German skincare company Beiersdorf announced that it acquired a majority stake in our Belgian life science startup S-Biomedic. Verve Ventures first invested in S-Biomedic’s Series A financing round alongside Beiersdorf in 2018. In this article, we look back at our journey with S-Biomedic.

Veronika Oudova co-founded S-Biomedic in 2014 together with Bernhard Paetzold and Marc Güell. At the time, she was living in Barcelona, working as a business analyst in market research, but looking for new challenges, she recounts in our interview (published in March 2022).

She met her two co-founders, both of whom have PhDs in microbiology, while playing beach volleyball. That year, there had been a very successful gut microbiome transplant. (The community of microorganisms that are living together in any given habitat is called the microbiome.) Bernhard and Marc, inspired by this breakthrough, thought of possible applications, especially to the skin microbiome.

An imbalance of the millions of beneficial and harmful bacteria on our skin can lead to a variety of conditions including acne, eczema, dandruff, and neurodermitis. Veronika had had skin problems herself and tried all sorts of products, from those sold at the pharmacy to home remedies. Nothing had worked. She was intrigued. Because of her background in management, Bernhard and Marc convinced her to help them turn their idea into a business.

S-Biomedic developed proprietary technology to source and combine beneficial bacteria directly from healthy human skin. “Imagine your skin, with a bacteria population living on it. Some of the bacteria are more pathogenic – they create irritation and inflammation and challenge your immune system. We swipe away the population and replace it with a live, new population. It lives on the skin and helps it return to a healthy state” Veronika explains the basic principle of S-Biomedic’s approach. It differs from probiotic skin care products already on the market by using true skin probiotics, which means bacteria that belong on the skin. It is also very different from traditional acne treatments whereby a ‘big blast’ is applied to fight acne but which ends up pushing the skin’s microbiome from one imbalance into another one.

The acne market is worth USD 4 billion; USD 2 billion in cosmetics and USD 2 billion in pharma. Probiotic skincare product sales grow about 15% year on year.

“The ability to select and combine specific beneficial bacteria strains into a pharmaceutical-grade product is a key innovation of S-Biomedic and makes up the core of its patent portfolio. This ensures that beneficial microbes colonize the skin in the most efficient and sustainable way possible”, explains Michael Blank, who leads Verve Ventures’ investment team. He was also responsible for Verve’s investment in S-Biomedic’s Series A financing round.

“Following the success of gut microbiome treatments, skin is rapidly becoming the main target of microbiome research and represents a fast-growing multi-billion dollar opportunity”, Blank wrote in 2018. Once again, Verve’s expertise as deep tech investor is demonstrated, as our team correctly identified the potential of S-Biomedic’s technological breakthrough in the fast-growing skin microbiome market.

At that time, pre-clinical studies had already yielded the first positive results, and S-Biomedic had garnered strong support from key opinion leaders in dermatology. Verve’s private investor network was able to co-invest in the round with the industry leaders DSM and Beiersdorf.

Invest in Startups

As one of Europe’s most active venture capital investors, we grant qualified private investors access to top-tier European startups. With investments starting at EUR/CHF 10’000, you can build your own tailored portfolio over time and diversify across stages and sectors.

Since then, S-Biomedic has launched its first proprietary product on the market and collaborated with Beiersdorf, the Hamburg-based multinational that counts leading international brands such as Nivea, Eucerin and La Prairie amongst its portfolio. In 2021, Beiersdorf generated EUR 7.6 bn in sales. Moreover, S-Biomedic published multiple scientific papers and emphasized clinical testing to ensure that its products are safe and effective. It has built a strong IP portfolio and a unique database of the strains they have physically available.

Verve’s team has supported S-Biomedic on its journey to a successful exit. “We appreciate and enjoy the direct and constructive communication we have with the team since the start of our journey back in 2018”, says Veronika Oudova.

In 2022, the company launched its first consumer product under the Sencyr brand in the German market. It was the first time worldwide that a product incorporating the beneficial skin bacterium c. acnes hit the shelves. It has garnered positive reviews on Trustpilot. “I’ve had acne for the last 3 years and Sencyr is the only thing that has helped me (big time).”, one customer wrote.

