The internet of things is finally taking off, thanks to satellite communication, explains Astrocast’s CFO Kjell Karlsen in this interview. In early 2022, the company will start delivering the communication modules that connect to its satellites.

CFO, Astrocast

Kjell Karlsen joined Astrocast as CFO in 2016 and led the company successfully through its IPO on the Oslo stock exchange in August 2021. Kjell has extensive experience in the space industry and was President and CFO of Sea Launch for almost 15 years, where he has participated in 39 launches with a total payload value of more than of USD 7 billion.

What does satellite IoT (internet of things) mean?

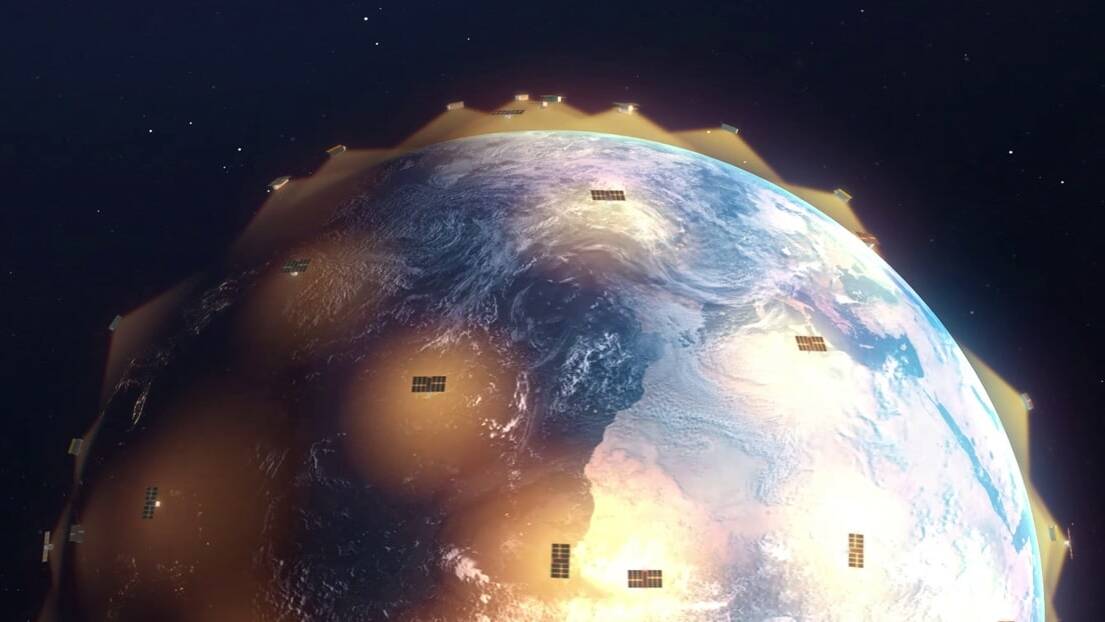

Countless companies have assets such as machinery, tanks, or buoys in faraway places. IoT means that these assets are connected and can send back data about their status, their location, or other data from sensors they carry. But connecting such assets is not possible by cellular networks, as those cover only about 10% of the earth’s surface. Connecting to assets across the globe is possible only with satellite IoT. Now, the incumbent satellite operators already have very powerful satellites in space. But such gold-plated systems are designed with government and defense customers in mind. These very expensive satellites provide real-time communication and a lot of bandwidth. However, they aren’t affordable for many of the industrial customers I’ve described. A gas tank doesn’t need real-time connectivity, it is more than enough if it can transmit data about its fill level every now and then.

“We can offer cost-effective connectivity.”

How can Astrocast offer satellite connectivity at a lower price?

The new possibilities of launching small satellites into orbit have decreased the cost associated with it substantially and there are also many more opportunities to have secured access to space. Since our satellites are much smaller than the incumbent satellite operators, they also cost less to manufacture and launch. This means that we can offer cost-effective connectivity, and I’m pretty confident that Astrocast will become the market leader in satellite IoT. Because of the prices we can offer, the market will grow exponentially. You can compare that to getting your first mobile phone. As soon as you have one, you start to use more and more data services.

What makes you so confident that Astrocast can become the market leader in satellite IoT?

There are several factors working together. We have a very strong technological base. Astrocast’s team has ample experience with designing and operating satellites. A strong team is quintessential, and since we’re based in Lausanne, right next to EPFL, we have access to very talented young engineers. And we have built very strong partnerships. Thanks to the satellite company Thuraya we are the only startup that has access to the L band spectrum, which is the perfect frequency for IoT applications. L band allows us to build communication modules that are very small and consume only a tiny amount of power. Our clients want the modules they integrate into their assets to connect to our satellites to be small. We recently met with Sulaiman Al Ali, the new CEO of Thuraya, during the International Astronautical Congress in Dubai. He is convinced of the potential of our company and thinks that through us, Thuraya can also offer its clients new connectivity solutions. Furthermore, we work together with Airbus and the European Space Agency. And recently we announced that Palantir has become an investor of Astrocast, and will partner with us to provide our customers data analytics tools. Finally, through the listing on the Oslo stock exchange, we can tap into the deep public capital markets to continue building our satellite constellation.

