Former Mammut CEO Oliver Pabst thinks that smart textiles have reached a tipping point. The ability to measure our bodies’ vital signs not only improves our performance but also allows us to become part of a community. In this interview, he explains why he joined smart textiles startup Nanoleq as an advisor and investor.

Nanoleq, Advisory Board Member

Oliver Pabst has more than 20 years of experience in the sportswear industry. He was Managing Partner of the surfwear company Boards & More, board member of high-end ski clothing company Bogner, and CEO of the outdoor sportswear company Mammut. He is an active business angel and a member of several advisory boards. Oliver has a Ph.D. in Economics from the University of St. Gallen.

Why did you choose a career in sportswear?

My grandparents had a knitwear factory and my parents both were in the fashion industry. So it is fair to say that after a short time at McKinsey, I continued a family tradition, albeit with a focus on sports apparel. I was always excited by product innovation, but also by innovation in business models and distribution channels. The common denominator of the companies I worked for is that they had strong brands with historic roots that had an interesting story to tell. But they needed to be transformed and adapted for a new generation of consumers. This is an exciting challenge.

How does one bring a brand into the digital age?

Giving the offering of a company a contemporary signature requires first and foremost a cultural change inside the company. Mammut, for example, wasn’t very present on digital channels, and this clearly goes against common sense. Brands prosper through their storytelling; a website and social media are the best way to establish this storytelling. But you need imaginative power to envision what is possible in the digital world and how they can give you access to new target groups. Just look at how brands like Nike or Adidas who have mastered this art are leveraging their digital channels.

“The sports market is driven primarily by product innovation.”

What are the peculiarities of the sportswear market?

Compared to the apparel market in general, the sports market is driven primarily by product innovation. The communication is extremely emotional, there are sports heroes and teams, success and defeat, blood and tears. And the enthusiasm about sport is at an all-time high, I would say. The past 2 years have shown us how important sports are for a well-balanced life.

During your tenure as CEO of Mammut, the company was sold to Philippe Jacobs’ Private Equity firm Telemos Capital. Why are financial investors interested in sportswear brands?

Financial investors are active in this sector because they can play a role in the consolidation of the industry. Furthermore, there is a vast number of niche brands that need capital and knowledge to expand internationally. I think this is a good sign as it helps the companies and the industry in general to become more professional.

Let’s talk about smart textiles. The fusion of textiles and electronics has been talked about for a long time, but so far, not really arrived.

I have been looking at what is happening in the field of smart textiles professionally for 20 years, and I have to say that we are reaching a tipping point now. The solutions we see today are easier to use than those before and more intuitive, which is the basis for broader adoption. The logic of smart textiles is compelling. If you’re doing sports, tracking what you do is essential to getting better at it. It is also the basis for sharing your performance with others and competing with them. Smart textiles allow sportswear brands to build communities.

“Smart textiles allow sportswear brands to build communities.”

Aren’t the top athletes who might use smart textiles a rather small community?

I think the quantified self movement is a broad cultural phenomenon and not limited to athletes. A very large number of people is interested in how their body is doing and measuring performance has gained importance for amateurs as well. Take the example of the exercise tracker Strava, which allows people to share their running or cycling data. Humans have a strong urge to share their experiences, and an equally strong urge to participate in whatever their friends or idols are doing. The ability to share the data of your training exercises with others, to improve your performance together with others is a great source of motivation no matter what level of fitness.

Invest in Startups

As one of Europe’s most active venture capital investors, we grant qualified private investors access to top-tier European startups. With investments starting at EUR/CHF 10’000, you can build your own tailored portfolio over time and diversify across stages and sectors.

You joined smart textile startup Nanoleq as an investor and advisor. How did you find out about the company?

While I was CEO, the outstanding employee Heike Bördgen left Mammut and joined Nanoleq. If such a person left a great company like Mammut, I had to find out what this was about. I got to know the co-founder Vincent and was fascinated by the simplicity and the look and feel of Nanoleq’s product. I already explained why I believe in the megatrend of sports data, and I realized that this is a product consumers will use and love because it feels comfortable. I find the team to be very capable and the business model of selling components to other brands while building up an own consumer product convincing. The market Nanoleq is addressing is huge.

You talked about sweat and tears in sports. Nanoleq’s first consumer product will be a shirt that can measure breathing and other vital signs. The target audience will be people who do breathing exercises – not really an exercise that makes you sweat.

The search for self-optimization is the same, no matter if you are running or doing breathing exercises to reduce stress. Breathing is highly relevant and has a huge impact on our well-being and performance. Striving to improve your breathing based on data therefore makes a lot of sense.

What are the challenges the startup Nanoleq faces?

They need to build a modern, contemporary brand that connects well with the target audience. This is a challenge on a conceptual level and at the same time, the base for growth. To build a brand you also need to break the rules to get attention. There are other challenges, of course, like scaling up the company and establishing a good go-to-market, but this is execution, not rocket science.

What do you mean by breaking the rules?

There are common, established practices in marketing that many companies follow. This is why doing things differently helps to differentiate a brand. The core strength of Nanoleq is its technology. The question will be how to apply this strength in this growing market in a way that is different from other companies. You need a certain boldness to break the rules.

Why do you advise startups and invest in them?

