We believe that our success should be directly linked to the performance of the companies we select. This is why we earn an important portion of our fees only when you make a profit. Here’s how our direct investment fees compare to venture capital funds.

YOUR INVESTMENT FEE IS ALL-INCLUSIVE

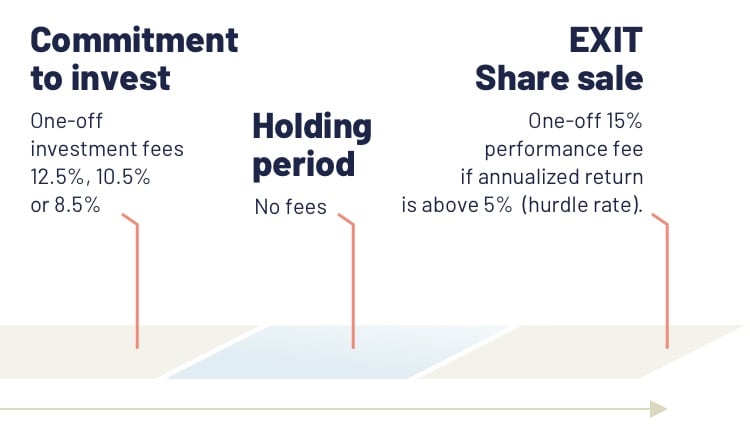

We charge the fees after the signing of the investment contracts. All fees (access fee, management fee and investment structure fee) are prepaid, except the performance fee which is only paid at the time of a successful exit.

Invested CHF in the last 12 months | < 60'000 EXPLORER | > 60'000 ADVANCED | > 200'000* LARGE |

|---|---|---|---|

| Total Investment Fees paid upfront at Investment | 12.5% | 10.5% | 8.5% |

| Total Performance Fee paid at exit of investment 5% hurdle rate | 15% | 15% | 15% |

The investment fees are charged for direct investmens in startups. This direct access is unique in comparison to classic venture capital funds and business angel groups. Have a look at this comparison of services and fees, for the different venture capital investment strategies.

INVESTMENT FEES BREAKDOWN AND INVESTOR SERVICES

One-off Access fee

As an investor via Verve Ventures, you pay no membership fees, no up front due diligence fees and are not required to commit capital upfront. All deal sourcing and due diligence work is financed by Verve Ventures. At time of investment, we charge an access fee to cover part of these costs.

Yearly Management Fee

For ongoing portfolio management, we charge a management fee as is customary. The fee is capped at 5 years and is reimbursed if an exit happens before 5 years.

Investment Structure Fee

Companies want to avoid fragmented captables and will typically not allow investments below 200k or 500k, in some cases below CHF 1m . To get into competitive investment rounds, it is thus instrumental that investors are professionally pooled.

Invested CHF in the last 12 months | < 60'000 EXPLORER | > 60'000 ADVANCED | > 200'000* LARGE |

|---|---|---|---|

| One-Off Access Fee | 5% | 3% | 1% |

| Yearly Management Fee | +1.1%(x 5 years) | +1.1%(x 5 years) | +1.1%(x 5 years) |

| Investment Structure Fee | +2% | +2% | +2% |

| Total Investment Fees | =12.5% | =10.5% | =8.5% |

One-off Access Fee

The access fee covers the following services:

- Deal sourcing (+5000 startups screened annually)

- Deal-by-deal access to VC-grade startup investments

- +150 hours of startup-specific assessment and business due diligence

- Investment terms negotiation with startup and co-investors

- Structuring and coordinating financing round together with institutional co-investors and startup to ensure smooth closing of the fundraising

- Investment proposal production, investor call and Q&A services

- Negotiation and legal review of final investment contracts

- Execution of investment (contract and fund transfer coordination)

- For follow-on rounds: calculating investor pro-rata, providing all startup reports and round information, investment execution (contracts and money wiring)

Yearly Management Fee

The management fee covers the following services:

- Verve Portfolio Reporting: Portfolio overview, success tracking, KPI tracking and continuous updating of portfolio information

- Overview of tax valuations per company and relevant documents for tax declaration

- Portfolio management, incl. AGM/EGM administration, BoD and management coordination

- Active portfolio value creation e.g. hiring support, client introductions, financing strategy, industry expert networking, discounted partner services

- Fundraising support for further financing rounds, incl. pitch training, syndication with lead investors and term sheet negotiation

- Exit support incl. exit window identification, coordination with M&A partners, exit workshops and advisory

Investment Structure Fee

The investment structure fee covers the following services:

- Operational setup of investment in fiduciary structure

- Maintenance and financial independence of fiduciary structure

- Legal compliance and investor KYC, digital onboarding and signature services

- Ongoing regulatory supervision and audit of fiduciary structure

- For direct investments: Direct investment structuring and additional coordination services with involved co-investors and the company

INVESTOR RELATIONS TEAM

Our investor relations team is happy to answer your questions regarding the investment fees. Please contact us via email: investors@verve.vc

Friederike Reinl

Cécile Zizzari

Terence Thiel

Frequently Asked Questions

Joining Verve Ventures is free of charge. Investors only pay if they actually invest. An indicative fee is already shown before committing to an investment, final investment fees are calculated based on investor’s investment volume in the last 12 months. At time of investment, we charge a total lifetime fee of 8.5%-12.5%.

On successful investments (in case the startup is sold or becomes a public company), Verve Ventures applies a 15% performance fee on the profits from the investment (carried interest). Carried interest only applies when an investment makes an annualized total return of at least 5%. If the annualized return is below 5%, Verve Ventures does not receive this performance fee.

As an investor via Verve Ventures, you pay no membership fees, no up front due diligence fees and are not required to commit capital upfront. All deal sourcing and due diligence work is financed by Verve Ventures. At time of investment, we charge fees to cover part of these costs. While the management fee for 5 years is charged upfront, if there is an exit before 5 years, we refund the remaining years of the management fee.

To grant you access to the most sought-after deals, we pool your investment through our dedicated company Verve Investment Syndicates. This ensures that your participation is compatible with the requirements of institutional investors. As a pooled investor, you are the beneficial owner of the shares; towards the startup, Verve Ventures acts as a single point of contact and takes care of all ongoing administrative work related to the investment. To find out more, have a look at the fiduciary section of our FAQ.

In addition to distributing quarterly and monthly reports per email, all reports are stored on the platform and accessible to investors. Verve Ventures also provides investors with a summary table of all investments as well as a standardized overview per company with consolidated relevant information on key performance indicators. We also share with investors all relevant information for tax purposes.

Verve Ventures supports its portfolio companies to accelerate their growth and success. Our Investment Managers help our startups with sales, recruitment, market entry as well as exit discussions via workshops with specialised M&A partners. This ongoing support raises the probability of success and adds significant value to your investment. Find out more about Verve Ventures’ investment topics and portfolio.

We believe that our success should be directly linked to the performance of the companies we select. This is why we earn an important portion of our fees only when you make a profit.