INVESTINGIN MEDTECH STARTUPS

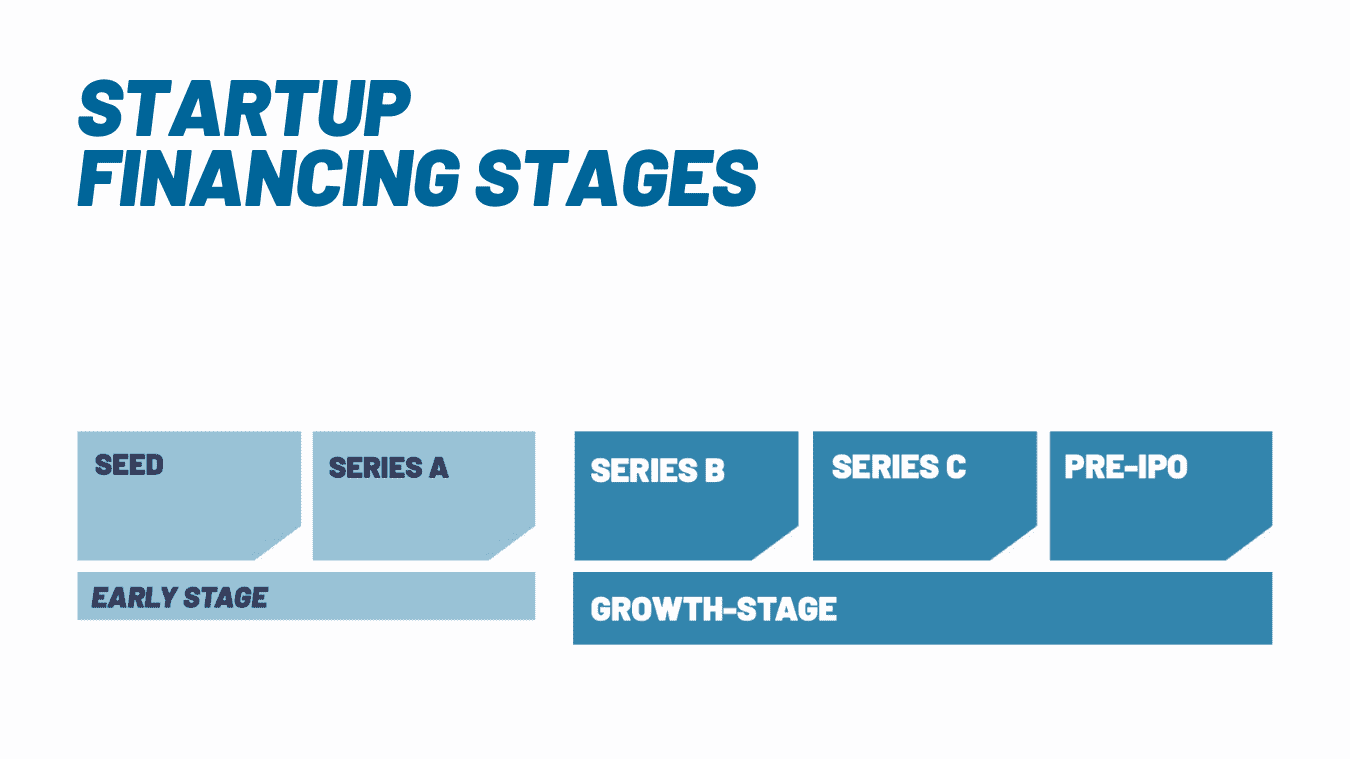

Investing in early-stage and growth-stage medical technology startups requires patience, risk tolerance, and an understanding of how products get access to the market. In this page, we argue why it is still worth it, and show how Verve Ventures assesses such companies.

WHAT EXACTLY IS MEDTECH

Our portfolio company Scailyte

Scailyte uses single-cell technologies to develop diagnostics

Medtech improves the standard of care and ultimately, contributes to people enjoying longer lives. Ranging from a simple plastic syringe to a computer tomography scanner weighing 2 tons, medical technology is incredibly diverse. Medtech startups address problems of the healthcare systems and provide new ways of treating patients.

SUBCATEGORIES OF MEDTECH

This short overview of the three subcategories of Medtech will help you better understand what Medtech is:

- Medical devices: is the most obvious subcategory of Medtech and includes all the devices that are used to treat (or diagnose) humans.

- In Vitro Diagnostics (IVD): from Latin, in vitro means in the glass. IVD is a fancy name for all kinds of tests that determine a patient’s health, using blood and other samples.

- Digital health: the third category encompasses digital tools that help to monitor and manage illnesses.

A medical device from our portfolio

Titanium color-coded cages developed by our portfolio company Neo Medical

WHY INVEST IN MEDTECH

The pace of innovation in the Medtech sector is high, with 14’292 patent applications filed in Europe in 2020, which is more than in computer technology or communications.