I think that technology is key to improving society and ourselves. I come from a family of entrepreneurs and want to support entrepreneurship. In my role as advisor, I can coach and support the team and challenge them. I can also open doors to potential clients. I invest a lot of time, not only money. As an early-stage investor, I’m always fascinated by meeting new people that are extremely motivated and have an incredible drive to bring new technologies to the market. I guess my main motivation is curiosity and a hunger for knowledge. And working with founders gives me a lot of satisfaction.

Written by

WITH US, YOU CANCO-INVEST IN DEEP TECH STARTUPS

Verve's investor network

With annual investments of EUR 60-70 mio, we belong to the top 10% most active startup investors in Europe. We therefore get you into competitive financing rounds alongside other world-class venture capital funds.

We empower you to build your individual portfolio.

More News

01.02.2022

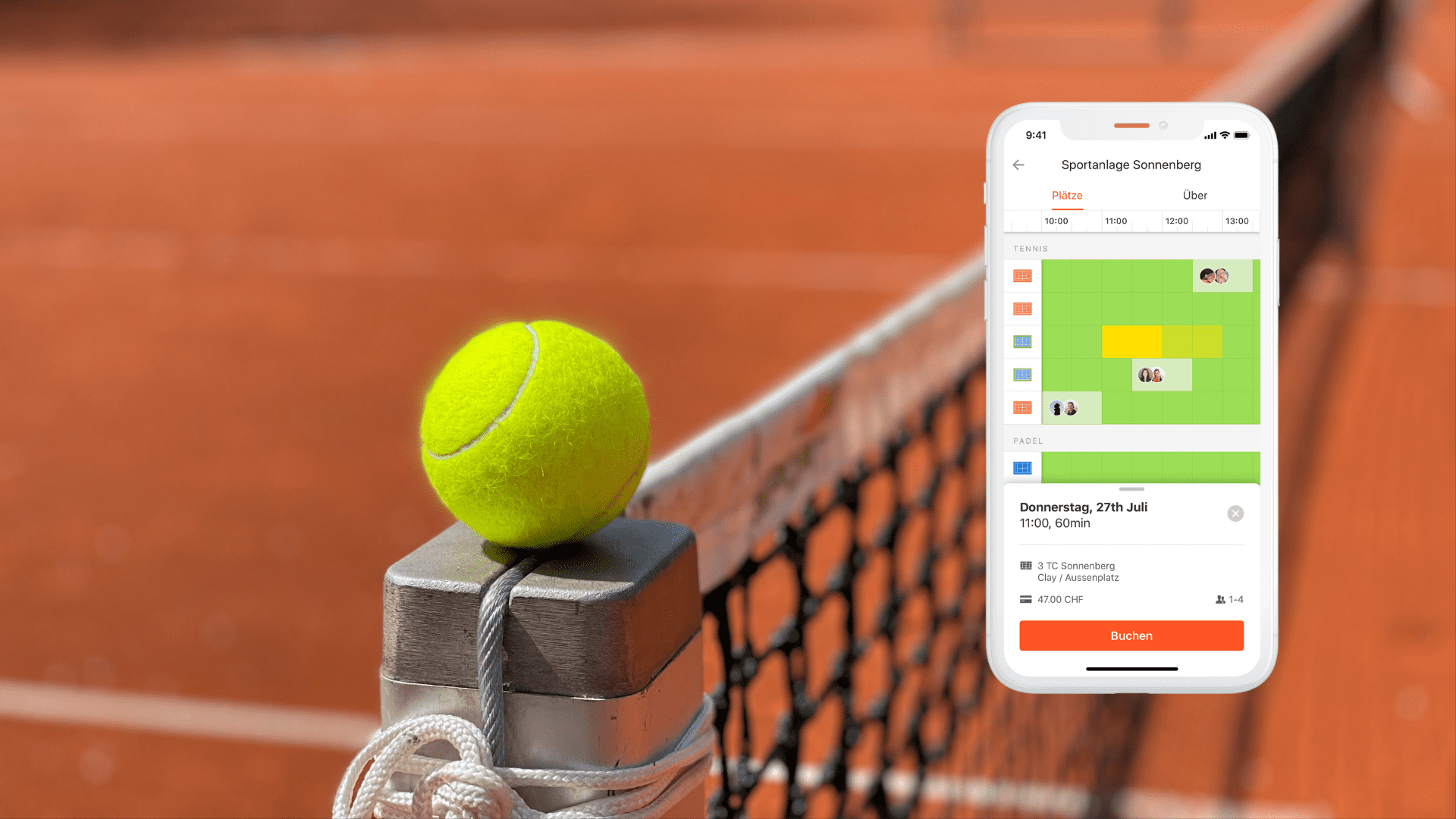

Playtomic acquired our portfolio company GotCourts

Playtomic, Europe’s leading tennis and padel social and booking app, has acquired GotCourts, a racket-sports platform operating in Switzerland, Germany, and Austria.

30.01.2022

“The flywheel is gathering speed”

In this interview, Verve Ventures’ co-founder and co-CEO Lukas Weber looks back at the company’s achievements in 2021.

16.12.2021

Nanoleq raises CHF 11.5m Series A

The financing round was led by Capnamic Ventures alongside ZKB, Verve Ventures, and a high-profile angel group including Michael Halbherr, ex-CEO of Here, and Oliver Pabst, ex-CEO of Mammut.

Startups,Innovation andVenture Capital

Sign up to receive our weekly newsletter and learn about investing in technologies that are changing the world.