With the acquisition by Beiersdorf, which has more than 20’000 people worldwide, S-Biomedic will continue to be managed as a standalone entity under Beiersdorf’s existing microbiome program. The purchase price wasn’t disclosed publicly.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

01.02.2022

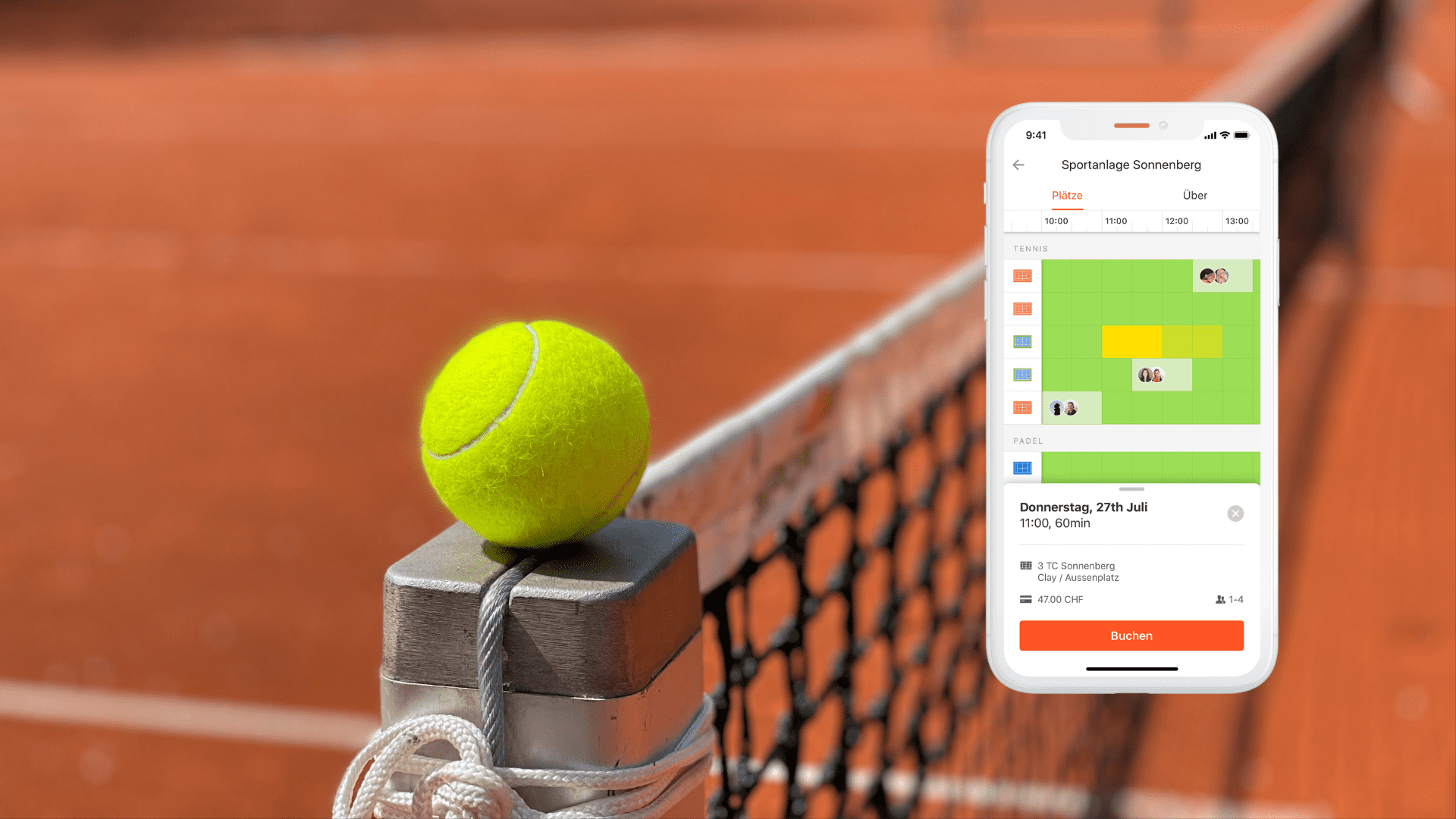

Playtomic acquired our portfolio company GotCourts

Playtomic, Europe’s leading tennis and padel social and booking app, has acquired GotCourts, a racket-sports platform operating in Switzerland, Germany, and Austria.