Investors in publicly listed Medtech companies have done well too: Over the past 10 years (September 2011 to September 2021), the index of the 100 largest global Medtech companies has gone up by a whopping 270%.

But the Medtech sector in general faces several challenges: more exacting regulation, competitive pressure from firms outside of the sector, increasing pressure on margins as healthcare costs are spiraling, and the availability of talent. For Medtech startups, in particular, the availability of capital is a pressing issue. Developing a product and bringing it to market takes time and is expensive.

Emma Schepers

Investment Associate of Verve Ventures explains the due diligence process

KEY ELEMENTS OF MEDTECH STARTUPS TO CONSIDER

Patents are by no way the only means to protect what a startup is doing, in some cases companies just keep their knowledge as trade secrets to themselves. But patents are important because potential buyers “will look more closely at these and ascertain if they sufficiently protect the technology for which the start-up shall be acquired and if they’re sufficiently broad. For an application, they will consider if it is likely that the patent will be granted and what it may ultimately protect. Also, they will typically want to know if the relevant markets are covered”, as patent lawyer Axel Remde said in our interview.

Regulation is another key element for medical devices. It is obvious that medical devices with an impact on patients’ health are regulated, and startups cannot just sell their products without going through some kind of control mechanism. In the European Union, the set of rules that aims to ensure a high level of safety is called “MDR”. The most important criterion for how high the hurdles are to bring a product to market is the classification of a device. MDR distinguishes between class I, IIa, IIb and class III devices. The exact rules are hellishly complex and run over 6 pages (Annex VIII of the MDR).

Reimbursement means that health insurance companies pay the cost for the service of a healthcare provider regarding the diagnosis and treatment of diseases. Whether a device or service is reimbursable or not, and at what price, will decide if technology will be widely available for patients, and profitable for a manufacturer to provide. In general, technology needs to provide better patient outcomes or cost savings to be reimbursed.

Learn more about the key elements of a MedTech startup with our free eBook.

EXIT CONSIDERATIONS: THE BUYERS AND M&A ENVIRONMENT

Potential buyers of Medtech startups are established companies that see a good fit between their own product portfolio and the technology startups develop. These so-called strategic buyers have amassed a mind-boggling EUR 1.2 trillion of cash that could be deployed for M&A, according to PwC. And while each one of them has its own agenda and might be interested in different technologies, a few generalizations can be made.

KNOW WHAT RISKS YOU TAKE WHEN INVESTING IN MEDTECH STARTUPS

The European Medtech industry is a hotbed of innovation that rests on a very strong research base. The M&A activity is intense, as Private Equity funds have discovered that Medtech companies are stable and crisis-resistant businesses. Strategic buyers have an unprecedented amount of financial firepower at their disposal, and as a result, valuations are on the rise.

From an investor’s point of view, the patent situation of a Medtech startup and its regulatory pathway merits special attention. This lengthy and costly process has been made even more challenging by the transition from MDD to MDR in Europe. Investors need patience and should ask themselves if startups will be able to raise the money necessary to pass this hurdle. This also means, of course, that investing in a startup that has already passed this stage and received market authorization poses a significantly smaller risk, which, however, comes at a price, as it will no doubt also be reflected in the company’s valuation.

SOME EXAMPLES FROM OUR MEDTECH PORTFOLIO

Neo Medical

Neo Medical has developed a Swiss-made toolset for spine surgery. Its ease of use has convinced surgeons. It reduces complexity, operating time, and the risk of infections. Instead of several hundred parts, it uses five instruments and fourteen implants only, and it still does a better job, potentially reducing risks of screw loosening, hardware failure, and eventually further reducing re-operation risks, while improving overall patient outcomes. To enhance safety, Neo’s screws and implants are sterile and single-use, which removes the need for sterilization in the hospital. This reduces the environmental footprint of spinal fusion surgery by 75% versus legacy reusable systems. This is an example of a medical device.

Main reasons to invest in startups

Survey among startup investors

Sympatient

Sympatient is a digital therapeutics company that offers the medical gold standard for anxiety therapy at home. The digital psychotherapy Invirto features mobile VR, an app, and guidance by real psychotherapists. Invirto enables patients to cut the long waiting times for therapy, empowers them to treat their anxiety independent of therapists office hours, and helps them improve at their own pace.

OncoDNA

Cancer kills 10 million people every year. Fortunately, the human effort to combat it is yielding impressive results. All these advances are impressive, but they also create a problem – it is too much to digest. Oncologists would have to spend 29 hours per day reading just to stay on top of scientific literature. OncoDNA has developed a powerful decision support system that has significant commercial traction. A perfectly tuned combination of genetic tests, a proprietary database, and reporting tools enable oncologists to find the right personalized approach for every patient, even those for whom everything has failed. Tens of thousands of patient outcomes are fed back into the system, creating valuable new knowledge.

With Verve Ventures, you have access to investments in the best MedTech startups in Europe. Get started now.