Astrocast raised CHF 40 million in a private placement before going public. You chose to list on the Euronext Growth market segment in Oslo because many potential customers in the maritime and fishing industries are already listed in Oslo and because Norwegian investors are used to investing in capital-intensive industries. How difficult was the preparation for the listing for you as CFO?

Preparing for a listing is a team effort, not just for the finance and legal team. Even our technical experts put in a lot of work to answer all the questions that investors have asked in their due diligence. Listing in Norway has been a good choice, as the positive feedback from investors has shown. Furthermore, space will become an important industry for Norway. In October 2021, the government has approved the building of a new spaceport close to the existing rocket launch site in Andøya in the north of the country. It should be ready by the end of 2022, and we may be able to launch some of our satellites from there. Astrocast was the first space company to list in Norway, but it certainly won’t be the last. And if there is a cluster of space-related companies, this creates heightened awareness and interest from analysts and investors, which is beneficial for us.

The share price of Astrocast certainly took off like a rocket on the first day of trading, in what the Norwegian press described as one of the most successful listings in several decades. But the stock price couldn’t defy gravity for long.

We focus on executing on our roadmap, not on the share price. When we decided to list, we aimed at a valuation that was reasonable and would make existing shareholders happy at the same time. There were quite a few space companies that went public through SPACS in the US, with very inflated valuations. The performance on the Astrocast stock on the first day was the result of a moderate valuation and illiquid trading. But the liquidity of our stock will improve with time as we execute our plan, announce new customers, increase revenue and become more visible.

What would you tell startups that want to become public companies that they do differently than you?

Do not plan to go public in summer. We first wanted to do the listing in July, but with everyone being on holiday, it was very difficult to reach all the people we needed to reach. The listing date ended up being in August. We’ve learned this lesson and will aim to close the next capital raise before summer 2022.

” With every new launch, we increase the service level we can offer to our customers.”

Even if the total cost of your constellation is modest compared to incumbent satellite operators, you will still be raising capital for the foreseeable future, to finance the next launches, right?

It is one of the major advantages of being a public company that we can now reach a very broad investor audience that would not invest in a private company. And with every new launch, we increase the service level we can offer to our customers. Right now, with 10 satellites in orbit, it is possible to send one to two messages per day. Once our constellation is completed, it will offer a signal every 15 minutes, which is very close to real-time communication. Our first 10 satellites are performing very well. This means that we might be able to achieve the final service level with a constellation of fewer satellites than we initially thought. This could reduce the financing need. We will launch our next satellites in mid-2022, and a few more later next year. We will also start delivering our communication modules to the customers we’re already working with today. This will be a significant milestone for Astrocast. The capital increase will follow this achievement.

I’ve seen some pictures that Fabien Jordan, Astrocast’s CEO, posted from the first mass-produced modules recently.

Yes, like everyone else we were affected by the chip shortage and it took longer than expected for the production to start. But our team led by Laurent Vieira de Mello, our COO, visited the factory in Austria that mass-produces the modules and the good news is that we can start shipping them soon. A lot of our customers have already done initial tests with test kits we have provided them before. Now they will need to go out in the field and integrate these modules into their assets, and in many cases, this will take a few months. So we’ll book the revenue from selling the modules first, and later there will be subscription revenue for the connectivity. In 2022, we’ll probably ship between 50,000 to 100’000 modules, and this number will continue to grow significantly in the future. The internet of things has been talked about for years, but thanks to satellite IoT, it will finally take off. There is no solution as cost-effective as Astrocast out there. In a few years, we will be shipping millions of modules per year.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

22.11.2021

“The M&A activity in the semiconductor industry is incredibly intense”

Serguei Okhonin has 3 decades of experience in the semiconductor industry. ActLight, his second high-tech startup, is one of Verve Ventures’ portfolio companies. In this interview, he talks about hearable devices that can measure the heart rate, mobile phone cameras, and why all of a sudden potential buyers started to contact him.

26.07.2021

How Astrocast connects things in the middle of nowhere

Startup Astrocast plans to launch 100 shoebox-sized satellites to bring connectivity to every place on earth. To finance this ambitious project, the company aims for a listing on the Euronext stock exchange. But why do even the remotest places on earth need connectivity?

16.09.2019

“Startups in Switzerland have great potential”

EPFL is not only one of the best universities in the world, but also a place where promising high-tech startups are created. Verve Ventures has backed a lot of them. We visited Prof. Martin Vetterli, the president of EPFL, in Lausanne and talked about science, technology, and entrepreneurship.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.