19.11.2021

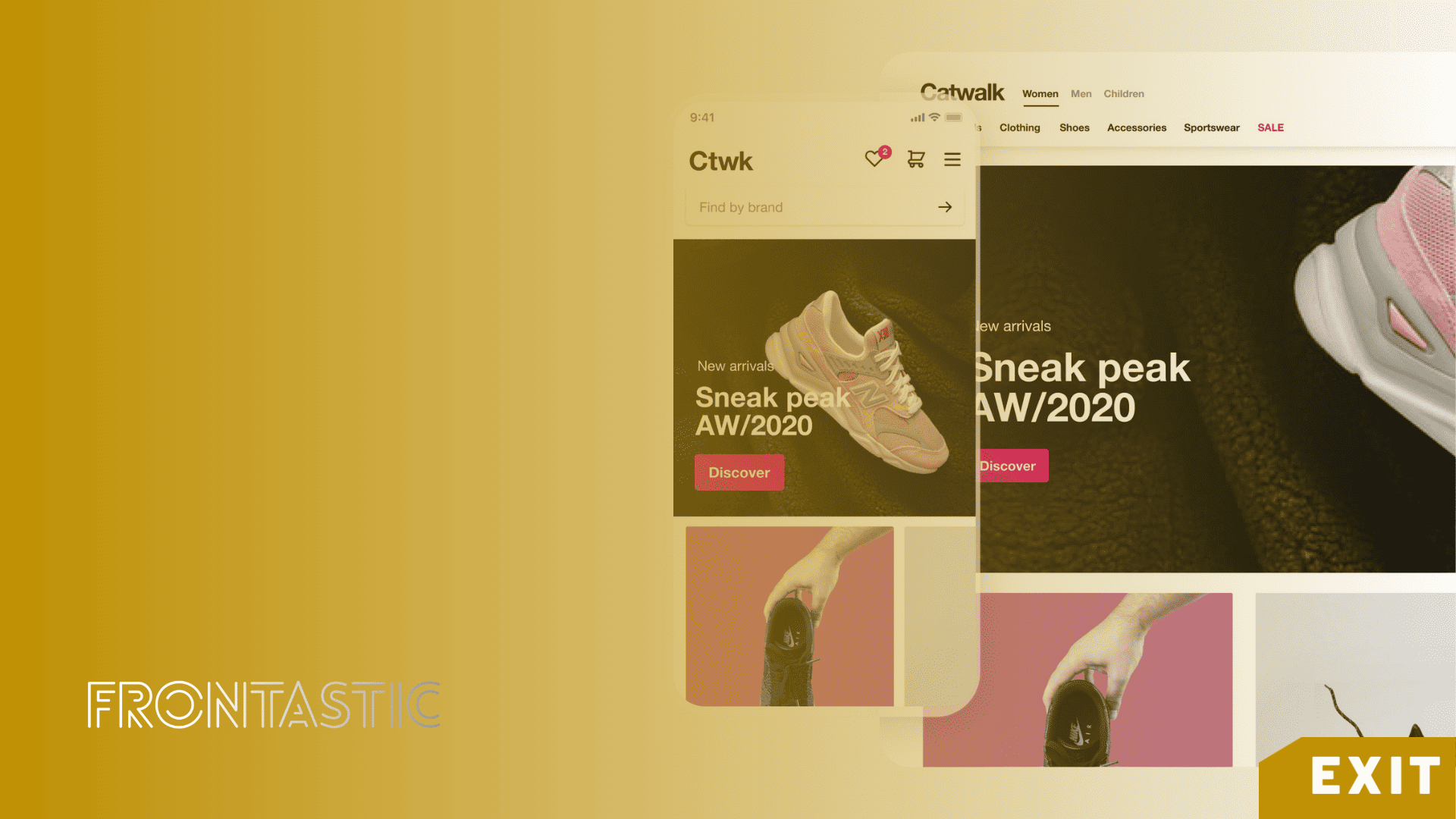

commercetools acquires our portfolio company Frontastic

Verve Venture's 6th exit this year was a speedy one: Our network invested in Frontastic at the beginning of 2021, based on our conviction that a paradigm shift in e-commerce is gathering speed. E-commerce firms don't want to rely on monolithic software anymore, but switch to a headless architecture. The acquisition of SaaS startup Frontastic shows the merits of our investment thesis.

11.01.2021

Building a diversified startup portfolio: why and how

Venture capital is a risky asset class because unlike in other asset classes, the major part of the expected returns come from a handful of investments. But there is a way to mitigate this hit-or-miss problem: Instead of trying to foresee the future and bet big on winners, investors should build a broad portfolio of investments.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.