ apartment, just brainstorming ideas and I told him there’s this big problem with property management. He agreed, based on his own experience dealing with property managers all day at work. We decided to look into a solution and that was basically the starting point.

Are there really no good property managers in Germany?

There are certainly good property managers, but there are quite a few black sheep too and once selected, it’s very difficult to change property managers. The most typical form of home ownership in Germany is co-owner associations. Let’s say there is a house which has 10 units and each unit is owned by a different person. By law, you’re required to have a property manager for the communal spaces and they are selected during annual owner meetings. Anyone who owns an apartment within the building can take part and has voting rights based on the share of the apartments they own. Contracts for property managers usually run two to five years. After that, there is the question of whether to continue with the current property manager or get a new one. It’s put to a vote and you have to get over 50% of votes in favor of changing them. When you ask people why they don’t just switch when they are clearly frustrated with their current property manager, the answer tends to be that it’s too big a hassle. There is also an implicit fear that changing might not improve things but actually make them worse.

What does the typical property management company in Germany look like?

Property management is a fragmented industry with many very small players. There are a couple of big ones, but even the largest one has less than 1% market share. The vast majority is made up of small to midsize companies that typically manage 500 to 1500 apartments, have a revenue of EUR 200,000 to 600,000, and 3 to maybe 6 people. This is the biggest chunk of the market. However, there is a long tail of very small companies that manage 200 to 400 apartments, and normally they are run by one property manager, often alone, sometimes with the help of a part-time assistant.

Why doesn’t that work?

The owners of these small companies are often the ones facing the customer and have many responsibilities they’re loath to delegate. They have a high employee turnover rate and prefer to check administrative matters themselves. This makes it hard for them to quickly deal with any new incoming requests.

In this context, how do you convince these property managers, who are so used to keeping everything in their own two hands, to work with EHV?

There are different reasons why a company would join forces with us. One is that the owner is just about to retire. At this point they still care about their business, but they know that in a few years somebody else has to take care of it. The succession problem in this industry is enormous. There aren’t many young professionals who are willing to take over these very small old-school businesses that have stuck around for the past 20 years. That’s where we come in as someone who can offer them a real long-term perspective.

Another reason for joining EHV is when owners still want to continue working as property managers, but are struggling to find talent and are overwhelmed by their day-to-day workload. This is where we can help, with central functions like HR and new software infrastructure. These back-office tasks are chores a lot of property managers would prefer to give up so they can focus on property management.

Digitization is one of the core pillars of our business.

EHV brings digitization to these old-school companies. How do employees who have never had to use digital tools adapt to them?

Digitization is one of the core pillars of our business. Old-school in the case of property management companies means entire walls of physical folders and software – if there is any – that’s from the 1990s. There is young personnel, but most people working for these types of companies will be in their 50s or even 60s. When we started out, we had this concern. Would people be opposed to change? Would they struggle to migrate to new software solutions? What we’ve found in practice is quite the opposite. The existing solutions are often just so subpar and difficult to navigate that employees are really frustrated with them. This makes them very open to improvements. There will always be exceptions, but the acceptance rate is high. I think almost everyone understands the need for some kind of software infrastructure these days.

You closed two deals in EHV’s first six months. How did you manage it?

In one company, the property manager was struggling with fluctuation and while he loved working in property management, he did not enjoy all the administrative tasks he was stuck with. We came in and said, we want to be your partner, we can take this administrative burden off of you and cooperate with you.

The other company was a very different case. It was a property management company founded as part of a larger realtor business 15 years ago. It was managed well, but the focus was never on property management. They had reached a point where the realtors saw the big challenges in digitization and realized it was time to hand over the reins to somebody whose primary focus was property management and would bring the business into a sustainable and modern future. And that was us.

Real estate is considered a crisis-resistant sector. What about property management?

Property management can be divided into two segments: rental management, which is when owners of entire houses delegate tasks to a rental agency, and co-owners associations which are required by law to choose a property manager. Multi-year contracts are the norm in both segments and this means stable recurring revenues. Then there are additional things property managers take care of such as larger maintenance work which they are also paid for. In hard economic times owners might postpone big investments like repainting a building. But if something essential, like a gas pump, is broken, there’s no way around fixing it. That’s why property management has this very steady, non-cyclical flow of income.

Written by

Investors

Our sophisticated investors include visionary family offices, leading wealth managers, institutions, founders, and senior executives. These individuals and organizations are all committed to shaping the next generation of innovation.

More News

“I experienced the challenges of bringing a MedTech product to market first-hand”

In this interview, MedTech expert Karina Candrian explains why startups should think about market access and regulatory topics early on.

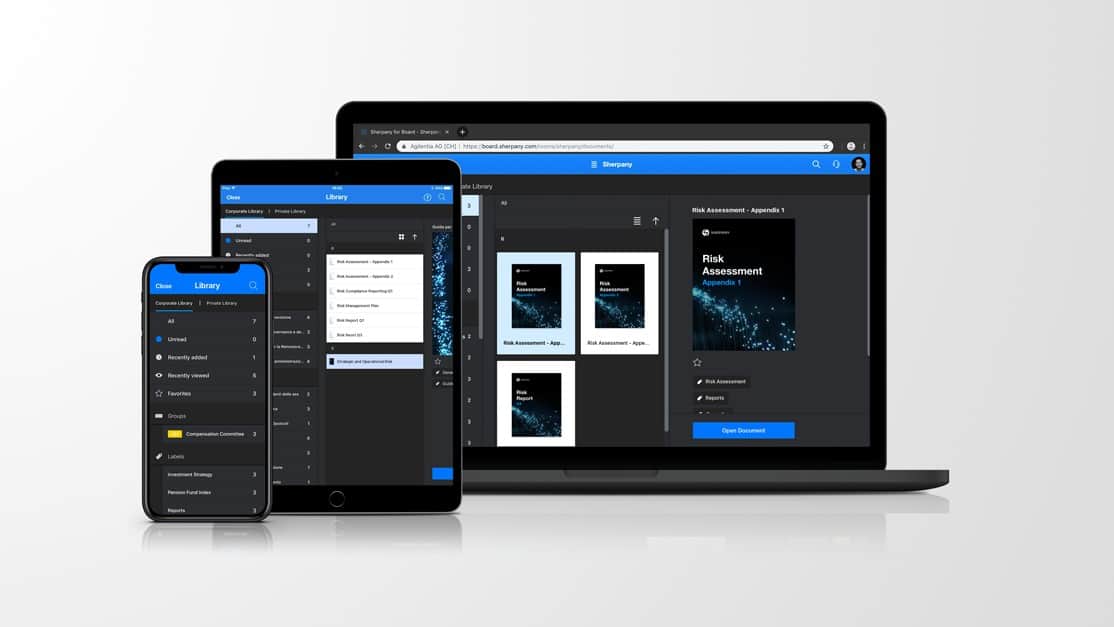

Sherpany (Meeting Management): Undisclosed Series B

Sherpany, a European leader of meeting management software, has successfully closed its growth financing round led by Cadence Growth Capital.

Avrios (Fleet Management): CHF 14m Series B

Avrios has raised CHF 14 million by investiere, Lakestar, Notion Capital, Swisscom Ventures, Edenred Capital Partners and Columbia Lake. investiere contributed CHF 0.9 million in this round.